A Beer or Not a Beer?

How Japanese tax law affects brewers’ barley ratios

By Ben Brown

Examine the cooler shelves in the liquor section of any grocery or convenience store and you’ll see what appears, at first glance, to be a vast selection of different beers. A closer look narrows these down mostly to offerings from Japan’s major brewers (Suntory, Kirin, Sapporo, and Asahi), with lip-service given to imports (Guinness, Heineken, etc.) on the end of the row in most supermarkets. The apparent variety can be overwhelming, so take a look at the next thing to catch consumers’ eyes once they’ve looked past the colorful packaging— the price tags.

Prices between apparently similar offerings from the same company can differ by as much as ¥120, or around half the price of the more expensive can. The keen observer, perusing the busy labels, will begin to notice some trends. All the “beers” that break ¥200 are labeled as “beer.” The next rank, in the area of ¥150 per can, is called happoshu, or “bubbly alcohol.” And the even cheaper tins, around ¥100 or so, earn the appellation “other brewed beverages.” This unwieldy hierarchy of price points can be traced back to Japan’s arcane alcohol taxation laws, specifically those for beer.

Records exist for a system of alcohol taxation during the Edo (1603-1868) and early Meiji eras. This system was focused on production: anyone who had the money and resources to purchase a license, was free to brew and sell alcoholic beverages. The land tax revisions of 1873 ushered in the creation of at least 1500 categories of federal taxes, including a general liquor tax. Beer specifically was first taxed directly in 1901, and the liquor tax quickly became a primary source of tax revenue, second only to the land tax.

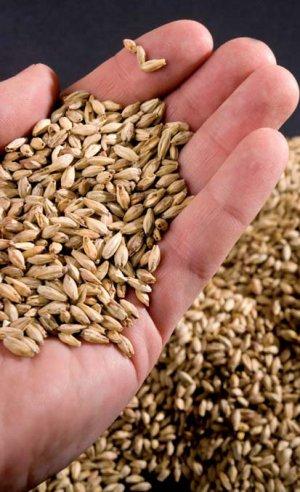

Beer, as defined by Japanese tax law, is a fermented beverage comprised of water, hops, and at least two-thirds malted barley (the remaining third may be any of several adjuncts, such as corn or rice starch). In comparison, this is significantly more lenient than the Reinheitsgebot, the Bavarian Purity Law of 1516 which many breweries worldwide still proudly advertise on their products, and which states that only water, barley, and hops may be used in the production of beer. Though no longer a part of German law, this definition is, for many advocates and enthusiasts, the only one applicable to beer.

The current system of liquor taxation dates back to a post-war overhaul in 1953, with major revisions in 1962 and 1989, and minor revisions over the past decade. Most significant among these major revisions was perhaps that of 1989, as the tax on luxury goods such as automobiles and large electronics was lowered drastically to compensate for the newly introduced general consumption tax. To the dismay of brewers across the country, beer, though long taxed as a luxury good, remained stable. Given this background, it would perhaps have been a simple matter to predict that the innovation of the industry would find a way around the specificities of the tax laws; in 1995, six years after the most recent liquor tax revision, that is precisely what they did.

In 1995, happoshu was introduced to the market. This clever new creation got around the tax definition of beer by including less than two-thirds malted barley. Substituting cheaper ingredients (rice and corn in particular) in greater quantities, major brewers were able to drive the malt content below two-thirds, taking this beverage away from “beer” and into its own category. Ingredients other than malted barley quickly emasculate the flavor and body of most ales, and of many lagers; but for the light, pilsner-esque style long-preferred in Japan, these adjunct ingredients—whose effect is essentially to lighten a beer while providing more fermentable sugars—work perfectly, and the crisp new pseudo-beers were hard for the average consumer to distinguish from their predecessors, except by price.

How much leeway did the industry gain by beating the old tax category? In the year it came out, happoshu was taxed at 18.6%. Beer, on the other hand, was at a whopping 45.5%. Consumers long used to losing three cans of their six-pack to taxes were happy to imbibe a near-identical beverage for far less yen. Sales of happoshu climbed rapidly. So rapidly, in fact, that it took the government less than a year to react with a new tax revision: in 1996, the taxes applied to this category were raised to 28.9%, and then to 35.5% in 2003.

Now that taxes have just about caught up with happoshu, pushing it close to beer pricewise, brewers are turning to a third option: beverages made without any malted barley at all. These Frankenstein concoctions rely on peas and soybeans for fermentable sugars (in place of malted barley, or even corn or rice), and are cobbled together from distilled alcohol, artificial flavoring, and coloring agents. They are low in tax and low in flavor, but for now at least they are keeping the brewers ahead of the tax curve, and their popularity is rising. It seems only a matter of time before another tax revision drives brewers to something even further from their roots, though at this point it is doubtful that any reasonable alternatives remain.

It seems only a matter of time before another tax revision drives brewers to something even further from their roots

Whether this battle between industry and government is good or bad for the consumer is difficult to assess. On one hand, the industry continues to innovate, offering more diverse and cheaper options. These options are increasingly lacking in flavor and body, but fate has dictated that the best selling beer style in Japan is a very light lager, so the cheaper deviations don’t fall far from the average consumer’s ideal. On the other hand, the tax levied on “proper” beer remains high: eight to ten times higher than the US, and about double the rates in the UK. This makes it difficult for consumers who appreciate the real stuff to enjoy it as often as they might elsewhere, a frustrating situation for beer purists, who see their ambrosia increasingly diluted as brewers divorce themselves from malted barley.

In the end, there’s nothing to do, really, save sit back and watch as the tax warfare and clever evasion plays out. Enjoy the spectacle, and sip a domestic as you do—and try not to picture the first half of your glass draining into the government’s coffers. JI