Commodities – Is There That Much Fuss Yet?

By Chris Cleary

After two decades of commodities bust, this decade has seen commodities rehabilitation. Not that we ever stopped using them – it would be a fair bet that the average person in a developed economy utilizes in some form or other the produce of at least half the world’s listed commodities contracts every day: oil, iron, nickel, gold, cotton, orange juice, rubber and so on. But rehabilitation as an investment class is recent, with gold turning the corner in 1999 and most commodities following from 2003.

Such changes seem to happen in cycles as they do with just about every other asset class out there. But we are now at the point where some big-name pundits, Stephen Roach for example, are questioning whether we are already in a commodities bubble. And as Jeremy Siegel says, “When everyone is talking about an asset, such as gold, silver, and other commodities, it is an excellent sign that prices have gone too high.” Agreed. (US real estate circa two years ago, tech stocks 2000, Japan stocks and property 1989, and so on.) Question is, is everyone talking about commodities? Do you hear conversations concerning commodities in Starbucks, at dinner parties or on vacation? Are commodities investment stories breaking out all over the media? When you think of financial investments, what comes to mind first: cash deposits, stocks, bonds, property, commodities? In other words, is there that much fuss yet? Especially when commodities bulls such as Jim Rogers, who has a lucrative history of getting these things right, are projecting rising commodities prices well into the next decade.

The case for commodities has several prongs to its thrust. The first point is that commodities are the basis of the physical goods we use money to buy, from hamburgers to houses. If we have inflation, the price of these things goes up and our money is worth less. But if we buy commodities, the value of what we have rises roughly with inflation. It doesn’t matter that technically inflation is caused by an overabundance of money, printed by overambitious or insolvent governments. It does matter that commodities – along with property – rise with rising prices; in fact they are the rising prices. When did we last have serious inflation? In the ‘70s and early ‘80s. And when were commodity prices last high? When inflation was high. Even for the fundamentally unconvinced, commodities are an insurance against inflation.

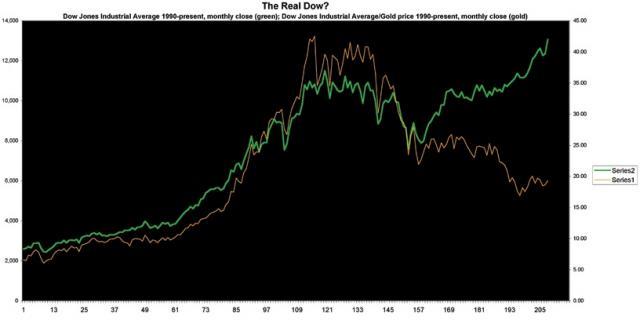

And do we have inflation? The deflation that China exported in manufactured goods is now being tempered by the inflation China and a burgeoning Asia in general is imparting through a ravenous demand for commodities, which they have earned the means to pay for. Nickel (used in the making of stainless steel) prices, for example, have risen 500% in just over three years. In addition inflation is being incubated through the massive liquidity injections Japan and the US have administered in order to stoke their economies as ‘deficits don’t matter’ (Dick Cheney), or because there is no silver bullet for pork-barrel politics (there is, but it tends to lead to a oneparty state and other nasties). People are wise to the fact that if governments print money the value of money falls. People do not yet seem to be wise to the fact that if governments create money electronically, deliver it to select brokerage houses and instruct said houses to purchase bond and stock futures, they are doing exactly the same thing paperlessly. Oh yes, and conceal that they have done this by discontinuing the publication of the M3 figures (since March 2006 in the US). The litmus test however, is precious metals, principally gold, prized as a store of wealth vis-a-vis fiat currencies. The gold price as a measure can be temporarily manipulated – by central banks sales, such as the Bank of England selling a large chunk of their gold reserves at the gold price low in 1999 – but left to find its true level in free markets is an unfalsifiable measure of the value of other assets. It is instructive to consider that the Dow Jones Industrial Average has made a run of new highs this year, but priced in gold it is worth less than half its value at the 2000 peak (Fig 1). Which is the real Dow?

Click on image for enlarged view.

