Conspiracy Theories - Some Calls Are More Equal Than Others

Back to Contents of Issue: November 2002

|

|

|

|

by By Sumie Kawakami |

|

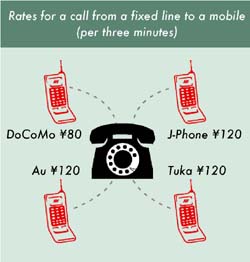

HAVE YOU EVER NOTICED how fast your coins run out when you're calling your friend's cellular from a pay phone? If your friend carries an au or J-Phone handset, a JPY10 coin runs out every 15 seconds or less in the daytime on weekdays. Each mobile phone carrier offers different sets of prices depending on the plan you use or the region you are calling from, but with very few exceptions, calls to a mobile phone from a fixed line or a pay phone are a lot more expensive than cellular-to-cellular calls. That same JPY10 coin that bought you 15 seconds on the pay phone would buy you 20 to 40 seconds when calling a cellphone from your own keitai. What gives?

Some industry watchers explain that callers have to pay both mobile carriers and fixed-line providers when making calls that cross over systems. But even so, aren't the prices too high when compared with cellphone-to-cellphone rates? Or to be more precise, aren't they kept artificially high? Heisei Denden and Cable & Wireless IDC think so. HAVE YOU EVER NOTICED how fast your coins run out when you're calling your friend's cellular from a pay phone? If your friend carries an au or J-Phone handset, a JPY10 coin runs out every 15 seconds or less in the daytime on weekdays. Each mobile phone carrier offers different sets of prices depending on the plan you use or the region you are calling from, but with very few exceptions, calls to a mobile phone from a fixed line or a pay phone are a lot more expensive than cellular-to-cellular calls. That same JPY10 coin that bought you 15 seconds on the pay phone would buy you 20 to 40 seconds when calling a cellphone from your own keitai. What gives?

Some industry watchers explain that callers have to pay both mobile carriers and fixed-line providers when making calls that cross over systems. But even so, aren't the prices too high when compared with cellphone-to-cellphone rates? Or to be more precise, aren't they kept artificially high? Heisei Denden and Cable & Wireless IDC think so.

Challenging the System The two companies have requested that mobile phone carriers give them a chance to patch through fixed-line-to-mobile calls. They say they can bring the price down significantly. Heisei Denden, for example, started negotiating with the four big mobile phone carriers as early as May 2001; it wanted to offer JPY60 per three minutes (30 seconds for every JPY10), but mobile phone companies have so far refused to give the company the connection it needs to provide the service. Another fixed-line carrier, Cable & Wireless (C&W) IDC, a Japanese subsidiary of a UK telecom giant, has also been negotiating for at least half a year with DoCoMo (and with others for a shorter time), a company spokesperson says. Mobile carriers argue that there are some "technical problems," says Heisei Denden spokesman Ken Takeda. But considering the fact that calls originating from KDDI and Japan Telecom services are already connected to all the other cellular phone carriers, what kind of technical problem would there be? "There is no technical problem. It's just an excuse," Takeda contends. Heisei Denden argues that price competition in fixed-line-to-mobile calls is impossible when rates are set by phone giants like NTT, J-Phone and KDDI. Interconnection Tariffs In the EU, fixed-line carriers set the prices for fixed-line-to-mobile calls. The basic rule is that rates are set by the carrier the caller uses -- it doesn't matter which carrier the receiver uses. In other words, if the caller is using C&W's service, C&W gets to decide how much to bill the caller. The Japanese system doesn't work that way; it's the mobile carriers that decide on prices, while callers are actually paying fixed-line carriers for the calls. Confused? For fixed-line-to-cellular calls, callers don't receive bills from NTT DoCoMo or au; if you are calling from an NTT subscriber line, you are billed by a regional office of NTT. If you are using KDDI or Japan Telecom -- either by using Myline services (pre-registered services) or by dialing 0077 or 0088 in front of the number you are calling -- you pay them. Why then should a mobile phone carrier set the price if the company doesn't even get paid for it? Japanese mobile carriers receive from fixed-line carriers what they call "interconnection tariffs" of JPY39.24 per every three minutes for calls to a mobile handset. Furthermore, as Japanese mobile carriers and fixed-line companies operate under a group structure -- i.e. DoCoMo under the NTT group, au under KDDI and J-Phone under Japan Telecom -- it doesn't really matter who decides on the price, industry sources say. For example, because au's profitability is consolidated into KDDI's financial statements, it doesn't make much difference financially for KDDI whether the caller pays KDDI or au.  Japan Telecom may be the exception as the company has been trying to restructure its fixed-line business and focus more on profitable mobile businesses since being bought up by British telecom giant Vodafone last year. After all, Japan Telecom was relying on J-Phone for over 83 percent of its profits as of last September. In general, "mobile services are the ones making the money in these groups and there is a lot of competition in local or long distant services," says an industry source who requested anonymity. "Mobile revenue is really helping the groups -- certainly NTT, perhaps KDDI." Last fiscal year, more than 50 percent of KDDI's revenue came from its mobile business.

