Japan Third Party - The Value of Being Bilingual and Bicultural

How a niche player has worked its way into the Japanese back offices, with the help of some of the world’s best-known technology brands.

By Jack Beazley

When most people think of outsourcing, their thoughts quickly turn to Ross Perot and the massive outsourcing business he formed as the EDS Corporation out of Plano, Texas. Indeed, in terms of size and singular focus, EDS was the first and still one of the best examples of the outsourcing concept. Born in 1962, the company offered American companies and various arms of the US government, including the military, a new way to cut costs in non-core areas of expertise, namely IT infrastructure and services. It was a powerful vision and today, EDS is still a major vendor of outsourced services to GM, as well as being the second largest IT services outsourcing company overall in the world, after IBM’s Global Services operation.

Forty-four years after the founding of EDS, the global outsourcing market has become a massive business. According to research company IDC, the leading 5 vendors, IBM Global Services, EDS, BT Group, CSC, and T-Systems accounted for 53.5% of the US$67.9bn worth of outsourcing contracts awarded in 2005.

But one country that none of the majors, other than IBM, has been able to penetrate is Japan. This hasn’t been for want of trying. EDS, for example, has invested significant sums in its Tokyo-based subsidiary, Japan Systems, as well as in hiring technicians and sales people for its local, directly owned entity. Why have such global players found it so difficult to sell to and work with Japanese customers? Our analysis is that there are at least 4 reasons why this is so.

1. Large Japanese companies have developed their own form of outsourcing, binding in long-term vendors with cross-share holdings and decades of trust. They are less comfortable with independent external vendors, and particularly foreigners, who want to own the infrastructure, data, and mission-critical services that they see belonging to the core business. At its extreme, the closeness of customer-vendor relationships can be witnessed as “Amakudari” (literally, “Descent from Heaven”), in which senior managers of customer companies, upon retirement, take up positions with their vendors.

2. In a country where there are a lot of “body shops,” EDS has attempted to provide value-added services as a means of creating differentiation and earn sufficient profits to commit fully to Japan. However, this pits them directly with vertically integrated giants such as Fujitsu, Toshiba, and CSK on the Systems Integration side, and specialist majors such as NTT Data, NRI, and Hitachi Software on the consulting side. Without the relationships these majors have, the firm has had to focus on niche opportunities.

3. Many Japanese companies do not have IT staff whose knowledge level is advanced enough to appreciate the value of targeted service offerings such as those from EDS. Instead, the focus for new accounts tends to be simplistic body shopping or directly connected to the outsourcing of follow-up services from software and other products sold into the customer. Thus, for a “third-party product and services-only” company, the opportunity to outsource services is limited.

4. Major Japanese competitors are willing to do loss-leader work, often throwing in IT consulting services as part of a larger deal. In particular, they are dedicated to retaining market share, even if it means a loss for the account in a given year. This type of approach is something that foreign firms, with their focus on quarterly results, find very difficult to do.

Outsourcing is efficient

Outsourcing in the American sense generally means to take over a customer’s engineering resources AND infrastructure, then run it more efficiently than the customer does themselves, allowing the customer to focus on their core business. Usually, the word “efficiently” means “more cheaply,” but it can also mean that the output and performance achieved is significantly better for only a modest increase in price.

How is it possible for an outsourcing company to offer a customer adequate support on the exact same systems (at least initially) and yet be able to reduce IT spending to the extent where they can make 10%-20% profit from the costs delta? The simple answer is that outsourcing firms gain efficiency and leverage in the focused area of IT as they become larger.

1. Lower costs.

The sheer operating size of most leading outsourcing firms allows them to systemize their back office, account administration, infrastructure operations (particularly data centers), recruiting and training, and procurement operations so that they have a lower cost base than their customers. Often this can be significant, exceeding 20% or more.

