'Independence' That Counts

Back to Contents of Issue: March 2003

|

|

|

|

by Sumie Kawakami |

|

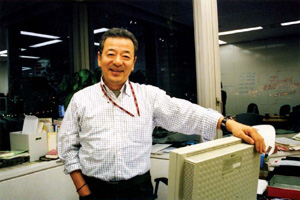

KOZO HIRAMATSU, PRESIDENT AND chief executive officer of Intuit (Japan), drives a BMW Z3 and rides a Harley Davidson, but he swears he couldn't have afforded to "buy" his own company from its parent if he hadn't partnered with a private equity fund. Intuit (Japan) is becoming independent from its US parent after it went through a management buyout (MBO). A Tokyo-based private equity firm, Advantage Partners, agreed in late December to pay Intuit of Mountain View, California JPY 9.5 billion, thereby becoming 100 percent owner of the Japanese entity. Hiramatsu and his team will stay in management, while Advantage Partners is sending outside directors. "When we announced the deal in front of our employees in Tokyo and Osaka, I received standing ovations at both places. I was very, very happy," recalls Hiramatsu. KOZO HIRAMATSU, PRESIDENT AND chief executive officer of Intuit (Japan), drives a BMW Z3 and rides a Harley Davidson, but he swears he couldn't have afforded to "buy" his own company from its parent if he hadn't partnered with a private equity fund. Intuit (Japan) is becoming independent from its US parent after it went through a management buyout (MBO). A Tokyo-based private equity firm, Advantage Partners, agreed in late December to pay Intuit of Mountain View, California JPY 9.5 billion, thereby becoming 100 percent owner of the Japanese entity. Hiramatsu and his team will stay in management, while Advantage Partners is sending outside directors. "When we announced the deal in front of our employees in Tokyo and Osaka, I received standing ovations at both places. I was very, very happy," recalls Hiramatsu.Intuit (Japan) is a vendor of popular Japanese accounting software, Yayoi Kaikei, which has received the annual best accounting software award from search firm BCN for four straight years. According to BCN, Intuit had a 27 percent sales share in large-scale computer stores during 2002. Industry sources say the company has JPY 6 billion sales annually. On the other side of the Pacific, the former parent Intuit has been as happy as Hiramatsu that its former subsidiary has grown up and moved out. The company announced that it expects to book a net gain of approximately $45 million from the transaction. Considering the tepid economy on its own shores, the American parent of Intuit may not be the only firm ready to sell its subsidiary in Japan. With the US economy limping towards an unforeseeable recovery, "select and concentrate" has become a buzzword among corporate strategists. Many IT-related firms are busy reviewing their business models and putting priority on the vertical domestic market. From takeovers to MBOs Intuit (Japan) isn't the only former foreign-subsidiary in Japan that recently went through an MBO. Last year alone, big name firms such as Tower Records sold off their Japanese operations. According to M&A broker Recof, 42 Japanese companies went through MBOs in 2002, up more than 30 percent from 2001, and more than three times the number in 2000. As foreign firms increasingly seek to sell off their Japanese subsidiaries, MBOs in partnership with private equity funds are becoming a viable tool for Japanese entities to win "independence," industry sources say. Intuit suffered from the hardship of localizing English software for the Japanese market after it made a dramatic debut in Japan in 1996. At that time, Intuit purchased a couple of Japanese software firms, including Nihon Micom, the original developer of the Yayoi software series, to launch its Japanese operations. "Intuit KK has been in a unique position compared to other US software vendors, who tend to develop their software at home and then localize it here -- vendors like Microsoft, Adobe, Symantec, Oracle, you name it," says Hiramatsu. "But Yayoi is literally 'made in Japan.'" Intuit made its entry when Japanese vendors were still afraid of foreign venture firms buying up their firms. Its Mountain View managers originally planned to localize Intuit's accounting software, Quickbooks, by using Yayoi's sales channels, which already had a solid footing in Japan. Quickbooks had established global recognition by then, and the US managers initially viewed the takeover as an opportunity for market access to Japan. "Intuit Inc. spent quite a lot of money in localizing Quickbooks," recalls a former Intuit salesperson. The strategy failed; Quickbooks never took off among Japanese consumers. "Accounting software needs a strong sense of