Subprime, Year Two: A silver lining for Japan?

By Brad Frischkorn

Now entering its second full year, the global banking industry meltdown continues to messily unravel on the back of the subprime mortgage market collapse. While Japan Inc has avoided the worst of the mess, the nation’s financial industry has not been left unharmed. However, any silver lining, if indeed there is one, may still look better from Tokyo than from abroad.

Investors in the equity and debt of banking stocks needn’t be reminded of the horrific loss of market cap for many of the world’s prestigious lenders. The fall from grace has been particularly gut-wrenching for those heavily exposed to the so-called “Alt A” class (a.k.a. Subprime) US housing loans and related derivative products. For the 17 months through May 2008 global banking sector losses have totaled a staggering US$400 billion, while capital raising campaigns to shore up remaining assets are running at about US$300 billion for the group, according to the Institute of International Finance. Heavily exposed banks still in business have seen their common share prices halved or worse.

Illustration: www.freesouldesign.co.uk

Illustration: www.freesouldesign.co.uk

Dodging the bullet, almost

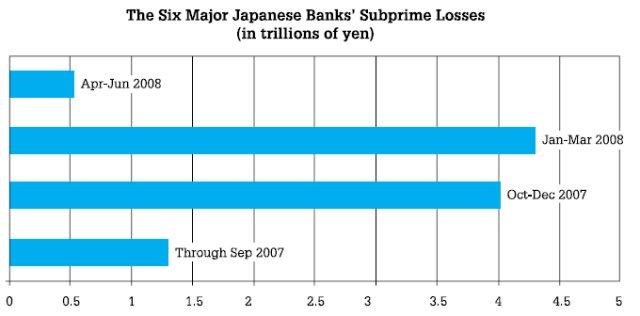

Japan and its banks have not entirely missed this industrial-sized wrecking ball, but relatively light exposure to the worst of the mess has held write-downs at major domestic commercial lenders and brokerages to about US$20 billion—still a bargain compared to their overseas rivals (see diagram 1). Good fortune and stick-in-the-mud conservatism both deserve credit; Japanese banks have not been at the forefront of exotic financial product development behind the subprime quicksand, nor have they committed heavily to investing in them. Just as importantly, however, Japan is still barely five years removed from the end of its own decade-long non-performing loan induced financial crisis, allowing hindsight to temper whatever hubris might have started to creep back into the system. The last time Japanese banks raised serious capital to save themselves was in early 2003, when massive share-diluting equity deals helped push the declining Nikkei 225 to a 21-year low. “The markets are better regulated, more liquid, and of course, the major banks are comparatively healthy now,” says one stock analyst. “But there’s no question that the country would be loathe to go through yet another meltdown after 14 years of stagnation. I doubt the public would stand for it.” Yet, anybody holding a regular savings account in Japan is tacitly continuing to help shore up the industry by forfeiting any semblance of an interest rate (a laughable 0.01% per annum at most banks), and by paying for ATM and other retail transactions that were formerly free of charge.

Subprime winners

Subprime pain is far from being evenly shared. So far, perhaps no one has benefited more from the current crisis than John Paulson, whose US hedge fund Paulson and Co bet heavily on the downturn in credit and mortgages via credit default swap and CDO markets, and the ABX subprime index. Net profits for Paulson’s fund totaled US$15 billion in 2007, including a reported US$3-4 billion for himself. The success of these trades is likely the most profitable event-driven set of transactions in history, surpassing the US$2 billion George Soros made in 1992 by shorting the British pound. “I’ve never been involved in a trade that had such unlimited upside with a very limited downside,” said Paulson, an ex-Bear Stearns M&A banker, in a press interview.

Among first-tier investment banks, Goldman Sachs has also managed to avoid much of the subprime fallout by hedging its bets aggressively. And while Merrill Lynch and Morgan Stanley announced billion-dollar asset sales to raise hard cash, JPMorgan Chase is also apparently keeping its head above water. Indeed, despite reporting a US$1.3 billion loss relating to bonds and other investments in sub-prime mortgages and quadrupling bad-debt provisions at its retail bank, JP had enough gas in the tank to take a US$500 million hit on acquiring the assets of failed rival Bear Stearns last May— and pay five times the US$2 per share auditors said Bear was worth at the time.

JP’s story in Japan is even more compelling; it retained about 45% of Bear’s 200 Tokyo personnel, growing total headcount by 10% when most of its rivals have cut back on hiring. Locally, the Bear takeover should help its securitization business. Commodities, structured products, and emerging markets operations should also benefit. Hedge fund expert Stephan Nilsson was one key holdover; as Head of Capital Introduction, he brings large volume institutional business to JP’s prime brokerage unit, and counts renowned hedge fund Renaissance Capital as one of his blue chip clients.

JP has also added some high-profile personnel to its Japan operations over the last year, including Greg Guyett, a 20-year company veteran. Doug Howland and Katsuyuki Kuki, respected figures in investment and financial institutions banking, have also moved over from UBS Securities Japan. The firm has even added former US Embassy diplomat and 16-year Japan veteran Chris LaFleur as a vice chairman. JP has interesting plans for LaFleur, whose marriage into ex-Prime Minister Kiichi Miyazawa’s family may give the company a leg up in scoring more public sector deals. Insiders also say LaFleur also fits into the company’s philanthropic pursuits as it seeks to raise its public profile.

