Investment: Regular Savings

How would you like to invest into the crash of ’29?

By Chris Cleary

Investing in hindsight is easy, a maxim most investors assent to— except when applied to their own recent hard-won successes, which are the rewards of foresight, and the willingness to embrace risk.

In hindsight all questions are answered. Hindsight tells us that:

1. After a vicious and sustained bear market, the last four years have been profitable for most types of stock investing.

2. A new commodities bull market has commenced, although it has been correcting for more than a year.

3. Bond prices have risen slightly, but basically have been directionless.

4. US housing prices could not go up forever, although for a time people thought they would, and were prepared to bid and flip on that expectation.

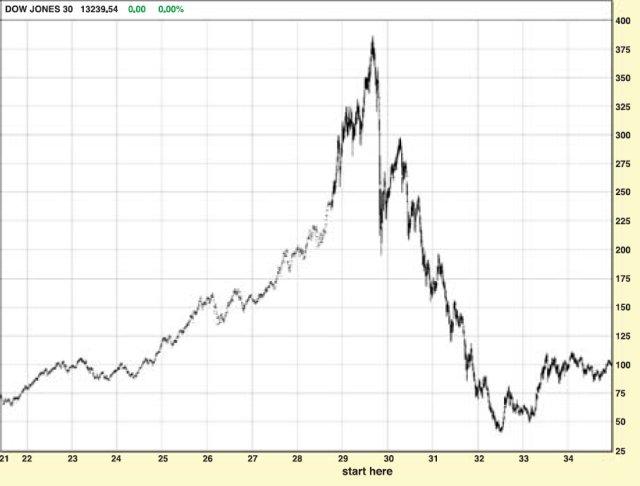

Figure 1: 1998 - 2006 Prophet Financial Systems. Inc. Terms of use apply

Figure 1: 1998 - 2006 Prophet Financial Systems. Inc. Terms of use apply

How predictable were these outcomes?

1. For stock markets, against the scary US deficits and the Iraq strategic howler, we can cite the beneficial effects of US tax cuts, depressed cost of capital, expanding world trade and, crucially, the accession of China to WTO membership, which has imparted more economic energy than probably anybody realised it would at the time. Nor could we foresee that Executive Order 12631, signed by President Reagan to forestall another 1987 crash, would become a standard tool for US Treasury Secretaries to prop up stock prices by surreptitiously buying index futures whenever stock market corrections threaten to become more than transitory affairs.

2. The commodities bull, although yet to commence, was already being anticipated by the precious metals complex four years ago, so not that difficult to predict: China, in the WTO, possessing a large shopping list for raw materials, and the wherewithal to pay; India following suit; Asia in general recovered from the Asian crisis. (See Commodities—Is There That Much Fuss Yet? J@pan Inc Issue 72)

3. Interest rates in the US, Japan and Western Europe were so low that they appeared to have no way to go but up. Up they went, at the short end, but not many foresaw that the expanding US trade deficit would leave its trading partners such a fistful of dollars that they had no option but to hold onto them, ‘safe’ in the bond market, depressing yields at the long end of the curve.

4. US housing—no contest. The only question was how long it took for reality to intrude. Although not many foresaw how far sub-prime would exact contagion through seemingly higher-grade financial instruments.

But of course these are explanations in hindsight. The real challenge, anticipation in foresight, begins today.

The business of prediction is not easy. All predictions when made are touted as successful (if not, why heed them?) but you can’t know they will be successful until they become so, which for investment purposes is a little too late. Conversely, for people who go public on such things, history is littered with failed predictions, mostly forgotten or deliberately swept under the carpet. Some failed predictions do survive and become famous, such as, “Stock prices have reached what looks like a permanently high plateau”—not bad for the week before the 1929 crash. And that was Irving Fisher, doyen of economists in his age.

At the same time human behaviour is not fully deterministic, i.e. The future is not fixed: investing is conducted amongst a mass of conflicting but insufficient information in a myriad of possible future scenarios. Some of these scenarios work out and some don’t. The correctly predicting investor may be simply fugitive from the laws of averages—in other words, lucky.

So given the difficulties of prediction, the unknowability of the future, how can you improve your investment chances without a direct line to God, or the defensive limitations of cash?

Remembering the future

Diversification is a simple, believable concept: don’t put all your eggs in one basket. And if you can quantify this adage to prove that 90% of investment success is down to sound basket management of eggs, as Harry Markowitz did, you can win a Nobel Prize in Economics (See Putting A Portfolio Together, J@pan Inc Issue 70). A portfolio made up of a variety of asset classes will perform better in the long run than a portfolio with a narrow focus, as that performance will inevitably be less volatile.

The principle of averaging is wellknown, but rarely gets the credence it deserves. It works like this: you will spend US$10 on apples per month. Apples are $1 each. You pay your $10 and Month I you have 10 apples. Month II the price goes down to 50cents. You have 30 apples. Month III the price goes back to $1 each. Your portfolio of apples cost $30 and is now worth $40. The price of apples is where it started but you have made 33%. Of course the price of apples may go down again, but longer term the price of apples tends to go up.

It can be difficult to handle psychologically when you keep paying a regular fixed amount into an investment and prices keep going down.

