By Robert K. Temple

Japan is a world leader in nuclear reactor technology. That lead, however, is threatened by China, France, Korea and Russia. Moreover, failure in the American State of Texas might be the end for Japanese vendors of commercial nuclear reactors; companies which have been spearheading expansion of Japan’s globe-leading industries. This failure is threatened not by mistakes by the companies themselves, but rather by the lack of political will and foresight of the U.S. Government, a government that has lacked the leadership to pass a carbon tax and not had the vision to appropriate adequate financing for nuclear power. Fortunately, there still is time for the Japanese nuclear industry to act to save itself, and, ironically, to save America as well from its short-sighted ways.

The solution isn’t complicated—but it is not inexpensive either. It will require Japanese vendors to take the lead and secure financing for plant construction and commitments for the power produced. Only by making sure these plants are constructed as planned will Japan secure its future in this developing industry. What’s more, if the world market for carbon-free energy continues to develop as anticipated, an added benefit of a commitment to take the output of these plants may be a nice additional profit in the merchant energy market.

This article will summarize the Who, What and How the Texas projects have failed or are likely to fail and steps that can still be taken to alter the current trajectory. Japanese companies had started down the right path, and they thought they had closed sales on three nuclear projects proposed to be built in Texas. Celebration of these deals may have been premature as one project is dead, another project was ordered by a company that now lacks the balance sheet to complete it, and the last project developer appears unlikely to be able to secure financing. Having recently lost out on nuclear projects in the middle east, Japan’s success in the U.S. market is critical to demonstrating it can deliver nuclear projects in a world market and compete effectively against the Chinese, French, Koreans and Russians.

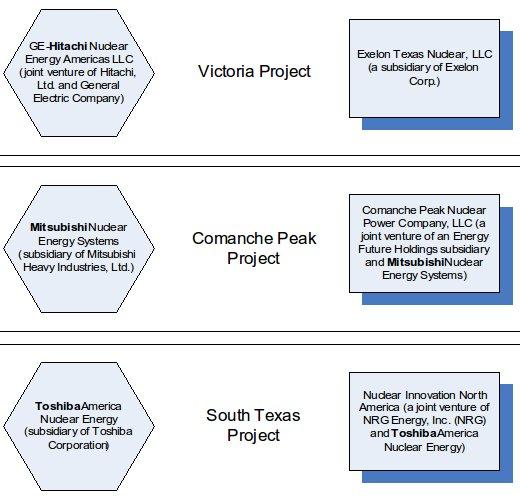

Who are the players?

In two of the three Texas nuclear projects the Japanese reactor vendor is already on both sides of the transaction, as reactor vendor and project developer.

What happened?

First, the limited capacity of US Department of Energy (DOE) loan guarantees has been a factor in all three of the Texas nuclear projects. The Energy Policy Act of 2005 allocated $18.5 billion in loan guarantees for advanced nuclear projects in the U.S. DOE short-listed four projects of the 17 project applicants for further consideration for loan guarantees. A conditional commitment was extended to the developers of the Vogtle Project for a total of $8.3 billion, tying up about 45% of the available loan guarantee capacity on a single project.

As neither the Victoria County Project nor the Comanche Peak Project made DOE’s loan guarantee short list, those projects have stalled. Given the absence of a liquid market to finance merchant nuclear development, federal loan guarantees or other forms of financing are essential to make these projects move forward. Exelon has changed the Victoria Project from an application for a reactor license to a site permit – a measure that could bank the site for later development. Energy Future Holdings, the main sponsor for the Comanche Peak Project, is thought to be too busy reorganizing its massive debt portfolio to move beyond seeking a license for its project.

Even Nuclear Innovation North America’s (NINA’s) interest in the South Texas Project, which made the loan guarantee short list, is at risk of not getting loan guarantees in part due to the lack of loan guarantee program capacity. The other two qualifying projects on DOE’s short list (VC Summer and Calvert Cliffs) may receive DOE loan guarantee commitments ahead of NINA, which could easily exhaust the remaining loan guarantee program capacity. A variety of bills have been offered proposing to expand the existing loan guarantee program capacity to between $27.5 billion (an additional $9 billion) up to $54 billion (an additional 35.5 billion). Loan guarantee program capacity alone, however, is not NINA’s only problem.

