"Dump REITs" Is Not The Best Strategy

Back to Contents of Issue: September 2004

|

|

|

|

by Darrel Whitten |

|

IN ADDITION, THERE APPEAR to be some misperceptions at work in the growing gap between Japanese Real Estate Investment Trust (REIT) stock prices and real estate stocks. Research in the US would indicate that REITs are a valid asset class, useful in diversifying large portfolios of Japanese financial assets -- not just another interest sensitive that should be dumped when interest rates begin to rise. IN ADDITION, THERE APPEAR to be some misperceptions at work in the growing gap between Japanese Real Estate Investment Trust (REIT) stock prices and real estate stocks. Research in the US would indicate that REITs are a valid asset class, useful in diversifying large portfolios of Japanese financial assets -- not just another interest sensitive that should be dumped when interest rates begin to rise.

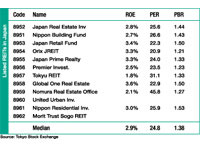

A more bullish BOJ makes Japanese investors nervous.................................. The Japanese market could remain choppy for the foreseeable future as global investors see how the US recovery deals with rising rates and tighter fiscal policy -- and how the presidential race unfolds. Foreign investors are again net buyers of Japanese equities, apparently having already discounted the risk that slower China growth could harm Japan's economic recovery. The LDP's losses in the House of Councillors' elections were also not as deep as feared, while Heizo Takenaka, Prime Minister Koizumi's reform program point man, has gained credibility now that he is an elected politician. Investors, however, profess that they have become more selective and are looking for lower beta stocks to protect gains. This implies at least a temporary move to larger and mid-caps away from small caps. However, as we have pointed out in the past, the small cap indices (particularly the TSE 2) have continued to hold up better during the recent correction, while showing much stronger performance than the Topix and certainly the big caps (such as the Topix Core 30) on the upside. As the recent Bank of Japan (BOJ) tankan business survey showed, Japanese businesses are feeling more bullish about domestic economic conditions than at any other time since the end of the speculative boom more than a decade ago. The BOJ is now also more confident that this economic recovery is different, and more importantly, sustainable. However, this makes investors nervous because the more confident the BOJ becomes, the closer the day when the central bank abandons its zero interest rate policy (ZIRP) approaches. Investors are not yet sure that Japan's economy, financial markets and corporations can withstand higher rates. However, Japanese firms are finally beginning to reap the benefits of many years of hard work to clean up their debt-laden balance sheets and retool their operations for greater efficiency and profitability. In addition, a wave of innovation in the digital electronics area in recent years has also helped recharge Japan's growth engine. Moreover, the banking sector's progress in reducing bad loans has provided additional thrust for the economy. Troubled companies are being scrapped or recycled into new, profitable businesses at increasing speed. These improvements will have a lasting, positive effect on the economy, and have positive implications for the secular recovery that we have been suggesting could happen -- one that could possibility support an extended economic recovery like the Izanagi Keiki of the 60s. More subdued market trading energy.............................................. Trading turnover has subsided to the lowest level in four months in a sign that the Japanese stock market is losing energy. Waning trading volumes amidst underlying bullishness is another reason why the large caps could very well continue to underperform for the foreseeable future. Having made good gains on domestic-oriented and financial stocks, foreign investors have recently been taking profits, as evidenced by the profit-taking in UFJ Holdings by the Sovereign Group, a particularly high profile early purchase of the financial sector that set other foreign investors as well as individuals chasing after financial stocks. But the best-performing foreign funds as listed above have few of the traditional Japan blue-chip favorites. Instead, they own regional domestic-demand oriented companies like Aica Kogyo, Touei Housing, Nishimatsuya Chain and Nitori Co. and consumer finance companies such as Life Corp. and Nissin. Growing investment in Japan's distribution through REITs.......................................................... The Nikkei is reporting that two major US real estate funds will each invest more than JPY100 billion in building large distribution/warehouse facilities in the Kansai region, while Japanese trading houses are also moving quickly to expand investment in distribution properties in major cities. Each company reportedly intends to procure funds by listing REITs specializing in distribution facilities. AMB, a major US REIT operator, plans to inject a total of \100 to JPY120 billion into Japanese distribution facilities by spring 2006. It has already invested about \30 billion in such facilities in Saitama and Chiba prefectures through AMB BlackPine, a Japanese subsidiary set up last spring. It is also expected to start building a facility in Hyogo Prefecture in August. Another US fund, ProLogis, will also accelerate investing in Japan's distribution facilities. Last year, it procured about JPY120 billion through its first fund launched in Japan and is now developing 13 facilities, including a warehouse already completed near the New Tokyo International Airport at Narita. It will also invite the same scale of money for its second Japanese fund in one or two years. This has stimulated Japanese trading companies to invest. Mitsui & Co. will expand its fund specializing in distribution facilities to about JPY50 billion from the present JPY10.4 billion. Both the foreign investment firms and the domestic trading companies plan to capitalize these investments by listing new REITs on the Tokyo market. While Japan's listed REITs had a less-than-stellar start, REITs in Japan are now stepping up their purchases of office buildings and commercial properties, and the total value of their assets is expected to double from their levels as of March 31 to around JPY3.32 trillion by the end of fiscal 2006. The total assets held by Japan's listed REITs reached about JPY1.59 trillion as of March 31. REIT capital