Investment: Market Turbulence and the Emotional Conundrum

By Chris Cleary

“The recent stock market woes have dented my investing confidence, so I’m sitting on the sidelines right now. I’m scared markets will go down more...if they don’t I’ll curse myself!”

When is a good time to invest? Obviously at market lows. And to disinvest? Obviously at market highs. The dictum buy low/sell high is perfectly rational.

However, market conditions are always uncertain. Fluctuation is the mechanism of price discovery. Markets fluctuate perpetually: whether they are moving sideways, upwards or downwards. Sorting trend from fluctuation is only possible when trend is established—in other words, in hindsight—and the end of a trend is likewise only clear given the advantage of history, I.e. Too late for investment purposes. Even when a trend has been established, there is no certainty in real time when trend falters and turns that a market has reached a high or a low: highs can go higher and lows can go lower. Nobody rings a bell.

To complicate matters, human beings are both rational and emotional creatures. Sufficiently rational to think of ‘buy low/sell high’ and assent to it, and sufficiently emotional to want to do the exact opposite when market conditions become extreme. Fear of loss makes people shun investing when markets are falling; indeed, the more a market falls the more investment-averse people become. On the other hand, rising markets induce lust for gain, and the more markets rise the more achievable gain seems; the higher a market goes, the more people want in.

However, with a few simple risk control rules and the risk/reward characteristics of investing, market uncertainty is tolerable; with a mechanical system, it is possible to make money. It is the emotional side, when people come to investing, that lets them down, especially when exacerbated by mass mood swings. Money—or rather the resources and opportunities it represents—is an emotional, visceral thing. As soon as emotions are plied by extreme events, and are corroborated by the concurrence of the crowd, they interfere with judgement. Which is why the uninformed investor tends to invest when news is good, markets are a popular topic, and people are excited about investing. Most likely, such a scenario occurs going into a major top and the investor stays in until after that top and a considerable distance down the other side. The inverse is when all the economic news is bad and people want to stay out of the market (if they are not in it already). Bad news can get worse, of course, and down markets can fall further, but the time to buy is when there has been consistent bad news and people think worse is not possible. Exactly the time that most people don’t want to invest, is the best time to invest.

As I am sure everybody is aware, the news is bad and seems to be getting worse day by day. There have been prior indicators of this: markets rising just about straight up for four years, and the US yield curve inverting twice in the last year, which is a pretty sure lead indicator of recession. But until last summer it wasn’t clear what set of problems and related events would trigger market jitters that would go beyond mere skittishness into a bear market. Now we know.

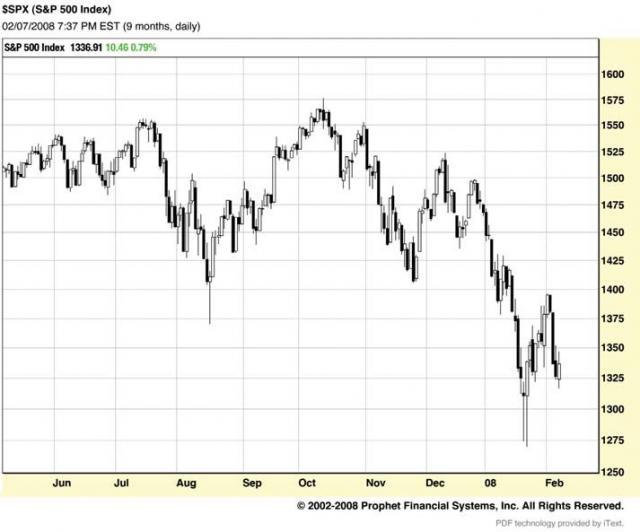

The graph of the S&P 500 at the current time of writing—I am using stocks as a proxy for ‘markets’ in general and the S&P 500 as a proxy for stocks—displays three sharp falls in the last half year on the same news complex. And it is a complex: a developing story in which each new chapter follows on with previously unsuspected but inexorable logic and widening frame of reference— unsuspected in this case even by the vast majority of inside players. Experienced pros are undergoing progressive disconcertment at the sheer scale of the effects of small causes, and powerful CEOs are losing their jobs. By the end of this story, not quite as many employees of financial institutions will have been fired as low-income families and/or topof-market entrants will have lost their houses, but they will; financial institutions’ profits will have been massacred, and their credit ratings decimated.

