Mitsui Mines for Nanotech Gold

Back to Contents of Issue: July 2003

|

|

|

|

by Kurt Hanson |

|

BIG THINGS COME IN small packages, and if major trading house Mitsui and Co. is successful, it will find untold treasures in atom-size packages via the burgeoning field of nanotechnology. Mitsui's wholly owned subsidiary, Carbon Nanotech Research Institute Inc., has begun large-scale production of a material called carbon nanotubes (CNTs) in its new pilot factory located in Akishima City, Tokyo. BIG THINGS COME IN small packages, and if major trading house Mitsui and Co. is successful, it will find untold treasures in atom-size packages via the burgeoning field of nanotechnology. Mitsui's wholly owned subsidiary, Carbon Nanotech Research Institute Inc., has begun large-scale production of a material called carbon nanotubes (CNTs) in its new pilot factory located in Akishima City, Tokyo.

CNTs have been grabbing lots of press lately -- even thriller hack Michael Crichton has written about them -- but that doesn't mean they are well understood.

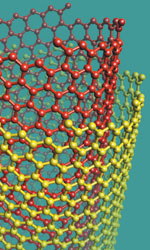

CNTs are carbon atoms shaped into cylinders that are only a few nano-meters in diameter, or less then 1/10,000th the width of a human hair. These nifty little tubes offer amazing electrical and mechanical properties that have only recently been explored. The toughest fibers known, CNTs are 100 times stronger than steel and are far superior to copper in conducting electricity. They can be turned into anything from golf clubs to fuel cells to NASA space ships. In short, it's a material that could transform manufacturing and industries on a worldwide scale.

Only one problem: The substance costs more than gold. Before the industry can manufacture nanotech products on a wide scale, the costs need to drop dramatically. But that may just be happening now.

Carbon nanotubes are 100 times Mitsui's brand new nanotube plant is the largest such facility in the world and promises to make CNTs affordable to one and all. In the first year of production it will crank out 40 metric tons of carbon nanotubes, peaking at 120 metric tons by 2004.

The goal is to make CNTs for as little as $300 per kilo, eventually slashing prices to $100 per kilo within a year. The production technique is called vapor phase reaction, a process that will allow the factory to produce nanotubes at one-tenth of today's costs.

Seiichiro Kiyooka, chief analyst at Fuji Keizai, an industry research firm, concurs that Mitsui's efforts in nanotube mass-production technology will eventually lower costs. Furthermore, he states that the company's leadership is stimulating competition and research and development projects in the nanotech industry, which will further bring down costs overall.

Nevertheless, rather than wait for the market to develop, Mitsui will provide CNTs to manufacturers in Japan to spur them to find unique ways to use the material. "The first step is to supply small and medium-sized manufacturers with free nanotube materials and look at their application methods," says Shuji Tsuruoka, a CNRI director. The firm has teamed up with the Tokyo Metropolitan Government to make other firms in Japan aware of the innovative program. It's a classic case of one hand washing the other.

Several automotive companies have already developed general industrial applications using Mitsui's nanotubes. Due to nondisclosure agreements, Mitsui was unable to provide information on which companies are using its materials for application studies.

"We are getting calls from Japanese industry. One manufacturer proposed using nanotubes, with their high conductivity, to make lightweight, high-voltage power lines."

Once production at the plant is perfected, Mitsui will either be spun off or form a joint venture with other companies, perhaps linking up with European firms.

Competitors are already breathing down Mitsui's neck. "In the field of CNT, Hyperion Catalysts International could be next, because they already have their commercial business. Also, some Japanese manufacturers such as Showa Denko, Nikkiso, NEC and Mitsubishi Chemical could be potential competitors," Tsuruoka says.

Green dreams

"Nano membranes and ethanol are the biggest potential market for nanotech," claims Tsuruoka. "Fuel cells are also possible with the nano membranes."

Currently, ethanol is made through an expensive and cumbersome distillation process. However, by using the nano membrane, the cost of ethanol production can be slashed by 50 percent.

Only one problem: The technology may well revolutionize ethanol production. This in turn could lead to environmental and economic benefits, such as reducing greenhouse gases while boosting the economies of underdeveloped countries that provide the sugarcane needed to make ethanol.

Under the Kyoto protocol, countries must reduce greenhouse gasses. A 10 percent ethanol additive to gasoline can help countries meet their goals. With an ever-increasing volume of gasoline consumed daily, the total volume of ethanol needed is enormous. Japan alone would require 500 million metric tons a year of ethanol to meet the 10 percent additive ratio, according to Tsuruoka.

Most ethanol is made from sugarcane, a vital commodity in many underdeveloped countries. Turning sugarcane into ethanol on a commercial scale could boost weak economies. Brazil boasts a huge sugarcane industry that produces biomass for ethanol production, which in turn provides 30 percent of the fuel for all of its cars. If ethanol becomes commercially viable, the implications for Brazil's economy are significant -- which is why Brazil has partnered with Mitsui on the pilot plant. Brazil could become a world-class fuel exporter: the Saudi Arabia of ethanol.

Small times

Nanotech is truly uncharted country. And as the science matures and new applications and inventions are discovered, the profound implications will become clear. The age of the small has arrived. @ |

|

Note: The function "email this page" is currently not supported for this page.

However, Sumio Iijima, the legendary nanotech research director at NEC Laboratory and the very man who discovered nanotubes, is skeptical of Mitsui's production claims of 40 tons a year. According to Iijima, other companies are working to achieve large-scale production. "Honestly speaking, we have not reached that stage at all. I'm not sure what the Mitsui people are saying," he says.

However, Sumio Iijima, the legendary nanotech research director at NEC Laboratory and the very man who discovered nanotubes, is skeptical of Mitsui's production claims of 40 tons a year. According to Iijima, other companies are working to achieve large-scale production. "Honestly speaking, we have not reached that stage at all. I'm not sure what the Mitsui people are saying," he says.

A small commercial plant producing 500 kilos of pure ethanol a day went online in Brazil in March. "We need to check the long-term problems and de-bug the system," adds Tsuruoka. India may be next in line for the new technology.

A small commercial plant producing 500 kilos of pure ethanol a day went online in Brazil in March. "We need to check the long-term problems and de-bug the system," adds Tsuruoka. India may be next in line for the new technology.