increases....................................................................... One important reason companies are stepping up their asset purchases is that REITs are gaining acceptance among investors. REIT dividend yields are currently at about 4 percent -- much higher than returns offered by long-term Japanese government bonds. Individuals and regional banks have jumped on the REIT bandwagon, and the market capitalization for REITs has jumped 120 percent from a year earlier to surpass JPY1.2 trillion as of April 30. In turn, the REIT companies may help to promote urban renewal projects. Strong demand for properties could spur more real estate developers to pursue projects, especially if the buildings they deal with are snapped up by REITs and enable them to recover investments quickly. In a Nikkei survey of 13 listed REITs and 11 companies that plan to set up and list REITs within the next three years, the total assets held by Japan's listed REITs reached about JPY1.59 trillion as of March 31, and these REITs plan to boost their assets by 70 percent to roughly JPY2.7 trillion, while the companies that intend to set up and list REITs expect to purchase about JPY620 billion in properties by the end of March 2007, bringing the combined asset amount to about JPY3.32 trillion. The REITs are bolstering their asset purchases in a bid to diversify their revenue sources. By establishing an earnings structure that is not greatly affected by changes in the utilization rates of certain properties, the funds aim to attract a wide range of investors. Because the decline in land prices for central Tokyo, which is home to a number of prominent properties, is showing signs of abating, the REITs are snapping up assets while they are still at attractive price levels. The REIT index published by the Tokyo Stock Exchange outperformed the liquidity-adjusted Topix 1,000 until March, but subsequently has been struggling, as increased expectations for full-fledged reflation in Japan have increased, while the side effect has been a significant rise in long-term bond yields from historically low levels. Normally, REITs are interest-sensitive, with performance worsening in direct proportion to the degree of concern over future interest rate rises. While the actual dynamics for the profitability of Japan's REITs are somewhat different, REIT stock prices peaked in a double-top fashion in March through April of this year, and have been consolidating since. The median decline in these stocks has been 6.7 percent, and the there is also a double low that was not seen in the Topix 1000 liquidity-weighted index. Not surprisingly, the most relatively expensive of the group, Nomura Real Estate, has corrected 12.2 percent, or about twice the median of the group, as its P/E ratio at 45.8x is nearly twice the median value, while ROE at 2.2 percent is less than the median 2.8 percent. The disconnect is that the real estate sector has been among the top performing sectors for the year to date, and the fundamental factors that would boost the stock prices of real estate companies should also boost REITs (rental returns). In other words, a disconnect is developing between REIT stock prices and real estate stock prices. With rising long-term bond yields and falling REIT yields, the gap between "riskless" returns and "risky" returns offered by REITs is shrinking. In the US, concerns about higher rates and inflated REIT valuations pushed down total returns, which include the stock price and dividends, more than 15 percent in April, the biggest monthly decline for the industry in more than a decade. But Global Real Analytics LLC offers another take: They claim that interest rate concerns that are negatively affecting US REITs are "irrelevant." The reasoning is that REIT shares tend to move independent of the broader stock market. Because of their corporate tax-exempt status and their greater earnings stability due to the fixed-term leases they have with tenants, REITs in the US have "substantially higher dividends and exhibit lower volatility and risk" than the S&P 500. In the first quarter of this year, REITs far outperformed the stocks in the S&P 500 Index and Treasury bonds in the average annual returns posted over the short term -- the last one-, two- and three-year periods -- and over the long term of 25 years, according to the report. In the last year, US REITs posted an average annual return of 51.6 percent, compared to 35.1 percent for the S&P 500 and -4.9 percent for bonds. During the past 25 years, the average annual return offered by the REIT sector was 14.7 percent, compared to 13.4 percent for the S&P 500 and 10.1 percent for bonds. The theory that US REITs performed better because the sector had more debt leverage than the average U.S. business and therefore benefited from historically low interest rates fails to hold, the report says, because data indicate that REITs had about the same leverage as other US businesses. Instead, the report says, the difference can be explained by the fact that as the US business sector expands, rents -- and thus the value of real estate -- grow at about the same rate over time. During periods "when REIT earnings and corporate earnings diverge, long-term leases help cushion REIT earnings relative to business earnings." The key appears to be higher dividend yields. The high average dividend contributes to a much larger total return for REITs than for stocks in the S&P 500 Index. Since 1979, dividends have accounted for 37 percent of the total return of REITs, compared to 12 percent for stocks in the S&P 500. The report also found that the performance of REIT stocks has a low correlation with the performance of the broader stock market, as measured by the S&P 500 Index, and an even lower correlation with bonds. Using the so-called Sharpe ratio, which indicates the amount of reward received per unit of risk assumed, the report concludes that REIT stocks have the lowest risk for the biggest reward when compared to the performance of stocks in the S&P 500 Index and Treasury bonds during the past 25 years. The report suggests an "ideal" portfolio would consist of about 46 percent allocated to REIT shares, 32 percent dedicated to an S&P 500 Index fund and 22 percent devoted to bonds. If the assumptions in this report are correct, now is not the time to abandon Japan REITs either, as they should be an integral part of a diversified portfolio of Japanese financial assets. Indeed, the growing gap between Japanese REITs and real estate stocks could eventually be resolved in the REIT stocks' favor. @ |

|

Note: The function "email this page" is currently not supported for this page.