2. Constant staff cost structure.

Slightly different to lowering costs, successful outsourcing companies have learned that good staff will always get promoted and cost more, so the idea is to keep the pipeline of junior recruits full, and the flow of advanced technology projects increasing. This approach provides a career development path for their talented staff, which ensures that they can move around and up through the ranks of titles and positions. Since the same position is being refilled on a yearly or 2-yearly basis, it is true that customers have to deal with receiving a new person on that cycle, something they often don’t like. So long as this is done in a purposeful and measured way, and the new staff are not so green that they put the operation at risk, then this is simply a function of efficient usage of resources.

3. Global off-shoring.

By virtue of their size, most foreign outsourcing firms have operations spread over a wide number of high and low-cost jurisdictions. Thus they can operate onsite support in Canada, but provide data center monitoring from a NOC in India, or provide database software development from a software factory in China. Japanese firms are not at this level yet, but companies such as Fujitsu, CSK and others are indeed experimenting with off-shoring.

4. Accumulated know-how.

Out-sourcing companies work with numerous clients and have a high awareness of best practice, so being able to recommend IT solutions and infrastructure that their customers may have not thought about yet, or which they don’t have the budget to test.

5. Initial capital investment.

Although now, in 2006, Japanese firms are starting to reinvest in their IT infrastructure, it does not have the same priority as product R&D and manufacturing facilities, and thus is usually under funded. Outsourcing firms, although they will hold back on systems investment in subsequent years, will usually upgrade a customer to a performance level that will allow them to be competitive with others in their industry for the period over which the systems are to be amortized.

Trends in the Japanese market

According to MIC Research Institute Limited, the overall IT outsourcing market in Japan for 2005 was worth about JPY2.45trn (US$2bn), being split up roughly into the following categories: Data Centers at 40%, contracted data processing at 30%, and the remainder being in-house manpower and general IT services and support. The market has been stagnant since the implosion of the dotcom sector in 2001, an event that had repercussions on data centers in particular, and grew only 1.5% year-on-year to 2005. However, thanks to the recent economic improvement, things are looking up again, and MIC reckons that this year, 2006, the overall market will be worth JPY2.61trn (US$2.21bn), up 6.5%. As one could expect, the biggest area of growth is expected to be data centers, which are likely to expand by about 8.7% annually through 2010.

The largest player in the conventional third party outsourcing sector is IBM Japan. The company blew past its competition, both local and foreign, back in 1999, when it announced that it had signed a 10-year deal with auto-maker Mazda Motor Corp., for a reported JPY55bn (US$480m) over the full period. The deal involved IBM Japan taking over responsibility for the development, operation and mainte-nance of Mazda’s host computers, supercomputers, 10,000 personal computers and most of its network links. While outsourcing deals had been hitting the news on a regular basis before this, the Mazda contract was sufficiently massive and independent that it served as a wake-up call to IBM’s domestic SI competitors, and touched off what has since become an outsourcing war.

IBM’s competitors were quick to react, and over the following 7 years have announced numerous deals on a par with or larger than the IBM-Mazda deal. Among these was the massive 2002 agreement between Hitachi and UFJ Bank, totaling a massive JPY250bn (US$2.12bn) over a ten year period. In typical Japanese style, the two companies formed the UFJ-Hitachi Systems joint venture — an indication of how closely Japanese firms want to keep their outsourcing partners. Ironically, with the merger of UFJ into the Bank of Tokyo Mitsubishi at the beginning of this year, the final outsourcing victor to the bank is actually IBM Japan, who in 2003 formed an outsourcing joint venture with Bank of Tokyo-Mitsubishi.

Like many trade wars in Japan, the bottom line is that the vendor with the best prices while still retaining service quality gets the work. This has led to Japan-based outsourcing companies becoming innovative in their search for cost base reductions. Back office operations are starting to spread to lower cost locations, such as placing data centers outside Tokyo, but not so far that they are affected by line latency; call centers in Okinawa where the labor costs are just 50% of Tokyo, and software development to Japanese-speaking locations in China, such as Dalian.

China in particular is attractive to Japanese firms, since there is an increasing number of Japanese-speakers there, with almost 100,000 Chinese students enrolled at Japanese colleges and schools every year. IBM Japan announced earlier this year that it plans to move 30% of its domestic outsourcing operations to China over the next two years, which it reckons will reduce domestic costs by 20%. The company is moving more than 100 system administration positions out of Chiba, a city located to the east of Tokyo, to locations in Dalian, Shanghai and Shenzhen.