Markets opening for Japan

Subprime and the weakening of US banks, a weaker US dollar, and increasing shareholder activism in the boardrooms of Japan have availed opportunities for Japanese firms formerly castigated as too timid to act on chances for growth beyond their own borders. Last year Japan Tobacco bought Gallaher Group of the UK for some US$15 billion—by far the largest cross-border acquisition in Japanese history. Thus far in 2008, Takeda Pharmaceutical has spent US$8.8 billion on acquiring US-based Millenium Pharmaceuticals. Such moves are some of the most significant since Japanese companies last ventured abroad with sacks of yen during the 1980s bubble. Flush with cash after spending a decade writing off debt and slashing costs, corporate Japan is now both hunter and quarry in the global M&A game. Current domestic deal volume still represents only a fraction of the global market, and some dismiss the big transactions as generational one-offs. But bankers have been excited about Japan’s M&A potential for years, and the tides may finally be shifting. New York-based hedge fund Steel Partners has controversially been trying to make acquisitions here for a while. Dalton Investments, another US hedge fund, said in February that it had purchased 10% of Tokyo-based SunTelephone as part of a US$325 million management-led buyout. And Carlyle Japan’s US$1.87 billion buyout fund remains the largest such Japan-focused fund in existence. That said, Steel Partners’ difficulties with both Bulldog Sauce and Sapporo Holdings reveal that, in M&A, even where there is a will, there is not always a way.

No time to rest easy

In the end, the subprime quagmire and resulting turmoil is a crisis of confidence, a precious commodity with limited renewability. "It’s obvious that the ratings agencies got it wrong. Totally wrong. Dead wrong."

Claudio Macchetto, Global Platforms Director, Paulson and Co.At a June hedge fund conference held in Tokyo, Paulson and Co lieutenant Claudio Macchetto, whose firm’s staggering subprime profits have vindicated its prescient call on the market, told a sobered audience that while IMF estimates of global bank write-downs stand at about US$945 billion, his firm was eyeing US$1.5 trillion—almost four times the current level—as a fairer figure, along with up to three more quarters of pain before recovery begins. As for the tanked assets themselves, some of which were triple-A rated, “It’s obvious that the ratings agencies got it wrong. Totally wrong. Dead wrong,” he said.

"Japan remains far from out of the woods in terms of deeper global subprime fallout"

Like most countries, Japan remains far from out of the woods in terms of deeper global subprime fallout and the threat of a general economic downturn. Many of Japan’s top institutions hold stakes in Fannie Mae and Freddie Mac, for which no technical nor legal precedent exists guaranteeing their survival. The Cabinet Office has already cut its fiscal 2008 real economic growth outlook from 2.0% to 1.3%. And while the Bank of Japan’s grip on controlling the yen/ US dollar exchange rate is solid, sharp yen appreciation may only be a matter of time, which would in turn threaten exporters, collectively the only real growth engine here.

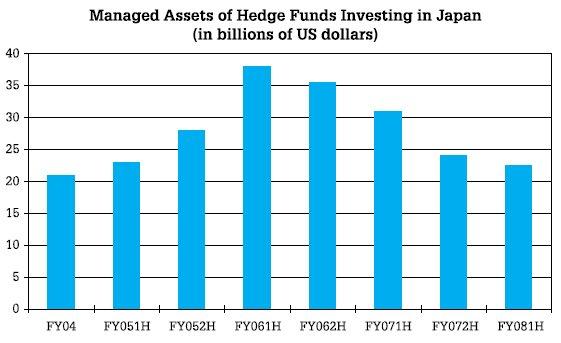

Such gloom does not put off bankers, who are paid well to spot and pounce on sometimes fleeting business opportunities. The loan market at home has become saturated, for example, Japan’s commercial banks have shifted to overseas lending while their foreign competitors are busy bailing water. The Nikkei 225 fell 13% for 2008 through end-July, and domestic IPO markets are in terrible shape, but that’s far better than other regional bourses such as China (-46%) and India (-30%). Hedge fund investments in Japan have fallen to four-year lows, but options and derivative strategies are otherwise booming on the back of the heightened volatility (see diagram 2).

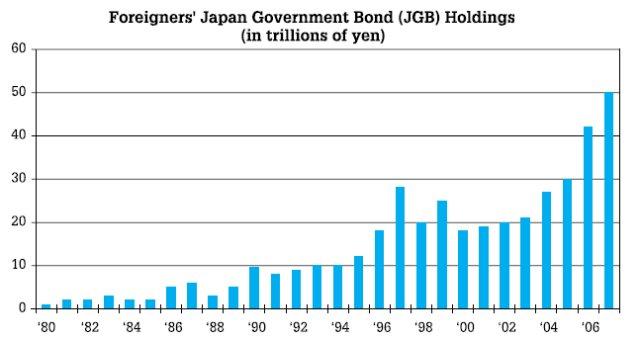

On the fixed income side, Aussie banks have flooded the Samurai bond market with supply now that US financials are tainted with credit risk. And, even boring and low-yielding Japan Government Bond (JGB) markets have seen foreign buying soar to record levels on the back of sovereign upgrades and a flight to the relative safety of yen assets (see digram 3).

“Opportunities always exist,” said one veteran capital markets banker. “It’s just a matter of finding them and then deciding what to do. There are no guarantees.” JI

Diagram 1

Diagram 1

Diagram 2

Diagram 2

Diagram 3

Diagram 3

Comments

Anonymous (not verified)

December 14, 2011 - 04:38

Permalink

Brad Frischkorn

Anybody know where Brad is these days?