Piping Hot Business

Rakuya Onsen and Aqua Japan Tokyo Redesign a Tradition

by John Dodd

Ask a foreign tourist the one place they enjoyed the most during their stay in Japan, and they will likely respond an onsen (Japanese natural hot spring). The steamy bath, beautiful scenery, communal sharing of the tub with strangers, and outstanding meals and service -- these add up to the essence of old Japan.

But onsen are not just a foreigner thing with which the modernity-obsessed Japanese have no truck. In fact, a recent 2005 industry survey showed that after a nearly 15-year downturn, the good times have returned for domestic hot springs, and that more than 70 percent of adult Japanese prefer to stay at onsens when traveling for leisure.

Recovery

One reason for the resurgence is the rebounding economy. The Nikkei 225 stock market index has risen by more than 60 percent in the last 24 months, and consumers are starting to enjoy a trickle-down effect from their employers. The media is even reporting the popularity of the luxury onsen, citing weekend stays at the Kyushu resort Yufuin for ¥300,000 (US$2,600) per person.

Another reason for the resurgence was the fallout from SARS and terrorism in 2003. Both kept Japanese tourists home that summer and the next. People who could afford overseas travel turned to quality onsens and ryokan (traditional Japanese inns). Many became repeat customers.

Turnaround Funds

In 2001 new things started happening to the tradition-bound onsen. Firstly, onsen-specific private equity funds appeared, a prominent one being Hoshino Resort, established in Karuizawa, Nagano, in 1991.

The Hoshino fund did its first buy-out of a resort hotel in Yamanashi Prefecture in late 2001, taking time to learn the onsen hotel business before buying out a number of other establishments, in Fukushima and Hokkaido. Then, with that experience under its belt, the company formed a joint venture with Goldman Sachs in October 2005. It plans to invest ¥30 - 50 billion (US$260 -- 430 million) into 50 establishments over the next three years. That will make the new group a major player, with expectations of managing about 1,500 rooms through a central sales and marketing operation.

Before the tie-up with Hoshino, Goldman Sachs had already targeted the onsen for investment, and earlier in 2005 committed to a ¥220 billion rebuilding program for the Komaki Hot Springs Village in Aomori. According to press reports, Goldman Sachs plans to market the onsen to customers elsewhere in Asia.

Separately, Hoshino has been successful as an independent operator. Its Karuizawa hotel, for example, had an occupancy rate of 90 percent in September 2005 and by October around 80 percent of its rooms were booked for New Year's Eve and New Year's Day, in spite of the price for a family of four for two nights being ¥200,000 (US$1,700)!

Definition and Geographic Distribution

The temperature of the water in an onsen bath ranges from 27 to 43Ž (80 - 110‹F). The water must have a composition of total dissolved solids (TDS) exceeding 1,000 milligrams per liter (less than for seawater), and must meet or exceed the specified concentration of at least one of 18 naturally occurring minerals. Hot springs are classified by one of nine dominant mineral combinations found in Japan, and also according to their temperature, osmotic pressure, acidity (pH), and hardness or softness.

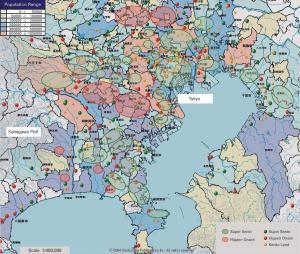

Most onsens are grouped in thermally active areas near major popu-lation centers. The distribution of onsen types around Tokyo reflects both demand and availability. These maps are used to plan new onsen facilities near a population base that will support a full operation. According to Aqua Japan Tokyo, a super sento (see below) requires a market of around 300,000 people to succeed.

Market Segmentation

Despite the recovery in the economy, not everyone is able to afford ¥200,000 to take the kids to a mountainside onsen for a couple of days; yet hot spring bathing is deeply rooted in Japanese culture. So estab-lishments at the low end of the market have been sprouting up. The market segments into four major categories: super sento, kenko (health) land centers, traditional onsen villages, and higaeri onsen.