IBM Japan’s competitors are not far behind. Both NEC Corp. and Hitachi Ltd., have also announced that they will increase their Japanese-language software development capacities in China by 30%, as they experience a surge in development orders for applications from financially recovering banking and manufacturing customers. The planned scale of outsourcing is quite massive, with NEC looking to farm out 800 engineering positions to its subsidiary in Shanghai by the end of this year, which will eventually increase to 1,200 positions by 2008. Likewise, Hitachi is already outsourcing 1,600 engineering positions to an independent vendor, and plans to increase this to 2,000 positions by the end of March 2007.

Then of course, there are the foreign off-shoring companies making inroads into Japan. Most successful of these are the Indian firms, led by Tata Consulting Services (TCS), which was the first Indian player to hit Japan as early as 1987. TCS and others have been “burrowing” their way into Japanese SI firms such as Toshiba, as an outsourcer to the outsourcers—the traditional Japanese concept of “Shitauke”. This has been a largely successful strategy, and although the margins have been tight, the company has been able to use the existing business base to ramp up its Japan-targeted activity. Currently TCS has about 1,200 people dedicated to outsourcing support of Japanese corporations and has just announced the establishment of a new Japan support center in Kolkata, India with 100 Japanese-speaking staff, who, significantly, learned their language skills primarily in India. The company plans to increase Kolkata to more than 2,000 staff over the next 2 years, and will integrate it with its other Japan-focused centers in Shanghai and Hangzhou, China.

Opportunities for newcomers — Japan Third Party

Against a backdrop of machinations, massive domestic players, and failed foreign forays, readers might be forgiven for wondering if there are any opportunities left in the Japanese outsourcing market, particularly for newcomers. The good news is that innovation and opportunity are alive and well, as evidenced on June 22, 2006, when an entirely new sector came to public attention via the IPO of Japan Third Party Co., Ltd (JTP). JTP focuses on helping foreign IT companies represent their products and services in Japan, acting as a logistics and support partner across the nation.

Although other outsourcing companies have gone public in the last few years, JTP managed to get listed and opened at a very respectable PER of 30, or JPY200,000 per share. By the end of trading on the first day, the price had risen to almost double, at JPY360,000 per share. The market’s enthusiastic reception for the company was mainly due to its story, which is both unique and robust. Not only does it compete in a bilingual niche that most Japanese majors are unable to participate in, JTP has also lined up some stellar brand name customers, including Sun Microsystems KK, SAP, Symantec, Nokia, Acer, and Hewlett Packard Japan. Yes, that’s right, JTP outsourcers to one of the world’s top ten outsourcing firms.

Discovering the Third Party

The JTP story started in 1982 when CEO Kazuaki Mori was attending a Rotarian conference in Austin, Texas, on behalf of his Japanese employer. Mori worked in the Field Service division of Omron, and was at the conference to learn more about how to support Omron’s ATM business in the USA. As one of the few non-Americans in the room, he quickly struck up a conversation with the gentleman sitting next to him, and mentioned how Omron was struggling with how to support their ATM business in the States. The man asked him why Omron, an ATM maker, was trying to be a field service company. “Surely,” he said, “You would want someone with an already established third party service network to do the work?”

Mori was astonished. The solution seemed too easy, especially when compared to the millions of dollars being proposed internally for a purpose-built service network. The concept and the term “Third Party” stuck with Mori, and he decided to check out several such vendors. He was impressed with their professional capabilities and yet their ability to control costs. Heading back to Japan, he floated the idea that Omron, too, should go into the third party maintenance business in Japan. The idea met with favor and a team was formed.

However, neither Mori nor Omron had counted on the revaluation of the Japanese yen in the mid-1980s, and the resulting loss of manufacturing competitiveness here in Japan. Omron decided to get out of the outsourcing business in 1987 and Mori, having decided that he had found his calling, resigned to start up Japan Third Party.

