Ardepro's Win-Win Formula

Back to Contents of Issue: October 2005

|

|

|

|

by John Dodd |

|

The clich?Ethat Japanese consumers prefer the new to the old no longer holds, not only at the level of consumables such as clothing and furniture stores, but also further up the food chain, in housing. According to the Japan Real Estate Institute, of the 1.7 million housing sales in Japan during 2004, 1.2 million new houses had been built and just under 500,000 were sales of secondhand apartments and homes. Many of these secondhand dwellings are located in older and better-serviced areas, indicating that buyers are willing to sacrifice newness for convenience and public facilities.

The clich?Ethat Japanese consumers prefer the new to the old no longer holds, not only at the level of consumables such as clothing and furniture stores, but also further up the food chain, in housing. According to the Japan Real Estate Institute, of the 1.7 million housing sales in Japan during 2004, 1.2 million new houses had been built and just under 500,000 were sales of secondhand apartments and homes. Many of these secondhand dwellings are located in older and better-serviced areas, indicating that buyers are willing to sacrifice newness for convenience and public facilities.That one-third of Japanese are buying used homes is a major mind shift with profound implications for the housing market. As Japanese society grays, the trend is to move closer to city centers, and even in earthquake-prone Japan, to build higher, thanks to aseismic design. This is good news both for condo-minium developers and renovation firms, and, of course, for those com-panies which sell the output of both. One company that has been able to take advantage of the change in attitudes is Ardepro Company Limited, a real estate developer specializing in refurbishing homes and apartments for sale. Ardepro, which handled about 800 property renovation/sales in fiscal year 2004, is still a small player in the market. However, the company has developed a highly integrated soup-to-nuts operation that allows it to make about 50 percent more profit than its competitors, and pay about 300 percent less in finance charges -- largely because of its quick turn-around on renovations and subsequent sales. This formula should make the company a major force in the housing-redevelopment market. Company Background Ardepro was listed on Tokyo's Mothers stock exchange (Ardepro: 8925) in March 2004. Its CEO and Chairman, Mr. Tatsuya Akimoto, has led the company since 1998. Although Akimoto is still only 40, his experience in real estate stretches back to 1988, when he founded Kouei Trust. Over the next ten years Akimoto planned his entry into real estate development, but understood that with the big keiretsu players having a stranglehold on the supply of new property, he needed an innovative idea if a start-up was to succeed. The Japanese real estate bubble came and went, and in the mid-nineties Akimoto began to conceive a new niche market -- one too small for the incumbents to participate in economically and where he could exploit changes in demographics and consumer values that the majors would be slow to spot. That new niche was the renovation and sale of older buildings for people unable to buy new houses.  By 1998, after almost seven years of economic stagnation in Japan and the Asian crisis, an increasing number of Japanese were being locked out of the real estate market. They were mainly salaried workers who had lost their jobs or young people, seniors, or women -- demographic groups always at a disadvantage in the job market. Add to these groups people locked into high home mortgages on assets that had lost 50 percent or more of their value and who were under financial pressure, and smaller private investors disillusioned with the microscopic returns of bank accounts and government bonds -- and you had the makings of a new customer segment in real estate. Akimoto decided to set up his operation to service these customers, focusing on keeping costs low, extending the savings to them, and helping them arrange financing.