NINA lacks both the balance sheet and source of income to repay a federally guaranteed loan. NINA’s share of the South Texas Project expansion is in the competitive Electric Reliability Council of Texas (ERCOT) market. NINA is a merchant nuclear development company without material assets beyond its interest in the South Texas Project expansion with which to secure financing for a multi-billion dollar nuclear development project. NRG’s CEO David Crane has made clear that this project is not going forward with parent-company guarantees from NRG. In its earnings call on August 2, 2010, Mr. Crane announced that his company is rolling back spending on the South Texas Project to $1.5 million per month while uncertainties about NINA’s ability to obtain loan guarantees remain.

How did this happen?

First, the current U.S. Presidential administration had priorities other than carbon or nuclear that it focused on. The administration used up its political good will, at least for the first two Congressional terms, on health care and Wall Street. It lacked the ability to get an energy bill through Congress with either a carbon penalty or that expands the loan guarantee program. Second, the economic crisis led to some reduction in electricity demand. This combined with a soft market for natural gas flattened an otherwise solidly increasing price curve for electricity within ERCOT.

Third, in light of the soft electric and natural gas markets and high capital cost for large nuclear projects the easy choice for power purchasers was to wait. Why commit to a long-term contract for electricity from a nuclear plant if electricity prices on the ERCOT market, driven by natural gas, remain soft? Fourth, it is easier in a market with soft electricity prices to justify waiting to build a natural gas plant than to invest in or buy output from a new nuclear plant. A new natural gas-fueled plant can be brought on line from permitting into operation in a little more than three years. In contrast, a capital-intensive nuclear power plant is estimated to take about ten years to bring through permitting and construction. Fifth, the DOE is looking for developers to be able to demonstrate that they can pay the debt service on loans receiving federal guarantees. In a merchant market that means the developer must have solid power purchase agreements with credit-worthy buyers. With a soft electricity and natural gas market in ERCOT and questionable stability of the merchant developers, potential customers are not rushing to make long-term power purchase commitments.

What can be done to change the ending of this story?

Changing what is a likely failure of Texas nuclear development into a nuclear renaissance will require adding to or supplementing the loan guarantee program capacity and having financially capable developers with commitments from bona fide customers. Putting a price on carbon emissions from fossil-fueled plants will certainly make nuclear more attractive in a competitive electricity market.

Expansion of or supplementing the DOE loan guarantee program is critical to any hoped-for resurgence for US nuclear development. An additional $9 billion with substantial assistance from Japan (for the South Texas Project) and France (for the Calvert Cliffs project) might allow the remaining three projects on DOE’s short list to get built. In the absence of additional allocations for loan guarantees, there will not be enough nuclear projects in the US to really prime the pump for new nuclear development. A shortage of US projects will dampen the world nuclear market.

Putting a price on carbon, either through imposition of a carbon tax or carbon cap-and-trade program, will put to rest the uncertainty of the price point for fossil-fueled generation as compared to alternatives. With relatively low natural gas prices even a small price on carbon makes the cost of nuclear and the risks of developing nuclear reasonable when compared to the alternatives. With environmental pressure on other fossil fuels, greater demand will raise the price of natural gas. The historic volatility of and likely increase in demand on natural gas continues to make nuclear a natural hedge against otherwise volatile electricity prices.

Beyond loan guarantees, financially stable projects can be achieved through two means. One alternative is to offer electricity under terms attractive to purchasers and another is to obtain increased equity involvement from financially sound partners or increased support from other resources.

With the first alternative the developer could sell electricity to companies with a balance sheet, including municipal utilities and electric cooperatives, in a fashion that protects each power off-taker’s interests from default by the developer. Municipals and cooperatives have little interest in betting their electric generation futures on the fate of a limited liability developer. Historically some merchants have demonstrated the ability, through bankruptcy and otherwise, to walk away from obligations under power purchase agreements. What municipal or cooperative wants to enter into a long-term power purchase agreement and assume the risk that they could be forced into the spot market for electricity if their developer counter-party walks away from its deal? Public-private partnerships which convey ownership rights in the event of default may have some interest for municipal and cooperative utilities. However, it will require a credible broker and a favorable agreement to interest these parties.