After establishing the basic principles (see diagram) by which he would run the company, Mori’s first corporate customer was Sun Microsystems Japan, thanks to an introduction from trading company giant Marubeni. This relationship has really borne fruit for JTP, and now, 18 years later, Sun Micro is still the company’s largest client. Sun’s Scott McNealy hasn’t forgotten the relationship either, and in December 2006, agreed to be a guest speaker at a JTP event.

Executing the philosophy

In setting up JTP, Mori made a few key personal decisions that have turned out to be far-sighted and strong contributing factors to the company’s current growth. We cover a few here.

1. Foreign client focus.

From personal experience, Mori had learned that foreign technology firms have traditionally struggled with the inflexible and sometimes irrational needs of their Japanese customers. Mori saw the need for a bicultural interface that could help innovative foreign products enjoy an equally strong reputation for service too. This means a strong focus on recruiting and training staff to be bilingual and bicultural, and to include essential services in the line-up that Japanese companies would seldom use, such as localization of software, production of Japanese-language user and service manuals, and compliance testing of equipment to Japanese standards. Today, 95% of JTP’s clients are foreign technology companies.

2. Services only.

Mori deduced early on that to compete on a product basis would quickly bring him to the attention of major domestic manufacturers, something that a start-up could do without. This turned out to be not only a successful early strategy, but has also helped long-term business as well. Since he isn’t known to IT customers as a product firm, he is not identified with any particular brand. This has allowed him to be the back end for a number of major foreign brands, without problems arising due to conflicts of interest.

3. Flexibility.

What foreign IT companies are buying from JTP isn’t just a customer support engineer or software developer, but rather an entire program. The company does everything from logistics and call centers, through to onsite support and board-level electronic repairs. More recently, JTP is using its “flow-through” capabilities to offer market entry services to foreign technology firms who have not yet arrived in Japan, yet another rich source of business.

4. Independence.

One aspect of outsourcing in Japan that inhibits the establishment of new, independent outsourcing companies is the practice of customers, and outsourcing companies tying themselves at the hip by way of joint ventures. While this may serve both sides for the immediate partnership, it creates an ossified and narrow focused business that finds it hard to adapt when circumstances change — such as happened with UFJ and Hitachi. As Mori points out, “Once a major SI firm like Fujitsu breaks a relationship with a client for whatever reason, those joint venture subsidiaries and affiliates are left with the reality of having to compete on the open market. However, since they typically only have knowledge of Fujitsu standards and the Fujitsu way of getting things done, they lack the experience and commercial hardening to go out and take on other smaller customers.”

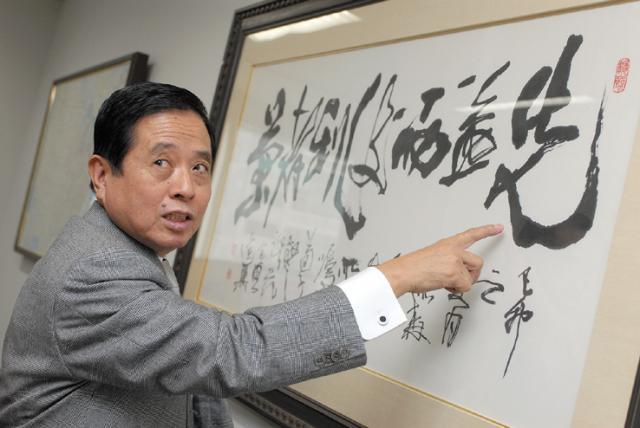

Kazuaki Mori standing next to a powerful message to his clients and colleagues. It reads, "If you value fairness over profit, you will succeed."

Kazuaki Mori standing next to a powerful message to his clients and colleagues. It reads, "If you value fairness over profit, you will succeed."

5. Reinvestment in know-how.

The company has continued to invest in the education of its staff, a virtuous activity that has since been turned into a solid business unit. JTP now trains more than 12,000 engineers annually in Tokyo and Osaka for customer companies. The know-how also extends to research and testing labs, focusing on localization, homologation and systems integration, approvals testing, and Japan-specific troubleshooting. The main testing center is near Tokyo International Airport in Haneda, while regional quality control testing is offered at 120 facilities around Japan.