1) Super sento. The super sento, started in Nagoya in 1989, caters to the mass market. These are an evolution from the local sento (neighborhood baths), and combine function with low cost. The balance of the two is achieved by large-scale operation, drawing more than 8,000 to 10,000 visitors a week per establishment! Typically a super sento has 15 to 20 different types of baths, including Jacuzzi tubs and steam and dry saunas. The baths in super sentos, with few exceptions, do not use natural hot springs most of the time. These facilities are recognizable by the sheer number of vehicles parked outside their massive buildings. They charge about ¥500 to ¥650 per weekday visit.

2) Kenko land. These pick up where super sentos finish; they include attractions for the rest of the family while grandma and grandpa chat with friends in the bath. Typically the facilities include banquet and catering services, karaoke, game centers, and massage chairs. Kenko land centers cost about twice the price of super sentos, running at around ¥1,500 to ¥2,600 (US$10 - 20) per visit. Kenko land operators have been losing customers to the super sento.

3) Traditional onsen. These are the establishments that most foreigners picture when they think of natural hot springs in Japan. Typically found in the mountains, such establishments are family operated. Emphasis is on service and presentation. Dishes of local delicacies are a major cost. A 10-course meal can add ¥10,000 to ¥15,000 per person to the basic tariff of ¥15,000. Meals and a bed come as a set package; that is why a stay is so expensive.

4) Higaeri Onsen Those who can't afford a traditional onsen can always soak at a super sento or its derivatives. Super sentos as a cheap and cheerful bathing experience have peaked in popularity, but they have become commonplace, and even the Japanese sometimes want to escape the crush when they relax. With so many customers, thousands a day at some facilities, the fittings and furnishings of many super sentos are battered, and the water sometimes isn't too clean.

So with a little more money in their pockets, the punters are looking for a new experience -- but one that doesn't cost hundreds of dollars a night or cause you to get stuck in a four-hour traffic jam somewhere beyond Mt. Fuji. Thus the higaeri onsen (day trip spas) are coming into their own.

Although the definition of higaeri onsen as a day-trip hot spa could apply to most super sentos, the term higaeri onsen connotes a smaller, refined establishment for a relaxed visit. It offers convenience, a reasonable price, a view and/or landscaping, and quality facilities. Operators make special efforts to procure land with a vacant, wooded hillside, or other natural features for bathers to look at, and then dig 1,700 meters to tap genuine natural hot springs.

It is difficult to develop a higaeri onsen near a city, that still feels secluded, and yet is convenient. While providing a Zen-like peace of mind, functionality must be sufficient to keep operating costs down. This is achieved with work systems and automated mechanical operations controlled by PCs.

One of the most experienced in this field is Kenji Uchida, CEO of Aqua Japan Tokyo, who has been planning and designing super onsens and higaeri onsens for more than 12 years. We spoke to him about what makes a higaeri facility successful.

JI: What are the keys to creating a traditional space?

Uchida: I focus on the sabi of Japanese tradition -- form, texture, color, simplicity, and space. The places to highlight these are in the entrance, the basic overall lines of the roof and support columns, and in various little nooks scattered around the facility which will surprise and delight visitors.

Ikoi-no-Yu is open from nine to one in the morning, letting it double as a local sento. But it's not like any downtown sento. From the nine inside and outside baths, all seats and resting places look out over a hillside planted in bamboo and cedar. Just like any high-quality ryokan in the countryside, the interior has lots of wooden beams and natural fabrics, while outside the pools are lined with timeworn rocks. It is easy to forget that you're a short drive from bustling Machida.

Rakuya Onsen

In the more than 20 projects undertaken over the last decade, Kenji Uchida has seen onsen operators rise and fall. He feels that the reasons for failure have been a mixture of poor marketing and poor cost control. The numbers for a well-operated facility are interesting. Uchida supplied them for his Tokyo I Onsen in Machida:

¥ Market: 410,000 people living within 5km of onsen;

¥ Initial Capital Outlay: About ¥1 billion;

¥ Lease of Buildings: ¥6.5 million yen per month;

¥ Water Source: Natural hot springs drawn from wells;

¥ Visitors: About 65,000/month, each paying ¥1,500;

¥ Revenue: ¥1.14 billion annually.