It is not the purpose of this article particularly to tell the causation story as it is generally familiar; it is recited here simply as the current example of bad news for a market. And it is bad news, make no mistake:

01 Mortgages are mis-sold in the US to people who can’t really afford them, in an overheating get-in-at-the-top housing market and on terms they don’t really understand; the mortgage terms involve later unexpected rises in interest rates that make the difficult-to-afford unaffordable.

02 Said mortgages are bundled to spread individual mortgage risk and sold (‘securitized’) as a bond equivalent, giving an income stream through repayments against a defined credit risk standard.

03 Said securitised bundles become building blocks in tiered bundles of loans of various investment grades (Collateralized Debt Obligations: CDOs) which are mathematically modelled to provide a defined risk/return profile at various levels of entry.

04 Said CDOs are then sold on with badged credit ratings in the debt markets to players (banks, investment houses, municipalities, pension funds, etc.) around the world who do not necessarily appreciate their complexity, or if they do, lose interest in the precise details of the next issuance; the combined risk/return profile subtly morphs through the transaction especially as the issuer of the CDO does not have to upgrade the risk profile of the whole package while the underlying credit risk of the instrument deteriorates in real time.

05 Said players devise sophisticated vehicles for said CDOs off their balance sheet but ultimately within their umbrella—SIVSs, shades of Enron’s raptors.

06 Bond insurers insure CDOs or the entities holding them.

07 Rates rise (at the time), or are contractually hiked at the assigned but not necessarily anticipated period.

08 The person at the bottom of the pyramid who couldn’t afford the mortgage, or was over-opportunistic in trying to get it, can’t pay any more.

09 The mortgage defaults, with evermagnifying shockwaves into the above tiered structures; billions in assumed value has become worthless. Bond insurers are over-exposed to the unisurable and sucked into the spiral.

10 Opacity and uncertainty (where is the debt hidden? / who are the walking wounded?) lead directly to reluctance to lend and thus a credit crunch which central bank easing cannot fully counter.

The benefits of financial engineering should be asserted against this surprised litany. Certainly it is useful to be able to bundle mortgages and thus spread risk, making mortgage lending more, and more widely, possible. And arguably, it is useful to further bundle bundled debts as it increases the capacity to offer debt—as long as debt is properly described and understood on both sides. As usual with financial engineering, it is a tale of ingenuity of great potential benefit to all, not only the contracted parties but society in general, gradually vitiated by greed (in obtaining fees for business on which there is no further responsibility), oversight (or rather the lack of due oversight), and complacency, which degenerate into a normally accepted practice— accepted until the consequences reveal themselves.

By the time this article is published, the S&P 500 chart will have fluctuated further: up a bit more, and then in a further, deeper plunge. There will be more bad news than there is at current writing.

Advice and further information on investment is available from:

Banner Japan

Tel: +81-3-5724-5100

Email: questions@bannerjapan.com

Chris Cleary is a Director of Banner Japan KK

This is a scenario expectation within a normal market paradigm. Market falls are not unique. Fear as an emotional experience makes them seem so, but they happen, and they happen on a regular basis. Markets cannot go up forever. Economic realities—which are the sum of human endeavour and frailties—proceed with the balance that is provided by price discovery. Good markets have an uptrend based in misgiving, in worry; bad markets emanate from over-enthusiasm and over-confidence. In other words, not only does the human emotional conundrum dispose people to act against their best interests; its excesses also usher in the character of the ensuing market counter-move. The new bull market will begin in fear and proceed nervously— until accepted, way later, as fact.

When is a good time to invest? There is an online quiz attached to this article at www.japaninc.com/market_quiz that will give you a brief historical tour, pose a few questions, and provide a commentary.

Implications for investing:

- Fear and greed are out to get you. Cast a cold eye.

- If you are a self-directing, risk-taking investor, you might want to pick up a few financials and homebuilders later in the year, but at your peril, and I wouldn’t advise doing so for a few months yet.

- Hold diversified positions in different asset classes, so you do not care about any particular market or trend so much (J@pan Inc Issue 70). We have been advocating gold since 2001, and commodities since 2004.

- Use the benefits of a long-term regular savings programme to take the worry and the snags out of the process. (J@pan Inc Issue 73) Medium to long-term, regular savings programmes work no matter what market conditions. This is especially the case if you do not have the time, the inclination, or the knowledge to invest directly on your own behalf.

- Study market history and give it much more credence than the ‘news.’

- Employ an adviser, if only to have someone to bounce ideas off. Also to ensure that someone else understands what you are doing: what would happen to your family if you were no longer around and noone else knew what was going on?