The year ahead - Looking for Hope in a Shattered Economy

Back to Contents of Issue: January 2002

|

|

|||||||||||||||||||||||||||||||||||

|

by Sumie Kawakami |

|||||||||||||||||||||||||||||||||||

... BLEAK PREDICTION FROM THE J@pan Inc team, but what did you expect? The year 2001 has thankfully been put to rest after September 11, war in Afghanistan, mad-cow madness, a continued slowdown in the global economy, rising crime and unemployment rates in Japan, disappointing performances of DRAMs, DVDs, and many other electronic products, and few surprises to cheer consumers. Prime minister Junichiro Koizumi is fond of saying, "No pain, no gain," but how much more pain are the Japanese expected to take before they cry uncle? ... BLEAK PREDICTION FROM THE J@pan Inc team, but what did you expect? The year 2001 has thankfully been put to rest after September 11, war in Afghanistan, mad-cow madness, a continued slowdown in the global economy, rising crime and unemployment rates in Japan, disappointing performances of DRAMs, DVDs, and many other electronic products, and few surprises to cheer consumers. Prime minister Junichiro Koizumi is fond of saying, "No pain, no gain," but how much more pain are the Japanese expected to take before they cry uncle?

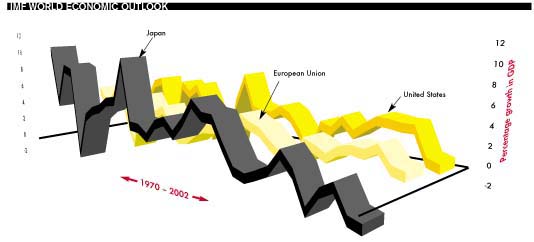

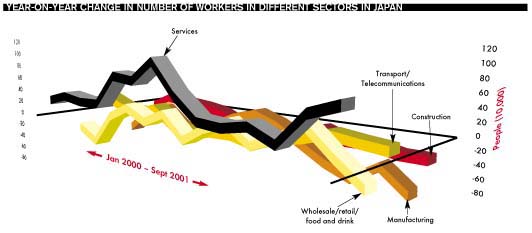

Buzzwords for 2002 will be "restructuring," "disaffected workforce," "outsourcing," "cheap and OK" food, and (we hope) "the second coming of Uniqlo." Japanese workers will be in the economic trenches, and back in the war room senior executives and politicians will have to make some hard decisions to try to finally right this economy. Expect more mergers, buyouts, and corporate collapses. And somewhere amid the chaos, expect new winners to emerge. The Economy Japan is the only industrialized country expected to see its economy shrink not only in 2001, but also in 2002, according to the International Monetary Fund's "World Economic Outlook." IMF revised downward its outlook on most industrialized countries in November to fully reflect the impact of the series of events that started with the terrorist attacks of September 11. While the IMF projects the US economy will show "a recovery which will strengthen through 2002," Japan is now expected to experience two consecutive years of contraction for the first time in the postwar period. The November report predicts that Japan's real Gross Domestic Product will shrink by 0.9 percent in 2001, and by 1.3 percent in 2002. The IMF notes that the global slowdown will be more prolonged than was earlier foreseen, and "the outlook for Japan has become increasingly worrying." Slowing growth would increase pressures on financial and corporate sectors across the globe, and, the report says, "this is of particular concern in Japan, where banks are highly exposed to developments in equity and bond markets." The IMF is not alone in its pessimism. Private financial institutions post predictions almost as bleak. Both Morgan Stanley and Fuji Research Institute Corporation see another year of economic contraction in 2002. Morgan Stanley sees the economy contracting a full point, while Fuji Research revised its growth forecast downward in November from -0.6 percent to -0.8 percent for 2001, and from -0.3 percent to a bleak -1.0 percent for 2002. Hiroshi Inagaki, a senior analyst at Fuji Research, says Japan will have to wait until at least September 2002 for any sign of an economic recovery. Inagaki says a decline in exports, especially in the area of electronics, following the slowdown of the US economy after September 11, could deliver a serious blow to Japan's manufacturers. Jesper Koll, chief economist in Japan for Merrill Lynch, says Japan's corporate profits are under severe downward pressure; they will deteriorate 35 percent by March and be flat for the 2002 calendar year. According to Koll, the share of national income taken up by corporate profits is at a record high, excluding bubble peaks, mainly due to a sharp expansion in the public deficit and a solid reduction in the household savings rate. But, he says, the government is no longer likely to continue to support inefficient companies. This may be good news for the medium term, Koll says, but the short-term hit on corporate profits is still underestimated. Restructuring Japan is in the throes of some seriously painful restructuring, as it takes apart bit by bit its lifetime employment system. Fujitsu plans to shed more than 21,000 workers, Toshiba is axing 17,000 by March 2004, and NTT East and NTT West are getting rid of 21,000 by March 2003. While some of these workers will be shipped to already overloaded subsidiaries, others will be sent home to mope or collect their compensation at "Hello Work," the nickname for Japan's unemployment offices. While companies feel they must shed workers and get leaner, some are offering some pretty sweet severance packages. The Nikkei Shimbun reports that seven leading electronics manufacturers will spend JPY1.05 trillion on restructuring in fiscal 2002, which begins in April. With expenses like that, the cost of restructuring is bound to deliver a temporary hit to companies' bottom lines. It is also bound to force management to come up with some creative cost-cutting concepts. Sharp, for example, is planning to introduce a job system in which workers can choose to take a 20 to 30 percent pay cut in return for a guarantee that they won't be transferred. The company is hoping to get volunteers from workers at regional branch offices who wish to stay where they are. One of the most influential workers' unions, the Japanese Trade Union Confederation (Rengo), is also considering accepting a "work-sharing" plan proposed by the Japan Federation of Employers' Associations. The idea is to reduce working hours and wages for some workers in order to save more jobs. There is talk about the government subsidizing companies that implement the plan. Disaffected Workers Another myth that was shaken in 2001 and will be completely relegated to history's dustbin in 2002 is the one about how hard-working and dedicated the Japanese are. The Gallup Organiza-tion, a multinational research firm, released some research in September on how engaged employees are in their work. The results are surprising. Gallup found that Japanese workers are less engaged in their jobs than workers of other industrialized countries. Gallup says that "engaged employees" (described as loyal, productive, and satisfied) make up only 9 percent of Japan's workforce, compared with 30 percent in the US and 17 percent in the UK. On the other hand, "actively disengaged employees" (disenchanted and disaffected, often vocal or militant in showing their negative attitudes to work and employers) make up 19 percent of workers in Japan. That's on a par with the US (19 percent) and the UK (20 percent). Gallup estimates that these disgruntled workers cost the Japanese economy between JPY19.7 trillion and JPY21.4 trillion a year, or almost 4 percent of gross domestic product. On a corporate level, this disengagement costs an average 1,000-employee company in Japan JPY263 million. "The single factor that contributes [most] to employee [dis]engagement is poor management," the report states. "Workers claim they don't know what is expected of them, their managers don't care about them as people, they are not well suited to their jobs, and their views count for little." Just think of all those Japanese companies that stick a bilingual worker who doesn't like numbers in the accounting division, for example, and you begin to see where the problem lies, says Charles Pribyl, a research consultant at the Gallup Organization. So what should good managers do? Weed out the really disgruntled folks during restructuring, right? But Pribyl says slashing unproductive labor is not an instant remedy in Japan. Instead, companies let people go and then expect those who are left to take on the extra work regardless of their talent or ability, he says. Pribyl predicts that the bulk of the 72 percent who are dissatisfied with the extra workload and are labeled "not engaged" may soon become actively disengaged. Downsizing