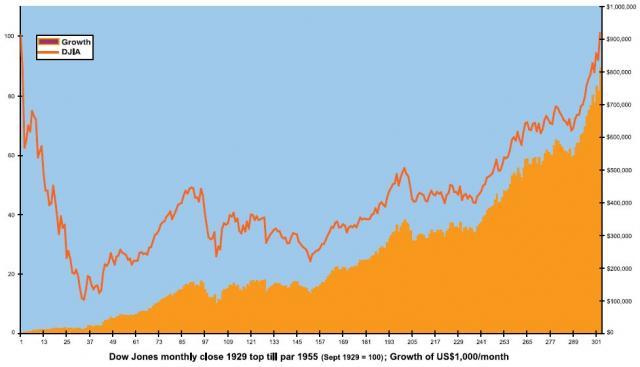

Let’s say we took Irving Fisher at his word and started a plan investing a nominal US$1,000/month (quite a lot at the time, agreed) into US blue chip stocks from the 1929 top. The crash of ’29, the Great Depression and World War II were to follow. Not that promising a future investment scenario to invest into. By the time prices have recovered to par — i.e. The Dow is where it was in September 1929 — it is late in 1955. The Dow has gone nowhere, but your US$303,000 invested is worth US$811,406 (Fig 2).

Figure 2

Figure 2

You might object that waiting for prices to recover to par skews the scenario. Let’s say, then, that you started in September 1929 and carried on for just shy of 20 years. At the end of this period the Dow is at 45.82% of its precrash top, i.e. A loss of 54.2%. However you are still ahead; your US$239,000 invested is worth US$324,890.

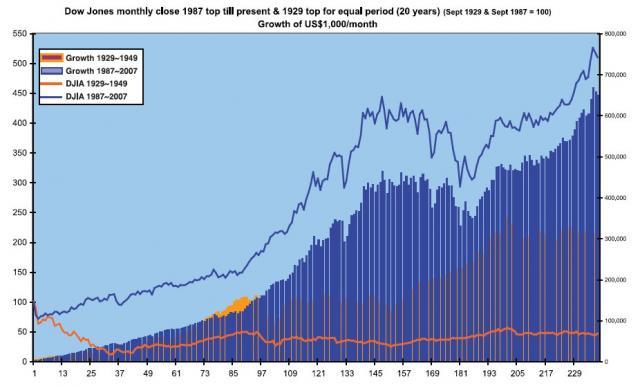

The reason for saying “just shy of 20 years” is that this is the same period from the 1987 pre-crash top to the present. That crash was not followed by Great Depression; instead it was followed by the end of the Cold War and burgeoning globalization, part of one of the all-time whopper bull markets. The returns from September 1987 clearly beat those from 1929 — the achieved lump sum is exactly double that of the 1929—1949 period (Fig 3). However those returns are from a 408.88% market gain; the demonstrable observation that you can invest into one of the worst periods in history, suffer a 54% fall in the invested index and still make money is testament to the power and benefits of cost averaging.

Figure 3

Figure 3

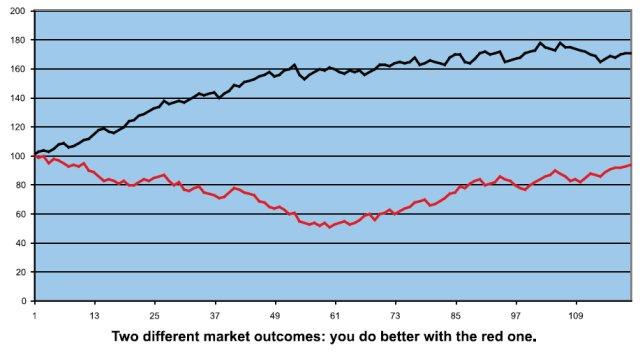

Investing on a regular basis is a good discipline; it also gives an advantage, a kind of diversification over time. Offered the choice of an investment that only goes up, and an investment that spends part of the time or the whole of the time in negative territory, most people opt for the obvious winner. For a one-off lump sum investment this would be sane and reasonable. However, the averaging capability of regular savings plans alters the picture entirely. Investing monthly, you would want the red line index not the black in Fig 4, although the black index is always positive and finishes up by 70%, whereas the red index is never positive and finishes with a loss of 7%. Nevertheless the returns from averaging into the red index line exceed those of the black line by 10% outright.

Figure 4

Figure 4

Is this easy to do? Portable private pension plans that are an agreement to invest a pre-determined amount monthly and thus average into the markets are available to all nationalities. They can be properly diversified from day one, are simple and convenient to fund (by credit card) and for most nationalities offer a variety of taxsheltering benefits. They are offered by large, reputable life insurance companies —household names with sturdy financials. A clutch of special offers is currently available, which makes them highly cost effective. For people whose attention is taken up almost exclusively by their own business, such plans require little attention, and because they solve so many of the problems of investing, are a convenient and reliable means of providing a financial safety net.

Information on portable private pension plans and current special offers is available from Banner Japan:

Tel: +81-3-5724-5100

E-mail: questions@bannerjapan.com

Web: www.bannerjapan.com

Chris Cleary is Director of Banner Japan KK