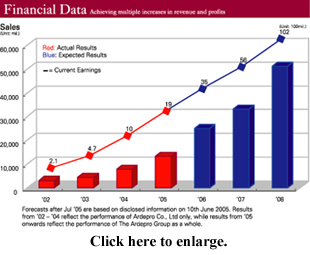

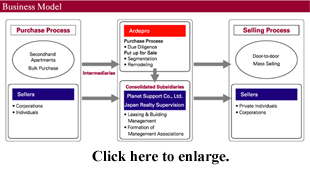

By 1998, after almost seven years of economic stagnation in Japan and the Asian crisis, an increasing number of Japanese were being locked out of the real estate market. They were mainly salaried workers who had lost their jobs or young people, seniors, or women -- demographic groups always at a disadvantage in the job market. Add to these groups people locked into high home mortgages on assets that had lost 50 percent or more of their value and who were under financial pressure, and smaller private investors disillusioned with the microscopic returns of bank accounts and government bonds -- and you had the makings of a new customer segment in real estate. Akimoto decided to set up his operation to service these customers, focusing on keeping costs low, extending the savings to them, and helping them arrange financing. The formula has been proven to work. Ardepro has projected sales of JPY13.5 billion and pretax profits of JPY1.905 billion for the 18th period (July 2005), for an estimated pretax profit level of 14.0 percent. Not content that current earnings are far higher than the industry average of 10 percent, Akimoto is aggressively trying to boost them to 14.7 percent over the next period. Furthermore, since Ardepro is growing at a rate of more than 50 percent a year, Akimoto expects that over the next three years sales will hit JPY50 billion and pretax profits JPY10 billion. Value of Repeatable Processes Ardepro's core business consists of buying, renovating, and selling properties, leasing, and property management. In addition, there are some ancillary services comprising financing, intermediary services, and consulting. Ardepro keeps costs low at all points on the value chain. For example, when procurement staff search and buy older buildings, they follow criteria set by Akimoto years ago. Buildings must be in good enough condition to renovate quickly, have sufficient apartments for renovation and sales to happen en masse (deriving savings from repeatable processes), and be located in areas where convenience outweighs considerations of age of the structure and personal pride. Although focusing the business on repeatable work processes sounds like a basic strategy, its execution in a complex multi-variable business environment such as renovation is difficult. A competitor that went public recently, JASDAQ-listed Intellex, has struggled to make a profit as a renovator/developer. The firm only had a net profit of JPY306 million on sales of JPY29 billion, for a modest return of just over 1 percent, owing to the limitations of its one-by-one business model. In contrast, Ardepro works only on a repeatable process basis. The company buys apartments in blocks, preferably a building at a time, and refurbishes and starts selling them just 86 days (on average) later, also in blocks. This approach offers several benefits. Firstly, it allows a cookie-cutter approach to the various finishing and marketing tasks. This includes volume discounts on purchases of fixtures, fittings, and ad placements. It also means up to 90 percent fewer sales people than normal. Typically a staff of just five can handle unit sales in a larger building where the rooms are all similar in layout and finish, by using standardized show rooms and team-based scheduling. Another benefit is that when the company can acquire an entire building (it will settle for portions of buildings, as long as there are multiple units available), it can rename and operate the building under its own brand. Then all the benefits that a developer gains from brand development and awareness, such as placing its logo on conspicuous parts of the building exterior and uniform branded marketing, accrue to Ardepro -- but without the costs of new construction. Or the time, either... Whereas regular developers constructing their own buildings require a gestation period of about 450 days, Ardepro has a stunning 86-day return on investment. In fact, Ardepro's record for inventory turnover is the complete renovation and sale of an 80-unit building in just 80 days! Repeatability also creates other business opportunities downstream. Post-sales services are one example. Ardepro will be able to provide seamless post-sales services through the soon-to-be announced merger of its consolidated subsidiaries, 100%-owned Planet Support Co., Ltd and 96.3%-owned Japan Realty Super-vision (JRS), on November 1. The merged entity, which will be known as JRS, will handle all aspects of property maintenance and management nationwide. Ardepro aims to have JRS listed within three years.  Who Buys Ardepro