The second prong is fundamental, the astonishing surge of Asian demand, ex- Japan. Two thirds of the planet’s population live in Asia, and hitherto have largely been marginal to the world’s economic system except as producers of commodities. The transformations of their economies, initially in the ASEAN countries and then in covert capitalist China and ambiguous capitalist India, has seen the creation of growing middle classes, now large enough and wealthy enough to spark consumption-driven growth. The US and Japan are still the world’s No.1 and No.2 economies but their preeminence will not last beyond the middle of this century. Last year, China replaced the US as Japan’s largest trading partner. Once they have glimpsed them as an achievable goal, Asian citizens are not going to surrender the possibility of first-world type lifestyles easily. Indian per capita oil consumption is one thirtieth and China’s one fifteenth that of the US. China’s economy is growing at 9.5% per year and India’s at 9%. Even if India and China’s oil use were half that of the US, the world would have a shortfall of 15 billion barrels per year, and consumption levels are likely to keep climbing. China plans to relocate a further 235 million people to cities over the next twenty years, which will require the construction of more than thirty cities the size of greater London, a s p e c t a c u l a r l y materials-intensive enterprise. And China has good reason to do this: the rebellions throughout its history have started amongst peasants in provinces. The massive demographic strains imposed by China’s rapid growth need – from a government point of view – to be contained, even more so considering the mismatch of the plurality of capitalism and China’s political system. Urban populations are more easily managed. Can China afford to do this? With a warchest of US$1trillion in foreign exchange reserves, why yes.

Those who argue that supply will naturally respond to demand perhaps underestimate the asymmetry between the two in relation to natural resources such as oil, metals and minerals. With mining and extraction the lead time to open a new production facility is about ten years. Even to re-commission a mothballed mine can take five. Mature oil wells can’t be pumped faster and prospective new fields are deep ocean, fiendishly difficult, capitalintensive and time-consuming to bring into p r o d u c t i o n . Two decades of c o m m o d i t i e s bust has meant chronic underinvestment. New investments undertaken in response to post-2003 demand will take years to feed into supply.

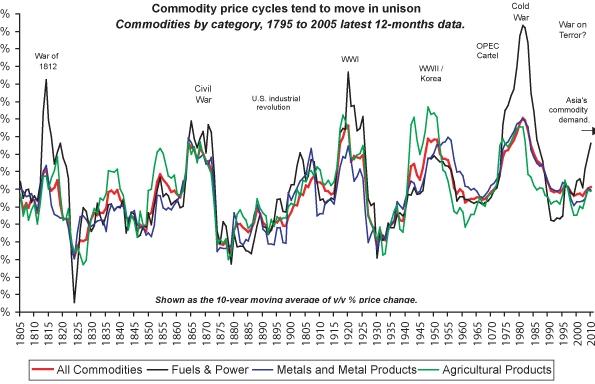

The third prong is the cyclical nature of commodities. This is most easily seen from a long-term chart. Fig 2 shows just over 200 years of commodity prices, with also the sub-categories of energy, metals and agriculture. What is noticeable is a high correlation among commodity types; also that prices move in pronounced fashion from peak to trough to peak. Unfortunately this cyclical pattern is not as regular as a shinkansen timetable, but it is reasonable to observe that we have just emerged from a major trough, and that on past form we can expect at least a further decade of rising commodity prices (to see how commodities cycles compare to those of stocks and bonds see Putting Together a Balanced Portfolio in J@pan Inc No. 70). It is also observable that there tends to be an outsized top every 50-60 years and we are not due one till 2030-2040; also that commodity tops are linked to wars. Do we have a war now? Yes, of sorts. And guns-and-butter US government spending – the swiftest reversal to a budget surplus ever recorded outside declared wartime. So it’s a fair assumption that commodity prices have plenty of rise in store. But also of course that one day the boom will end, but then again this is likely to be ten or more years away.