In late 2003, Uchida the elder got together with his 31-year-old son, Shigeki, and together they agreed there had to be a better way to run the onsen business. Noting how operators like Hoshino and Goldman Sachs are staking out the high end, and that the super sento market is saturated, they decided to focus on quality higaeri onsen. Thus was born Japan's newest developer and operator of onsen facilities, Rakuya Onsen, in April 2005. The pair plan to open their first facility in April of 2006, and already have backers for several locations.

JI: What's wrong with traditional onsen?

Shigeki: They're too expensive to run profitably and many are now in a state of advanced disrepair. Facilities built in the 1990s were financed by public or "third" sector organizations [NPOs], and have either been shut down or sold off. The remaining ones suffer from excessive manpower, expensive materials and food, and old-fashioned management techniques.

JI: But aren't people prepared to pay for quality?

Shigeki: Of course some are, but as a proportion of the population, you're talking about just zero point one percent, which is already being aggressively targeted by the likes of Goldman Sachs. There are millions of regular people out there who believe in the value of hot-spring bathing and want to visit an onsen on a regular basis.

JI: What are Rakuya's business plans?

Shigeki: Currently Rakuya is a facility development organization. Although we plan to build original facilities, right now we are working closely with several operators to tie-up and form a new alliance that will give our new business some scale. These operators have recently built facilities in Gyoda City, Saitama, and in Machida City. They will come under our operating banner and use our systems. We expect these three facilities alone to bring about 1.83 million visitors a year and earn revenues of around 2.58bn yen annually. I'm also working on other deals in the Kansai and Kanto areas.

JI: These are big numbers.

Shigeki: That is the nature of this business. Individually operators are struggling to build a stable business, but collectively, we can start thinking about going public and creating something much larger.

JI: What about your development plans for new locations?

Shigeki: For me this is the most exciting aspect of the business. We are currently looking at five other sites, including one in downtown Tokyo. The key point is the proper location of our onsen. Through our extensive experience, we are able to analyze population centers in Kanto and find pockets not yet served by similar premium onsen facilities. If we find an area with at least 130,000 people living within 5km of a certain point, we then look for vacant land that has outstanding visual features and make an approach to the owner.

JI: You mentioned going public. What are your plans?

Shigeki: With our current plans, we expect to turn a profit and to be at 4 billion yen in sales in the second year of business. We think we can move through to an IPO by 2009.

JI: This seems quite ambitious.

Shigeki: It is ambitious. However, with the level of backing we are receiving, and the fact that the initial business grouping is large in visitor numbers, we are confident we're on the right track. Don't forget that if we get the locations right, for every new higaeri onsen we bring on stream, we can expect to see visitor traffic of about 1,000 to 2,000 people a day, resulting in revenues of 80 to 100 million yen a month.

JI: Do you see yourself tying up with someone like Goldman Sachs?

Shigeki: Not them specifically, since we don't want to overlap with the likes of Hoshino. However, we are very interested in talking to other foreign bankers and investors who may have an interest in the onsen business. I think we can say that we are one of the few independent operators around that has sufficient expertise in planning and running such facilities profitably, and as such we hope that we would be a solid business partner. JI

*******

Aqua Japan Tokyo Inc.

CEO: Kenji Uchida

Address: 1-17 Kanda Sudachou, Chiyoda-ku, Tokyo101-0041, Japan

Email: ken@aquajapan.co.jp

Web: wwww.aquajapan.co.jp

Rakuya Inc.

CEO: Shigeki Uchida

Address: 3F 2-11-10 Kyobashi, Chuo-ku, Tokyo 104-0031

Email: s-uchida@rakuya-onsen.com

Web: www.rakuya-onsen.com