The Case for the Defense

Back to Contents of Issue: April 2002

|

by Jonathan Allum |

|

January is generally supposed to be a benign month in equity markets but 2002 has proved a notable exception, especially in Japan where the market has tumbled to levels not seen since the mid 1980s. This suggests a fundamental deterioration in Japan's condition but this is not apparent from the economic data -- the Japanese economy remains in a severely depressed state but this is something that has been apparent for some time. But if the underlying fundamentals have not significantly deteriorated (and one must concede that they have not improved) the sentiment surrounding Japan has turned distinctly more alarmist -- one cannot open a serious business or financial journal without reading of the impending implosion of Japan. January is generally supposed to be a benign month in equity markets but 2002 has proved a notable exception, especially in Japan where the market has tumbled to levels not seen since the mid 1980s. This suggests a fundamental deterioration in Japan's condition but this is not apparent from the economic data -- the Japanese economy remains in a severely depressed state but this is something that has been apparent for some time. But if the underlying fundamentals have not significantly deteriorated (and one must concede that they have not improved) the sentiment surrounding Japan has turned distinctly more alarmist -- one cannot open a serious business or financial journal without reading of the impending implosion of Japan.

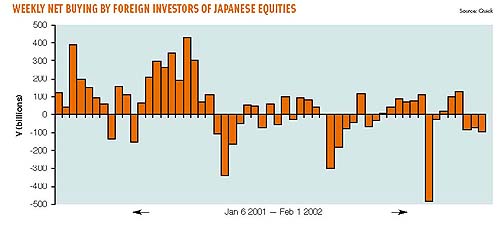

Much of this pessimism centers on Prime Minister Junichiro Koizumi and the perception that his administration is losing its reformist zeal. Two episodes are most commonly quoted: The rescue of Daiei (8263) In late November and early December last year, the equity market was falling sharply on the perception that a substantial swathe of Japanese industry was about to follow Aoki (1886) into bankruptcy. Corporate bond yields were rising, as lists of those most likely to fail were widely circulated. The thirst of many (generally foreign) observers for creative destruction was about to be satisfied. Prominent among these names was Daiei, which was confidently predicted not to see in the New Year. But in the event Daiei was deemed too big to fail and is to be the subject of a rescue package. Now, even some of the more fiscally challenged construction companies are being encouraged to merge as a means of survival rather than liquidate. So, this time around the market is falling sharply on the perception that a substantial chunk of Japanese industry is not about to follow Aoki (1886) into bankruptcy -- the distressed shares themselves have in general bounced very sharply from their December lows. The sacking of Foreign Minister Tanaka Makiko Tanaka's tenure at the Foreign Ministry was not a success and was principally marked by a series of bitter disputes with her civil servants. But there has been no doubt that Tanaka stood on the reformist side of the fence and was prepared to fight hard against conservative forces in both the bureaucracy and the LDP. This was recognized by the electorate, which gave her popularity ratings to rival Koizumi's own. The prime minister has long since distanced himself from Tanaka and removed her from serious decision making and thus might not have seen her final sacking as of any great importance, but it has severely dented his own popularity -- always his own most potent weapon -- and given heart to the anti-reformists who delighted in Tanaka's political demise. Thus international sentiment has become ever more negative (if that were possible) and foreigners have once again become net sellers of Japanese equities.

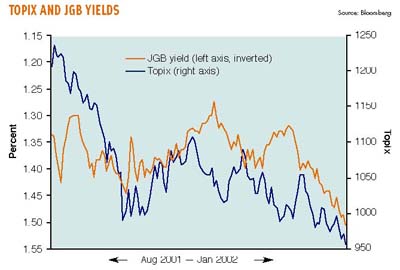

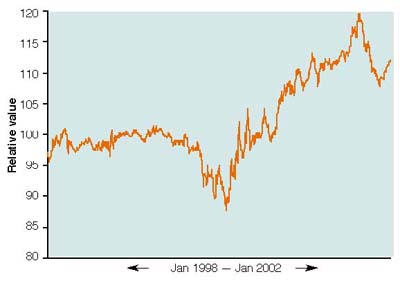

My own concern focuses on something rather different, namely the weakening of the yen. This trend has been encouraged, at least sporadically, by the Japanese authorities and has invoked the wrath of the Americans. It has generally been seen as economically beneficial in that it will help the exporters. The yen has weakened sharply from the low 120s to the mid 130s as we went to press. But the deliberated debauching of the currency is a very dangerous game if it helps entrench a general 'Sell Japan' attitude which can erode all Japanese asset values. In 1998, when the equity market was crumbling (as now) on fears over the banking system (as now), the JGB market was soaring on its perceived safe haven status. This time around both bonds and equities have been falling together. Happily, the Japanese authorities seem to have lost their enthusiasm for talking the yen down and the currency is showing signs of stability. I regard this as encouraging. I also regard as overblown the persistent talk of imminent crisis. The prevailing view is that a banking crisis is in the wings, brought forward by the ending of blanket insurance on bank deposits. There is some evidence of crisis behavior with funds being shifted into the stronger banks from the weaker ones and especially from the credit unions, and an unprecedented demand for gold, but this is still a long way short of a fully fledged run on the banks. It is noticeable, for example, that there has been no surge of Post Office deposits and, curiously, allegedly risk-averse Japanese individuals have become net buyers of equities. If fears of financial system collapse are reflected in current equity prices, I would suspect that these are unnaturally depressed. So what reasons are there for, even qualified, optimism?  Most importantly, many Japanese shares are simply very cheap. It is quite possible, across a large swathe of the market, to buy companies with solid balance sheets on substantial discounts to book value. And the evidence is that value investing methodologies -- which would focus on such stocks and have a very good long term track record -- are beginning, after a poor period at the tail end of last year, to deliver outperformance once again. The chart below, using the MSCI indices, shows how 'value' has performed relative to the Japanese market. There is some selective evidence of bottoming in the Japanese manufacturing sector, with December figures for both industrial production and private sector machinery orders coming in better than expectations. Globally, the evidence of economic recovery is mounting. This will impact many Japanese sectors and it is noticeable that in a weak 2002, many of the classic cyclical sectors (pulp and paper, transport equipment, rubber products, machinery et cetera) have been amongst the best performers. The primary market continues to boom. The first day premiums on new issues this year have, on average, exceeded 100 percent and there is a healthy pipeline stretching forward into March. It is unfortunate that Japan's sunset companies receive so much more attention than the newer companies which continue to come into the public domain.

In 1998 I was surprised (and shocked) to see the TOPIX index below 1000 which I regarded as a tremendous buying opportunity and a level that I would probably never see again. I was wrong -- this totemic level was breached again in late 2001 and again this year. But I still regard it as a buying rather than a selling level. ii Jonathan Allum is a 20 year plus veteran of Japan's financial markets and the London-based Japan strategist for KBC Financial Products, UK Limited. |

|

Note: The function "email this page" is currently not supported for this page.