Online FX trading has taken center-stage in the global currency market, spurred by an urgent need for liquidity in volatile times. Valerie Lee, Société Générale’s Head of EBusiness AsiaPacific, tells us how the increasing use of online tools is driving growth of currency trading in Asia.

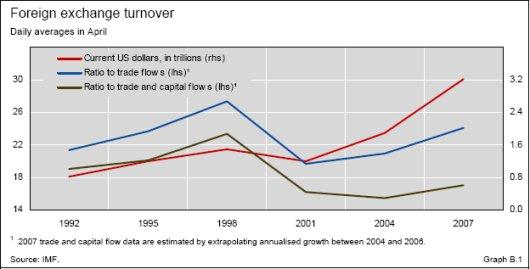

The bull in currency markets must be a happy one, for it has kept up a relentless run despite the upheavals in other parts of the financial landscape. Growth in foreign exchange (FX) activity – average daily turnover rose to $3.2 trillion in April 2007, a 69 percent rise from 2004 levels based on current exchange rates, according to the Bank for International Settlements (BIS) – continues unabated in Asia, driven by trade flows and the need of companies and banks to hedge their currency exposures. The International Swaps and Derivatives Association (ISDA) puts the notional amount outstanding of interest rate and cross-currency swaps at end-2007 at $382.3 trillion, up from $285.8 trillion in the previous year.

Within Asia, Hong Kong, Singapore and Japan account for 4.4 percent, 5.8 percent and 6 percent of global FX turnover respectively, according to the BIS’ Triennial Central Bank Survey published in December 2007. A large part of the growth in FX trading has been propelled by online trading, as evidenced by Asiamoney’s FX Poll published in September 2008 that found financial institutions to have conducted 56.5 percent of their FX trades via online tools, up from 32.4 percent in 2007. Whilst electronic FX trading is not a new concept, the recent surge in volatility in FX markets has raised awareness of the benefits offered by electronic trading platforms – lower cost, liquidity and transparency, to name a few. “In Asia, the use of e-trading platforms is already a common practice with many banks offering single-dealer portals to bank counterparties. Besides the obvious benefits of a reduction in trading cost vis-à-vis traditional phone trading and the convenience of automated trading, another crucial advantage offered by e-trading is that it allows bank users better control, thus resulting in a reduction in human error because every transaction is automatically recorded,” says Valerie Lee, Société

Générale’s Head of E-Business Asia Pacific.

THE RISE OF E-SUPERSTORE

“While the take-up in Asia was slow initially, the pace of sign-up for e-trading has increased significantly over the past year. The consolidation of banks has resulted in fewer counterparties in the market, and the need for greater liquidity provides a value proposition for banks to capture a bigger part of the e-trading business,” Lee adds.

“This year, we have broadened our product line to include fixed income solutions, interest rate swaps denominated in the US dollar, yen and the Australian dollar. Going forward, our plan is to add more assets classes to our e-product family,” she says.

Today this is the standard e-banking operation model:

- Traders log on to e-portals

- Click and pick from the shelves of global liquidity providers

- Transactions settled electronically

Today, banks are keen to set up their one-stop-shop e-superstore, equipping e-portals with different assets classes to cater to the needs of counterparties. Many investment banks have been operating single dealer portals for years. Multidealer portal services providers Fxall and Currenex have been expanding their market share in Asia, whilst financial data providers such as Reuters and Bloomberg have also joined the

competition. “Banks have devoted a lot of resources to build up their e-portal business, enhancing their technology by adding hedge engines and algorithm trading, as well as API services to customer sites. The result of such advances in technology has generally been tighter spreads on most currencies, which has worked to the advantage of clients. While volume has ballooned, the intense competition amongst banks has kept bid/offer spreads thin.

“Externally, it is crucial that clients of our e-portal, who are mainly bank dealers, get quick responses to their price requests. This is extremely crucial when the market is volatile. During the Lehman crisis, for example, many clients found it difficult to get quotes from the market. Because liquidity during that period was extremely thin,

those who relied on one or two single-dealer portals had no choice but to accept wide bid-offer spreads quoted to them. So clients now tend to have three or four portals in order to diversify their trading risks,” Lee notes.

Lessons learned from the global financial turmoil has changed the focus of e-business

- Counterparty risk – Top Priority

Banks have become more concerned about counterparty credit risk, which essentially is the risk of a trading partner not fulfilling his obligations in full on the due date or at any time thereafter. It is a risk that affects all aspects of business. Consequently, there’s been a liquidity reshuffle in favor of liquidity

providers with good credit standing. - Buy-side customers need more liquidity providers in order to diversify their risks

During the crisis, traders found it difficult to get quotes from the interbank market due to extremely low liquidity. Those who relied on traditional trading methods, and one or two single-dealer portals had no choices but to accept wide bid-offer spreads quoted to them.

- E-portals add new functions in order to cope with changing needs of customers

Different dealing rooms are set up differently and dealers have different requirements and preferences. Online trading tools have to cater to a huge variety of needs. New functions are constantly being developed in e-portals based on requests from buy-side customers. The day that e-portals are as indispensable to FX dealers as Blackberries is certainly upon us.

Article contributed by the Société Générale in Japan

Société Générale Group has been operating in Japan for 35 years. With approximately 700 staff, the group is currently active in three key areas: corporate and investment banking, asset management and private banking.

Valerie Lee is director, head of e-business Asia for Société Générale, Corporate and Investment Banking Valerie Lee is responsible for the marketing and development of products relating to electronic trading portals in Asia for Société Générale, Corporate and Investment Banking.

Blog:

Other posts by Japan Inc: