Things in Japan are looking grim. They keep getting grimmer, and it doesn't seem they will be getting less grim anytime soon. To give you some idea of what this means, only this week we learnt that Japan’s steel production fell 28 percent in December. This was the steepest decline in no less than six decades. Meanwhile Hiroshi Yoshikawa, Tokyo University professor and head of the Japanese government business cycle measurement committee said that Japan’s present recession may become the longest in the postwar era. “We’d better get ready for a three-year recession,” he said in an interview with the press this week. The decline “will be very severe, not only in terms of duration but also depth”.

And those famous exports, which dropped by an astonishing annual 35% in December, accounted for 61 percent of the growth in the last expansion, an expansion which was the longest in over 60 years. What this means, bluntly put, is that until exports recover there isn't much likelihood of any more general economic recovery, and exports won't recover till global trade starts to expand again, and the bank and credit crisis is over, which means you can pretty much forget about 2009 as far as I can see.

Thus we are over to "do the best you can under the circumstances" mode, and to applying some sort of fiscal stimulus. And of course, Prime Minister Taro Aso has not been backward in coming forward in this regard (especially with elections looming at some point), and his second stimulus package has now been passed by the Lower House. But here comes the shocker - the package provides for an actual increase in deficit spending of a mere 1% of GDP - a drop in the bucket when you are talking about your worst recession since WWII. Even worse, the proposed fiscal 2009 budget - which begins on April 1 - provides no new stimulus. Newspaper reports which mention an increase in spending of 6.5% are misleading since they compare the proposed budget for fiscal 2009 with the initial budget for fiscal 2008. But the final budget for fiscal 2008, actually included two supplementary budgets, and the final readout ended up being a tad higher than what is currently proposed for 2009.

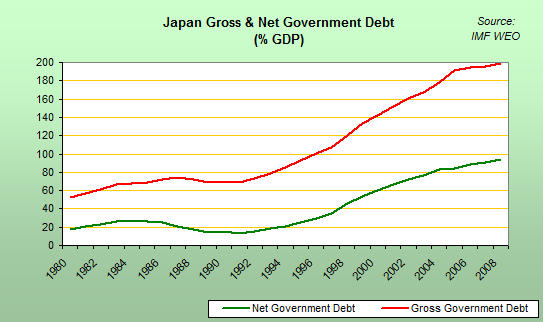

However even with spending staying flat (on the rather dubious assumption of no further packages) the Japanese government will still need to sell 33.3 trillion yen of new debt, the most in four years, since the economic contraction means there will be a revenue shortfall. The so-called primary budget deficit, the excess of spending over revenue excluding bond sales and interest payments, will balloon to 13.1 trillion yen from this year’s 5.2 trillion yen. And here we have Japan's dilemma, since something needs to be done to soften the blow of this recession, but with debt having been allowed to expand so rapidly over the last decade (see chart below), there really are limits on how much can responsibly be done.

government debt

government debt

The most obvious problem is that increasing spending at a time when tax revenue is falling threatens the government’s goal of balancing the budget by 2011. But Aso has already indicated that the government shouldn’t prioritize fiscal discipline when the economy is ailing, and so far as it goes the argument is reasonable. This is a "once in a lifetime" crisis (we hope) and so once in a lifetime measures are in order. It's just that Japan has now been busily taking "once in a lifetime measures" for over a decade, and we still don't seem to be getting anywhere. But we are ballooning government debt. Many quibble with the widely quoted 2008 OECD debt to GDP number of 182%, since it is a figure for gross debt (which the OECD can easily justify for reasons that we don't need to get into here). But look at the green line above which shows net debt, this has also been rising and rising, and is now near to 100% of GDP on IMF data. The point is we have just been through the longest expansion in over 60 years, and yet at no point did net debt to GDP start to fall. This is the real core of the problem that Japan faces in 2009, that previous fiscal policy did not attack the growing fiscal deficit in the good times, so there is little room to manoeuvre in the bad ones. Which is why the Japan economic outlook in 2009 is grim, grim and nothing but grim.

By Edward Hugh

Edward is a macro economist, specializing in growth and productivity theory, demographic processes and their impact on macro performance, and the underlying dynamics of migration flows. He is a regular contributor to a number of economics weblogs, including Global Economy Matters and Demography Matters.

Blog:

Other posts by Edward Hugh:

Comments

Fishman (not verified)

June 30, 2009 - 03:08

Permalink

Too many people are living

Too many people are living way beyond their means. People have become accustom to having everything at once and are not interested in saving up for something that they really want, they would much rather go out and buy the item on credit. This kind of problem behavior will only lead to a correction in the market and this correction looks like it will be for much longer than people first thought.