6. Regional development.

As a bilingual interface, JTP receives requests from foreign firms not only in Japan, but also elsewhere in Asia, wherever Japan end-user customers are operating. This has led the company to set up technology help desks in Singapore, Thailand, Hong Kong and Australia. The regional approach also extends to recruiting. The company takes on engineers from all Asian nationalities, so long as they can speak English and Japanese. Indeed, many are trilingual, also speaking their native languages of Korean, Chinese, Vietnamese, etc. Employees are expected to be able to communicate with their clients in at least English and Japanese.

Benchmark clients

Probably the real secret to JTP’s success has been its ability to work with brand name clients. As mentioned earlier, the company got its first big break in 1989 when it started repairing workstation boards for Sun Microsystems Japan. This was a particularly proud moment for Mori, and he has a framed Stingray Workstation Board card mounted on the wall in the company’s board room.

A second major client is HP Japan. JTP does system integration for HP Japan. Stock analysts are quick to point out that Sun Micro and HP Japan between them account for more than 40% of JTP’s business and that this represents a possible weakness in the company’s strategy. Mori agrees that taking too much business from any one client could be an issue, although he is nevertheless gratified to know that such major firms value his services to the extent that they do. So, to provide JTP with a more diverse base, he came up with the concept: è≠ó ëΩïiéÌ(“Shouryou-Tahinshu”), meaning “Small amounts [of business] from various sectors”. This ongoing strategy actually originated in the early 1990s, when Mori was approached by the founder of Dell Japan, Mr. Katsumi Iizuka, for onsite support of Dell products. Mori feared that his client would be too large for his young company and made the difficult decision to introduce them to a larger operator, Tokyo Denki, instead. Although Iizuka has long since left Dell they are still friends and trusted business colleagues to this day.

Another company that is currently a niche business, but promises to become a bigger piece of JTP’s revenue pie, is Philips Electronics, a leader in the medical devices industry. JTP provides technical support for the Philips HeartStart Automated External Defibrillators (AED). The company provides Philips’ customers with call center and second tier technical assistance. Given that foreign medical devices makers hold about 12% of the overall Japanese market in 2005, and are forecast to increase that share rapidly, JTP is well positioned to grow its business in the sector. Included in the unique know-how that JTP is acquiring is the modification and certification of electronic devices to Japanese standards, the production of user and technical manuals, and, of course, the technical experience to troubleshoot and calibrate these devices.

Other notable clients include US printer manufacturer Lexmark, which entered Japan in the mid 1990s. Lexmark contracted with JTP to handle their call center in 1996, and since that time has expanded the relationship to include onsite support engineers and some equipment repairs. Then there was Taiwan’s largest PC maker, Acer, which contracted with JTP for four years before setting up its own in-house operation in Japan. Asked whether customer relationships like that of Acer were doomed to be temporary, Mori says, “Providing we can keep the flow of new opportunities going, and right now there are more than enough, there is nothing wrong in my mind with doing such a good job that the company decides to set up for itself. We earn ourselves a reputation as being the partners to come to when the going gets difficult, or for peak periods, new product releases, and so on. This is good for business.”

"We earn ourselves a reputation as being the partners to come to when the going gets difficult, or for peak periods, new product releases, and so on. This is good for business.”

SMS strategy

In fact, the Acer experience leads us to Mori’s analysis of his overall business opportunity with each customer. Companies don’t all come to him for the same reason, but because of their particular circumstances. As pointed out earlier, it is JTP’s flexibility and solution-oriented approach that keeps them in business.

Unlike many Japanese companies, which only want to do business while a customer’s business is stable and growing, JTP understands that foreign firms have global markets to take care of, and there is correspondingly an ebb and flow of interest and involvement in the Japanese marketplace. JTP feels that large companies may be a bit slower in paying their bills if they’re shutting down an operation, and smaller ones just getting ready to launch represent a possible credit risk. However, rather than be put off by this, the company simply factors such “alternative” business into its risk profile, making sure to do credit checks as appropriate and spending adequate face-to-face time with the clients, ensuring they are committed and capable.