Who Buys ArdeproThe impetus for people to buy renovated homes is generally one of simple economics and value for money. According to Akimoto, while a new 80-square-meter apartment in Ebina can cost around JPY20-30 million, the same-sized used apartment, prior to refurbishing, can cost just JPY8 million -- less than half price -- a compelling value proposition. Ardepro's main client base is the 49.8 percent of Japanese workers with annnual incomes of JPY3 million to JY7 million. Since most banks will grant a housing loan up to four or five times the borrower's annual income, consumers can afford a home priced between JPY15 million and JPY35 million. In targeting this demographic, customer education is important. Ardepro presenters are trained to show each prospective customer how, while they may be paying JPY120,000 in rent monthly now, they can have the same or better premises for JPY70,000 a month or less by buying their own place. And they get to own the asset at the end of the period. Akimoto says that there is a whole generation of younger Japanese who, having lived through the recession of the nineties, have become resigned to the idea that they'll never be able to buy their own home. However, when they are educated on the economics of purchasing, and a loan program with a suitable lender is arranged, the sales conversion rate goes up accordingly. Ardepro uses a hub-and-spoke concept in its marketing. The hubs are the main offices in nine major cities, and the spokes are the sales offices radiating outward into the suburbs. Currently, other developers do about 50 percent of their marketing via the Internet. Ardepro, however, depends upon word-of-mouth and does much of its initial prospecting by flyer advertising. As people learn to go online for deeper information, Ardepro plans to expand its marketing effort to the Internet, providing plenty of photos and data for always information-hungry Japanese consumers. Meanwhile, on September 5, Ardepro entered into a tie-up with IDU Co., Ltd. for auctioning of real estate. The two companies put up 40 properties for the initial auction, with plans to showcase 100 properties annually in the near future.  Holistic Management Philosophy

Holistic Management PhilosophyThe real estate development industry resembles the hospitality industry in that customer experiences largely determine whether or not a business flourishes. Word-of-mouth sales are important. Akimoto sets high standards for himself and expects nothing less from his staff, at all levels, all around the country. In particular, he believes that employees need to take a holistic and human-oriented approach to business and their customers. If they don't, they will lose out to companies who do. By holistic, Akimoto has defined three areas of focus for himself and his managers: financial well-being, physical well-being, and mental well-being. Only by having these beliefs and excelling in all three areas does Akimoto feel that Ardepro can succeed to the satisfaction of its shareholders. Specifically, financial well-being is a result of reliable, well-tuned operations and, of course, the product positioning of the company in the market. Physical well-being is the ability of the staff to get business done without spending 100 hours per month at the office -- as well as reliable back office operations created by investment in systems, processes, and staff education. Mental well-being results from the satisfaction the staff derive from helping people on a personal as well as commercial level. Certainly, by allowing customers to leave money in their pockets, through lower costs, staff are helping customers in a big way. Akimoto's concern about his staff's emotional and mental well-being is strongly stamped onto the company psyche. For example, his belief that every employee needs a high sense of self-worth and purpose has led to the development of a set of inspirational guidelines -- to help under-motivated staff understand how to harness their own success. Mottoes such as, "The most regrettable experience for a person is to have lived on this earth and feel no sense of accomplishment," and, "The most regrettable condition for a human being is to have nothing worthwhile to do," are circulated for the staff's consideration. While this may seem a bit over the top to Western readers, in Japan, at least, these mottoes are of a depth to shake even the most insensitive person into doing some introspection. It's great for business, and the customers really are satisfied. Distressed Properties The distressed property market in Japan is colored by both cultural and territorial issues. On the cultural side, pride, stalling by the owners to face reality and divest their assets, and the lack of risk-based equity are all reasons why a lot of distressed property finds its way on to the market at a very late stage. Consequently, distressed properties must be sold quickly and on unfavorable terms, unless the portfolio is big enough to warrant the attention of a major financial institution with the means to offer bridge financing. On the territorial side of the equation, the two main players in distressed assets are the mortgage-holding banks and a small group of secretive realtors specializing in such property. The banks, which have traditionally wanted to hold on to debtor assets, often try to turn a profit on a resale by a suitable subsidiary financial company at a later stage. This hoarding of repossessed assets, although diminished somewhat on account of the FSA's insistence that banks clear their bad debts, still persists, thus limiting the supply of such property on to the market. The specialty realtors draw their pool of properties from banks and other realtors. Even with the economy improving, there is always some home owner or business operator who took one risk too many or got caught up in an intra-industry downturn, causing the owner to dump his assets quickly. Strangely, despite the limited volume of such property, rather than capitalize on it and invest, the specialty realtors are risk averse and want to act purely as brokers -- moving the properties quickly and at minimum cost. The result is that if you're an Ardepro or similar renovation specialist, and you have the cash to make an outright purchase, you can pick up distressed property at a fraction of its real value. Akimoto has long understood the opportunity in distressed real estate. He sources it roughly in the ratio of 60 percent from realtors, 30 percent from banks, and 10 percent from auctions and private individuals. Because of the speed at which properties are sold off and the lack of time to do suitable due diligence, coupled with the cash-only nature of the business, he has devel-oped a system to lower the risks of handling such opportunities. Firstly, since disgruntled tenants may restrict access to inspect a property, Ardepro's mass purchase approach means that they can inspect a percentage of units in a given building and draw conclusions as to the condition of the non-inspectable units. Thus the quality of the purchase is made based on the experience of his surveying and assessment team, and some educated risk-taking. A thorough knowledge of building codes and techniques from 20 to 30 years ago is helpful, as is a healthy line of credit -- because deposits usually have to be lodged within a couple of days of the property becoming available, and full payment is due within a month after that. Distressed real estate is not as plentiful as it once was and getting a good deal is somewhat a matter of chance. There are many new players at the low end, including private investors, and the banks and funds are starting to improve their efficiencies at the high end and are now picking up smaller properties that at one time their overheads would not have allowed them to touch. Akimoto takes the deals when he can get them, but doesn't rely on them for overall profits -- preferring instead to excel in overall execution.  The Future

