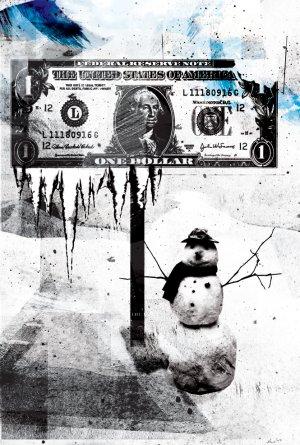

Currency -- Forex Goes Pop…

By Ian Copsey

By Ian Copsey

And now the seasonal exchange slowdown begins.

The past few months have seen the Forex trading profile raised as the US dollar shot higher by between 20 and 40 percent against all currencies except the yen, where it made equally dramatic losses of around 18 percent. This forced the yen to appreciate by between 35 percent and 45 percent against currencies with high interest rates.

Clearly it hasn’t just been the Forex market which has seen such dramatic movement. Investors have reacted to the fear of a financial implosion as central bank chiefs issue dire warnings of further bank failures and an economic collapse that could match the 1930s depression.

Governments and central banks have scrambled to react to events which just one year ago they said could never happen.

The seasonal nature of the Forex market over the year-end will see deales steadily fall.

The seasonal nature of the Forex market over the year-end will see deales steadily fall.

With lower oil prices relieving inflationary pressures, interest rates have been slashed, with key Fed rates now at 1 percent while the Bank of England has cut by 2 percent over the past month to 3 percent.

Governments are announcing economic stimulation packages to shore up flagging consumer spending as lower house prices, higher inflation and job losses ravage consumer confidence.

However, there has been little impact on hemorrhaging industrial growth as more companies plan layoffs and in the US, General Motors is rumored to require a bail out as large as any bank.

So how exactly has this impacted on exchange rates?

As investors shun the equity markets there has been a flight to security. If you can’t trust the economy to support share prices, and while banks face a bleak few years as their reduced capital base restricts lending while loan defaults are on the rise, then the automatic reaction is to buy treasury bills.

This has forced a massive repatriation of overseas investments back into US dollars at a pace that hasn’t been seen in over 20 years. However, not everyone is buying US Treasuries. Over the past year, Japanese Life Insurers have sold yen to buy US Treasuries but left the exchange risk open. With the yen appreciating following the bust of the carry trade bubble, Life Insurers have moved to avoid making a loss. Hence a massive repatriation back into yen.

The question is, what will happen over the next few months? Will this trend continue or will we see more stable Forex markets?

The answer lies in the seasonal nature of the Forex market over the year-end. I am writing this article in the middle of November, which means that within one month the level of deals being transacted within the interbank market will be steadily falling.

It is a time of year when bank traders will have made their targets and do not wish to risk giving back any of their profit to reduce their bonuses. If they haven’t made their targets, they will equally not wish to make the shortfall look worse.

This has a temporary impact similar to the credit crisis where banks find it hard to move large deals through the market without an abnormally large impact on rates. Everyone in the market knows this and large exposures will be covered ahead of time.

With the sort of moves we have seen over the past few months the adjustments in investment portfolios are likely complete. A December market could not accommodate such volumes as we have seen without an even more massive impact on exchange rates.

While the coming two to three weeks ahead of December do raise some risk of marginal new highs in the dollar against all currencies except the yen, this risk does seem limited. Indeed, I’d suggest we will not see the pound dip below 1.50-1.51 and the euro below 1.19-1.21.

Already, over recent days, we have seen the yen remain relatively stable against the dollar while the euro has been weak. This suggests the main moves are over.

Therefore the weight of argument suggests that the coming two to three months to January-February next year will see a gradual unwinding of positions that will favor the dollar against the yen which may well approach the 110.65 high again. The pound is likely to rise to around 1.70-1.75 while the euro is likely to struggle around the 1.35-1.40 area.

What happens after that, though, is another story…

Ian Copsey is a veteran currency analyst with 26 years experience and provides a daily report for Forex traders through www.fx-forecaster.com. He is the author of the John Wiley publication “Integrated Technical Analysis.”