locality; local cultures, commercial traditions and commercial codes play significant roles," the salesperson adds. "These were crucial elements, especially in Japan." Hiramatsu agrees: "Ninety-five percent of our clientele is small enterprises with 35 or fewer employees. Just because we don't target large firms, locality has been a crucial issue." However, the same locality issue that worked against Quickbooks was seen as an asset for Yayoi. After the company stopped selling Quickbooks, "Intuit KK also decided to go through the select and concentrate process; we focused on products that were already selling well, rather than trying to sell something that was more difficult." It was Hiramatsu himself who proposed the deal to Steve Bennett, Intuit CEO who was a senior executive at GE. "Steve has always been very open about M&A opportunities," Hiramatsu says. "Intuit Inc. had already acquired and sold many firms. It was natural for us to talk about that possibility." Hiramatsu approached Bennett as early as 2001, but "at that time he told me 'not at this moment.'" In the following year, Hiramatsu spotted his chance when Intuit sold its Quicken Loans mortgage business via an MBO. "I tried again in September 2002, telling him, 'We want to do it as well.' This time, he agreed." The following three months went quickly for Hiramatsu. Industry sources say Advantage Partners paid quite a premium for the deal, but Hiramatsu shrugs off the argument, saying that pricing wasn't the only factor for selecting his partner. "We actually had more than 10 candidates lined up for the deal. We trimmed that number to six after interviewing them. Then we did due diligence; we went through many matchmaking meetings, physical examinations, exchanges of blood samples, et cetera," he says. "Most important was the fact that Advantage Partners has the longest record; the firm has been in Japan more than 10 years. It also has solid experience and a record of many successful exits. Plus, many of their staff originally came from consulting firms, such as Bain & Co. They had some expertise we didn't have. That was really reassuring," Hiramatsu says. Partnership for the future "Our goal is to IPO within three years," says Hiramatsu, who claims the firm's operating income has doubled over the past two years, despite the weak economy. Even with the termination of Quickbooks, which had JPY 1 billion annual revenue, Intuit KK's revenue growth stayed flat last year. "Our opportunities lay in the growth potential in the IT sphere within small- and medium-sized enterprises, which have been largely left behind from the waves of computerization. Look at the numbers. Only 60 percent plus of our target companies are PC equipped; when it comes to accounting software, the percentage goes even lower. That means opportunities are great." Intuit (Japan) also has a secret weapon -- the MARCH Project, designed to provide accounting solutions to clients via 30,000 to 35,000 accounting offices in Japan. The area has been "an untouchable sphere," as it has been dominated by a handful of system integrators, such as Miroku Jyoho Service (MJS), which says it had 8,301 accounting offices covering 16,472 firms as of March 31, 2002. "We will provide PC-based solutions, where theirs are still networked based," Hiramatsu says. Reaching out to accounting offices "should give us a new set of revenue streams." Having served as president of IDG Communications Japan and AOL Japan, Hiramatsu knows what it means to be the head of a foreign organization in this country. "Anybody would rather become his own boss than be a hired mama-san," he jokes, referring to the "mama-sans" who run Japan's many watering holes. But Hiramatsu still has to prove himself to his partner -- Advantage Partners, which has 100 percent of the firm's shares and is equally eager to get things going. Hiramatsu admits that he never dreamt of becoming the head of a software vendor, especially one dealing in accounting software. He met with Bennett in November 2000, after his job at AOL suddenly ended because of DoCoMo's takeover. Like many other Japanese professionals in this era of economic uncertainty, Hiramatsu was faced with a radical midlife career change. Could he make a lateral leap this late in the game? "In my discussion with Steve before I joined the firm, I told him that I had always played major league baseball, and I didn't want to switch to NBA basketball now that I was over 50." But switch he did, and his career on the courts has officially just begun. @ |

|

Note: The function "email this page" is currently not supported for this page.