The FutureArdepro's goals for the future are straightforward: increase the flow of properties, get better at extracting profits from that flow, and prepare the company for its next stage of growth. Improving the flow of properties will come from general expansion of the company's sales network around the country, and through a rising awareness in the public of the brand. Akimoto believes he can build the Ardepro brand through solid financial performance and through offering outstanding value for money on properties he sells. So far it looks like he is doing everything right, and word-of-mouth referrals are fast becoming an important prospecting tool. Extracting more profit is getting progressively difficult with the current class of real estate, so Akimoto is planning to target a broader range of salaried workers -- those earning up to JPY22 million -- which he figures will cover about 64 percent of all workers in Japan. He feels that if he can translate the savings techniques learned at the lower end of the market for more luxurious accommodation, then he can reasonably expect to see profits per unit increase. He will also have the satisfaction of teaching financial discipline to some of his competitors, who currently take their high-end positioning for granted. Akimoto also plans to extract more profit by strengthening Ardepro's IT capabilities, by making property management its core competency, and by turning to the capital markets -- real estate securities firms and asset management companies -- rather than banks for funding. Borrowing on capital markets would help reduce the financing costs of larger, more expensive projects. At present he has no plans to expand overseas, but he is interested in possible tie-ups with international firms wanting a partner to do developments in Japan. Lastly, Akimoto is preparing Ardepro for the next stage of growth, the goal of which is a listing on the first section of the Tokyo Stock Exchange. Because the company will hire several hundred more employees during this phase, Akimoto will no longer be able to exercise personal control over all aspects of the firm. So a key component of preparation is the strengthening of its corporate governance, both through bringing in out-side directors and increasing transparency to shareholders via more corporate communications. To underline the firm's commitment to improving its internal control and adherence to international standards, specifically the Sarbanes-Oxley Act, Akimoto is actively restructuring processes and revamping the organizational structure. He has tapped Kenichi Sato, the former president, to spearhead this effort. Sato's title is Director of Corporate Governance. Information will be disclosed to stakeholders accordingly and more corporate resources will be devoted to achieving transparency and accountability to investors. Ardepro is also considering the future possibility of English-language disclosure to foreign stakeholders. JI Contact details Ardepro Co., Ltd CEO Tatsuya Akimoto Address Keio Shinjuku 3-chome Bldg. 2F 3-1-24 Shinjuku, Shinjuku-ku,Tokyo Email e_ir@ardepro.co.jp Web www.ardepro.co.jp No telephone inquiries please. |

|

Note: The function "email this page" is currently not supported for this page.