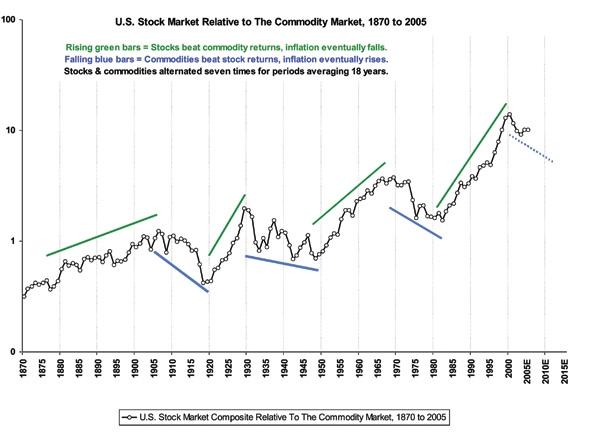

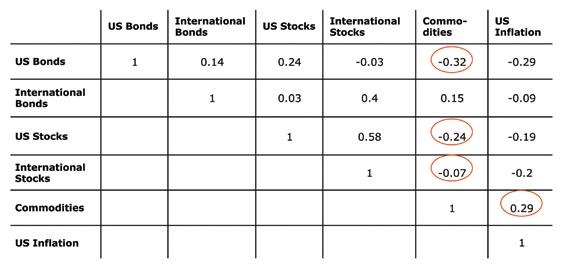

The fourth point is the low correlation of commodities to traditional financial assets. It has been mentioned that commodities tend to move opposite to stocks and bonds. Fig 3 shows the relative strength of commodity prices to stocks over the last 130 years. Overall, stocks tend to do better, but the periods when they don’t and commodities are more profitable last for a couple of decades. We would seem to have embarked on such a period now. As in Fig 1, the nominal Dow appears to have decoupled from the gold-valued Dow. Nominal values may be at new highs, but real values have tilted back to commodities. Even for the unconvinced, the correlation matrix (Fig 4) shows that commodities are a useful asset class in putting together a diversified portfolio. A study by Plante & Roberge of prices 1970-2006 shows that even though the volatility of commodities is higher, an admixture of commodities to a traditional 60:40 portfolio of stocks and bonds reduces risk in a portfolio most effectively at 25% commodities and is beneficial up to 45%, whilst simultaneously improving returns. Diversification matters – although within a diversified portfolio there is a clear case in current conditions to be overweight in commodities.

What of the arguments questioning commodities investments?

1) The rate of return on commodities is roughly equal to the rate of inflation

This is true, but it is an ‘in the long run we are all dead’ type a r g u m e n t . Inflation, often caused by unpredictable debasement of currency, can destroy a financial portfolio (three consecutive years of 20% inflation halves the value of your savings). Commodities will proof a portfolio against inflation.

2) There is no return for holding commodities

True, but businesses that use commodities (e.g. a flour producer) are prepared to lose on a wheat futures contract as long as they have a dependable price. For them, this is an insurance premium. Additionally, most commodities contracts are margined and the investor will have 90-95% invested actually in T-bills, which do produce a return.

3) In the long term, commodities underperform

Compared with stocks, yes. Fig 4 makes this clear. But there are lengthy periods where they outperform. There are good reasons already mentioned to think we may be in such a period.

4) China is in a slowdown / there will be an economic clampdown

This rumour keeps emerging and never gets past rumour status. Inevitably China will have periods of contraction in the next thirty years, but they might be from 9.5% growth to 6.5%. China has signed up long-term commodity deals all over Africa and the Southern Hemisphere and has taken a stack of direct equity stakes in commodities producers. China isn’t going to go away and an ever-swelling India has to be factored in.

5) Recent institutional demand for commodities has been tailing off

Typically institutions are slow to act and slow to react. Their entry into the commodities market was late, in response to already risen prices. Now many of them hold losing positions. They will put more money in when the fundamentals of supply and demand move prices up again.

6) Commodity prices have been borne up by speculative money

This is a fair point made by Richard Bernstein. Commodities with contracts available to speculative money are priced up to 60% higher than commodities not easily traded by speculative money. However, these commodities contracts will presumably always be accessible to speculative money. These contracts have survived the 2006-2007 consolidation (with copper, for example down 40% at one point). Beyond that, the same reasoning applies with point 5: once price moves up, expect a lot more money to come in. Speculative money injects volatility, not price limits.

7) That we are in a classic bubble

Certainly commodities prices peaked in 2006 and most have been correcting since, but this is normal wall-of-worry behavior in any bull market. Things do not move in a straight line. Bull markets periodically rebase on the way up.

8) Everyone is talking about them

This is where we come in. We will know when they are. Really, how much fuss do you hear out there?

For ways to invest in commodities please see http://www.bannerjapan.com/where_to_invest or contact Banner Japan on 03-5724-5100 / questions@bannerjapan.com Chris Cleary is Director of Banner Japan KK