Currency: The Socialization of Capitalism

By Michael Condon

With reports of a planned currency deal with Japan and the EU, and bailouts of financial institutions, is the US now interventionist?

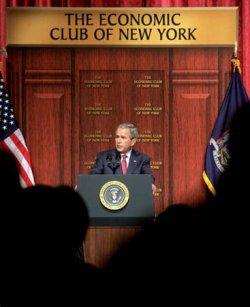

George W. Bush scanned the throngs of restless journalists as he stood at the podium of the Economic Club of New York. Things could have been better.

It was March 14, and following a flood of failed mortgages, a plummeting US dollar and the Bear Sterns bail-out, the US federal government was attempting to play poker with the media.

Recent reports in Japan stated that the US had planned to prop up the dollar through trading of the euro and the yen.

Recent reports in Japan stated that the US had planned to prop up the dollar through trading of the euro and the yen.

Illustration: Phillip Couzens

“The market is in the process of correcting itself,’” the president said. “I believe there ought to be action, but I’m deeply concerned about law and regulation that will make it harder for the markets to recover.”

The US government had undertaken a program to, at that point, refinance $17 billion dollars worth of mortgages.

During his 40-minute speech, Bush declared that everything possible that could be done was being done to rectify the problems facing the market. “Today’s events are fast moving, but the chairman of the Federal Reserve and the secretary of the Treasury are on top of them and will take the appropriate steps to promote stability in our markets,” he told the press.

The one thing that Bush failed to mention in his speech was the dollar. Later, when pressed by a CNBC reporter, Bush said: “It’s important for us to put policy in place that sends a signal that our economy is going to be strong and open for business,” and make clear the US “supports the strong dollar policy.”

But what the public was unaware of at that time was that the US were in talks with the EU and Japan about a currency buy-out to boost the dollar. The news, broken in the Nikkei Shimbun months later, marked a change in tack for the US government, which had taken an anti-interventionist stance. Ironically, in 2001 and 2004 the US had criticized Japan for manipulating the price of the yen through currency deals.

During George W. Bush’s speech at the Economic Club of New York, the US president failed to mention the dollar. Over the next two days reprenstatives from the US, Japan and the European Central Bank reportedly drew up a currency intervention plan to shore up the greenback.

During George W. Bush’s speech at the Economic Club of New York, the US president failed to mention the dollar. Over the next two days reprenstatives from the US, Japan and the European Central Bank reportedly drew up a currency intervention plan to shore up the greenback.

Over the weekend of March 15-16, officials from the US Treasury Department, Japan’s Finance Ministry and the European Central Bank drew up the currency intervention plan to jointly shore up the greenback, according to the Nikkei’s report. On the Sunday, the US Federal Reserve supported the JP Morgan buy-out of Bear Sterns. This combined with the Fed’s unorthodox move to cut its discount rate by a quarter percentage point to 3.25 percent, at the same time offering to lend money to an unprecedented list of companies, sent the dollar into a downward spiral, sliding to a 12-year low of 95.75 yen.

According to the Nikkei, which cited unnamed sources, the three powers didn’t get to a point where they set a specific exchange rate or the magnitude of the currency swaps. Since the article was published, some within the media have suggested that a dollar buy-out may have, in fact, happened. Although the dollar took a severe hit, it didn’t go into a complete free-fall—the market eventually shifting and pushing the dollar up about 15 yen.

Currency expert Ian Youngson from financial services company Banner Japan KK, is one who doesn’t believe in the conspiracy theories: “I think that there was no central bank intervention whatsoever,” Youngson says. “The dollar got too oversold and then the selling just dried out.” He believes that interventionism within the highly emotive currency market is essentially flawed policymaking. “The problem with intervention is that it never works.”

Ian Youngson, currency expert Banner Japan“The problem with intervention is that it never works—the government ends up spending billions…and it [the dollar] could have been pushed up to 100-102 (yen) and then it would drift back to the same level.”

However, Dave Lawson, a business analyst at foreign currency services firm Elldridge Lynch, disagrees: “Yes it does work, the trends are driven by emotion… it doesn’t take a particularly big movement to get a currency trader to change his position.” Lawson doesn’t see it as any significant change in policy but does agree on the fact that any deal between the US, the EU and Japan was unlikely to have been put into play at that point. “There was some belief that the currency had moved far enough… at that point the market’s tolerance shifted.”

Dave Lawson, business analyst for Elldridge Lynch“There was some belief that the currency had moved far enough… at that point the market’s tolerance shifted.”

The Nikkei’s report came just before US Treasury Secretary Hank Paulson’s announcement that the US government would bail out mortgage giants Fannie Mae and Freddie Mac—two mortgage lenders that proved to be the biggest financial institutions ever taken over by the US government. This, together with the Bear Sterns bailout and the $85 billion takeover of AIG, represents a partial socialization of the US capitalist markets—a dramatic return to governmental control of the American financial system.

While a federally-backed buyout didn’t materialize for Wall Street mainstay Lehman Brothers, and as more financial institutions come under pressure, what is to say the US government will not foot the bill? The bankruptcy of Lehman Brothers may be a harsh warning message to other potential suitors of stricken American financial institutions—the US government will not guarantee all losses.

But, at the time of writing, US stocks had seen their biggest decline post-September 11 and Wall Street was going into damage control.

If more big names go down, or the US dollar takes another nosedive, the American government will, as Bush said, “take the appropriate steps.” And Japan may be there to buy a few dollars. JI