"Things will get worse before they get better," Pribyl says, adding that it may take another couple of years before Japan will rebound. He says the present level of workers' engagement is a predictor of future economic performance: The economy gets better when people are committed to their work. The US economy is showing signs of recovery, with 30 percent of workers engaged in their work. But for managers in Japan, 2002 poses some special challenges. The "silver" and youth markets Finally, some good news: The service sector is alive and well. But has it been misread? Yoshio Minato, general manager at IBJ Investment, thinks so. "It is too often said that the electronics giants are sinking, but the service sector is vibrant," he says. He believes that when it comes to the service sector, people are too focused on Japan's rapidly aging population, the so-called "silver market." "Those who have money and are willing to spend are in the younger, single population; seniors don't spend much," he says. "We haven't seen a second coming of Uniqlo yet, but I expect something similar of that sort to come in 2002." Labor Services With the labor market in flux, labor services are bound to be in demand in 2002. Just take a look at the temp industry, for example. It has grown into a more than JPY1.4 trillion market, with more than 1 million people dispatched in fiscal 1999. Just within the Tokyo metropolitan area, 633,170 people were dispatched in the first half of 2001, up 25.4 percent from a year earlier, according to the Temporary Work Services Association of Japan.

More companies are opting to hire temporary staff and cut back on part-timers, who used to be the favorite source of cheap labor. That's in part because the government is planning to force companies to give part-timers more benefits. Expect the temp industry to keep rising in 2002 (see "Statistics," page 14, December 2001). In addition, the higher unemployment rate gives recruitment businesses a bigger pool to choose from. In September 2001, 6.75 million employed people were hoping to change jobs, compared with 6.32 million a year earlier, according to the Ministry of Public Management, Home Affairs, Posts, and Telecommunications. More unemployed people and more people willing to jump ship add up to a fluctuating labor market where savvy recruiters can do well. Some major temp agencies are primed for increased demand. As of early November, Intelligence, a leading agency, ranked 4th among all listed companies in return on assets, and 14th in return on equity. The growth of the market is partly due to a series of deregulations. The Revised Temporary Employment Law, which came into effect in December 1999, considerably liberalized the temporary staffing industry in Japan. Prior to the law's passage, the government allowed only 26 job categories to be open to temporary employment. The new law has removed these restrictions for all professions except construction, port transportation, and security services. Further deregulation in December 2000 lifted a restriction on companies' use of temporary staff for more than a year, allowing companies to hire these workers as permanent employees after that year. Another new area of development in the labor business is outplacement. Labor unions that have been strong since leftist movements in the 1960s and an entrenched seniority system in most companies made it very difficult for companies to fire workers. But the rising unemployment rate has gradually changed the picture, and more and more companies are offering workers packages of additional retirement money and outplacement services.

Projections of Annual

Growth of Japan's Real GDP

|

|||||||||||||||||||||||||||||||||||

Note: The function "email this page" is currently not supported for this page.