The second alternative is for weak developers to cede project interest at a reasonable cost to companies with enough of a balance sheet to complete the project. To some extent NINA has been trying to do this, with a promised sale of at least 10% of NINA to Tokyo Electric Power Company (TEPCO), but the sale to TEPCO will close only if NINA is able to first close on DOE loan guarantees.

Given the development risks and the limited capabilities of NINA, expansion of the South Texas Project probably needs more partners to make that project a reality. What may be required to get these projects launched is additional support from the Japanese to bridge the gap in the US loan guarantee program or shore up the weak developers. While Japanese vendors have taken minority (12%) stakes in two of these projects, it may take a larger commitment.

Another approach to address the financial weakness of the Texas developers is for the Japanese to guarantee a larger portion of the project risk. This could come in the form of guarantees for repayment of DOE-backed loans or additional direct project support from the Japan Bank for International Cooperation. While that would expose the guarantor to additional development and ERCOT market risk, it would assure completion of the projects and demonstrate Japanese confidence in the competitiveness of their products. There may also be a broader role TEPCO could play to help manage these risks.

Conclusion

The projects the Japanese sold in Texas currently appear to have stalled and may be destined for failure. A change in course with developers, loan guarantees and possibly carbon may be necessary to alter this outcome. If there is a penalty on fossil-fueled alternatives, then carbon-free nuclear is a viable alternative source of electricity in the competitive ERCOT market.

There are actions within the control of the vendors that can change the outcome for these projects. Vendors must convince developers to bring in additional credit-worthy partners (or sell projects to companies with the balance sheet to complete them). Developers must obtain commitments for energy from these projects to have any likelihood of success. Credible brokers offering project-level guarantees will be needed to get credit-worthy purchasers to commit to long-term power purchase agreements with developers.

For the sake of their position in the world market, Japanese should be willing to take on a greater share of the risk and potential reward from the Texas nuclear projects. Whether that comes in the form of additional equity interest or guarantees for repayment of project debt, to avoid losing additional share of the world nuclear market the Japanese must demonstrate they can be successful suppliers of nuclear technology outside of Japan.

Blog:

Other posts by Japan Inc:

Comments

Anonymous (not verified)

September 2, 2010 - 12:50

Permalink

Why is Texas compared?

Very nice article. I wish the article would expand itself to cover the 26 reactors throughout the US rahter than just Texas. Financing is the key and Japan can very much help out in this manner.

The last time I looked, there were some 28 projects being considered. Here is a breakdown as of June 1, 2009 (little dated sorry):

Technology Lead Number of Units

US-APWR Mitsubishi 2 units

US-EPR Areva 4 units

ES-BWR GE-Hitachi 6 units

AP1000 Westinghouse 14 units

ABWR G.E. 2 units

So out of all the NEW reactors being proposed how many do the Japanese have their finger in?

US-APWR - that's obvious, Mitsubishi

US-EPR - nope, not Japanese but Japan Steel Works (JSW) will supply a lot of the critical reactor components.

ES-BWR - yep!

AP1000 - Look who purchased the nuclear arm of Westinghouse, Toshiba!

ABWR - Even though G.E. is mentioned, I believe Hitachi & Toshiba were selling this technology at one time. If I am not mistaken, the South Texas Project is ABWR and will come from Toshiba (need to reconfirm).

Anonymous (not verified)

September 5, 2010 - 22:55

Permalink

time for Japan to go solar!

This makes it clear that there is no future for atomic power in Japan.

After the Kashiwazaki disaster it should be clear that a nation with so many reactors on earthquake faults is playing the worst form of radiaoactive Russian roulette.

The future for nukes in the US is dimming every day.

If Japan wishes to have a stake in the world's energy industry, it must abandoned this failed technology and move 100% into renewables.

Harvey Wasserman, editor. NukeFree.org