Japan Telecom may be the exception as the company has been trying to restructure its fixed-line business and focus more on profitable mobile businesses since being bought up by British telecom giant Vodafone last year. After all, Japan Telecom was relying on J-Phone for over 83 percent of its profits as of last September. In general, "mobile services are the ones making the money in these groups and there is a lot of competition in local or long distant services," says an industry source who requested anonymity. "Mobile revenue is really helping the groups -- certainly NTT, perhaps KDDI." Last fiscal year, more than 50 percent of KDDI's revenue came from its mobile business. Political Dimension Heisei Denden and C&W IDC, frustrated by being rebuffed at every turn by the mobile carriers, have pushed to involve the Fair Trade Commission, the Ministry of Public Management, Home Affairs, Posts and Telecommunications and even the US Embassy in this issue. Heisei Denden appealed to the Fair Trade Commission in September. The company argues that the price mechanism which mobile carriers use to set prices for fixed-line-to-mobile calls breaks the antitrust law because it blocks fair price competition and forces callers to pay higher prices. The company asked the commission to investigate the issue. Heisei Denden is also asking the posts ministry to arbitrate between the company and the mobile carriers. "Despite a recent trend of deregulation in the telecom industry, rates for fixed-line-to-mobile calls cannot be improved by free competition or the company's efforts if the prices are set and controlled by the group companies," says Heisei Denden's Takeda. "For an independent interconnecting carrier like us, it is vital to set the price cheaper in order to expand users. Besides, the fact that fixed-line phone companies or interconnecting carriers don't have the right to set a price is unfair." According to Takeda, the company plans to offer a fixed-line-to-mobile rate of JPY60 per three minutes as soon as the dispute gets cleared. Heisei Denden still would have to pay interconnection tariffs to both NTT DoCoMo and a regional office of NTT -- JPY39.24 and JPY4.94, respectively, for calls within metropolitan Tokyo. That's already JPY44.18. For calls outside of Tokyo, the fees would go up to a total of JPY54.80. How is the company planning to make money on this service? Industry sources explain: Since the interconnection tariffs are charged every few seconds, fixed-line carriers would still make money by charging their customers for 1-minute or 3-minute increments. Most callers to mobile phones talk only a few seconds anyway, they say. Heisei Denden is not alone in the boat. C&W IDC also asked the posts ministry in August to issue an order to change the terms and conditions of the NTT DoCoMo group's interconnection tariffs. C&W IDC's press release says the action was intended to protect "the public interest with regards to the retail rate of calls originating from fixed lines and put an end to discriminatory price-setting practices against fixed-line operators." NTT DoCoMo stipulates in its terms and conditions that it will decide the rates of calls originating from fixed lines. C&W IDC claims that these terms and conditions have prevented the company from reaching an agreement that would allow it to create new services from fixed lines to mobile phones. "Fixed-line carriers such as C&W IDC must surrender the right to set retail prices for calls to mobile phones originating from their own fixed networks," the company says. "C&W IDC believes it is discriminatory that only fixed-line operators are subject to such pricing control by NTT DoCoMo." All other interconnecting carriers -- be they mobile, PHS or international -- are free to set the retail price for calls originating from their networks (i.e. KDDI sets its own rates for international calls). Who Pays More? Meanwhile, NTT DoCoMo president Keiji Tachikawa told a press conference in September that the right to set the retail price should go to the one who pays more of the costs, and that would be the wireless carriers. He argued that retail prices have gone down significantly -- by about one-third -- over the past 10 years. A KDDI spokesman also told J@pan Inc that the company pays the cost of creating and maintaining wireless spots, databases and other necessary facilities; therefore it should have the right to decide on the price. So far, the posts ministry has stayed on the sideline. A source at C&W IDC says it normally takes a long time for the ministry to react to this kind of filing so immediate action is unlikely. But Takeda at Heisei Denden holds more hope: Changing the system "is in the ministry's interest as well as ours and our customers," he says. "It would help Japan as it goes through the ongoing (US-Japan) telecom talks." Exclusive business practices in the Japanese telecom industry have consistently been the target of US criticism. And the posts ministry is under pressure to do something because the second year of the "regulatory reform" discussions between the Bush administration and the Koizumi cabinet is about to finish. Last October, both governments submitted a set of recommendations to each other: In the telecom sector, the US asked Japan to assure that fixed-line carriers get the right to set the retail price when their customers call customers of NTT DoCoMo. "We certainly applaud Heisei Denden and Cable & Wireless for using the mechanism at their disposal to find an answer to the problem," says a US official who has been involved in the talks. "These cases are important because they put (the issue) right in front of the government. Now they have problems in interconnection negotiations, problems with the terms that the dominant carrier is requiring in order to conclude interconnection negotiations, and the government is going to have to decide. "The reason why we focus on calls to NTT DoCoMo is because that's the dominant carrier in the market," says the official. "We haven't gotten a clear explanation from them as to why NTT DoCoMo can make a distinction between (fixed-line) carriers and other kinds of carriers in setting prices on their customers." Some industry sources even say that the ministry, being stuck in the middle between the domestic mobile industry and US political pressure, is happy to receive these complaints because these filings make it look like they are at least doing something to change the system. The US has for a long time asked Japan to ensure that the telecommunication regulatory function be independent: Japan needs something equivalent to the US Federal Communication Commission, an independent institution with specific rules on the appointment of a commissioner, on the way it deals with the industry and on the steps that the commission must take when revising regulations, the US argues. For now, callers will have to wait and see how the talks progress, and pay phones will enjoy a steady diet of JPY10 coins whenever anyone makes a call to a friend's keitai. @ |

|

Note: The function "email this page" is currently not supported for this page.