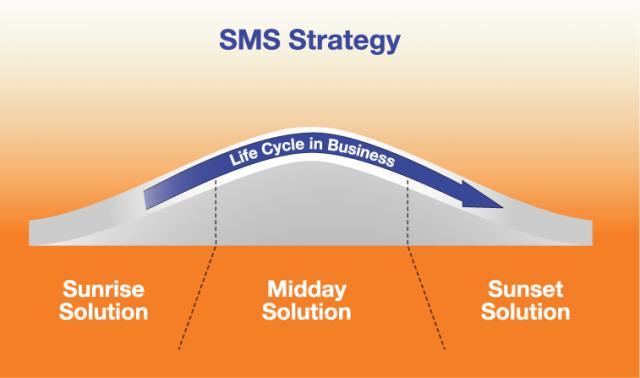

This reality has given rise to the company’s well known SMS Strategy, representing the three phases of foreign company involvement in Japan and the different needs that each phase represents.

1. Sunrise

This phase represents foreign technology companies wanting to enter the Japanese market. JTP makes it possible for such companies to stay focused on Sales and Marketing, while being sure that logistics and customer support are being taken care of. This is a highly promising source of business, and with the establishment of a full-blown office in Santa Clara, California, Mori hopes to be able to approach at least 10% of the 500 or so technology companies in the Bay Area who are freshly or repeat funded every year.

2. Midday

This is where JTP got its start, assisting foreign firms who have been in Japan for a while. Business is usually good, but the competition is never far behind, requiring even successful firms to look at outsourcing as a solution to reduce operation costs and time-to-market. JTP’s value proposition is that it invests in such relationships at its own cost, looking to amortize the investment over the course of a productive long-term business relationship.

3. Sunset

The Sunset phase may refer to either the closure of a company or a product line. Technological innovation is steadily shortening product life cycles and it is hard for foreign firms with smaller presences in Japan to maintain parts inventories, post-service life phone support, and service engineers. JTP offers tailored support packages that allow foreign manufacturers a known fixed-cost means of winding down a product or an office. Now, even a temporary set-back causing most of an office to have to close doesn’t mean that the manufacturer has to burn all its bridges in doing business in Japan.

The future

Although the stock market may go through its inevitable gyrations (as of writing in early November 2006, JTP’s stock price had come down quite a bit from its opening price), Mori is quite confident about the company’s future, pointing out that not only are there 5,000+ foreign capital companies in Japan that he doesn’t do business with yet, there are of course an unlimited number of prospects overseas looking at the Japanese market. The 50 or so prospects in the Santa Clara area every year are just the starting point.

Mori sees the company building on its SMS strategy, helping firms re-structure and to move product support smoothly off the internal operation and into a slow burning shut-down phase. He staunchly defends the level of business he does with Sun Micro and predicts that this customer will remain 20% to 30% of the company’s business for the foreseeable future. That said, of course JTP will be increasing the diversity of its customer base.

In particular, Mori plans to increase the amount of business being done with software companies, since the production of hardware is consolidating globally into the hands of a few majors. This means that JTP will increase the recruiting and training of software engineers. Part of this effort will be the extension of training programs for students sourced out of Nanyang Technological University, Singapore, and other prestigious national universities around the region.

As an indication of what that future might look like, JTP signed a landmark agreement on August 2, 2006, with USA storage king, EMC Corporation. The agreement calls for JTP to provide extensive skills development training on the Documentum product range to both EMC internal and end-user customer engineers. A further related announce-ment came on August 28, when JTP agreed to start an SE education support program with CAPLAN, the Itochu-related temporary staffing company, for outsourced engineers, as well as IT students. JI

Contact details

JAPAN THIRD PARTY Co., Ltd.

Chairman of the Board: Kazuaki Mori

Shinagawa-Intercity A Bldg. 2-15-1 Kounan Minato-ku Tokyo 108-6021

Tel: 03-5782-7600

Email: market@jtp.co.jp

www.jtp.co.jp/english/index.html