Searching for the Bottom

Back to Contents of Issue: March 2003

|

|

|

|

by Stefan Whitwell |

|

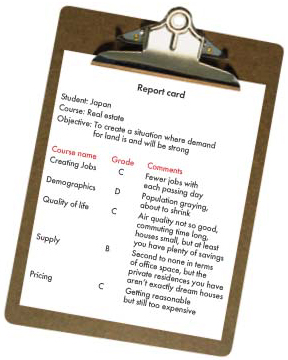

TOKYO REAL ESTATE PRICES have fallen for 11 straight years. Commercial land in the capital has dropped in value by almost 80 percent. That must mean that now is the time to buy, right? Not so fast. TOKYO REAL ESTATE PRICES have fallen for 11 straight years. Commercial land in the capital has dropped in value by almost 80 percent. That must mean that now is the time to buy, right? Not so fast.Tokyo is the largest commercial office market in the world, with 840 million square feet of office space in its 23 wards, according to a Morgan Stanley strategy report from 2001. Just take a look at the Tokyo skyline and you will see the enormous construction projects underway -- the biggest just keeps getting bigger. Some people might find the timing of this expansive construction curious at a time when the economy is ailing, companies are reducing staff, unemployment keeps climbing to record highs, foreign companies are leaving Japan and, last but not least, land prices and rents are falling. What gives? The Land and Transport Ministry's latest land price survey, released last July, revealed that land prices fell by an average of 5 percent from a year earlier, the 11th consecutive year-on-year decline. Since 1990, residential land prices in Tokyo have declined 60 percent and commercial land prices in Tokyo have declined 79 percent, according to media reports. Yet, despite this downward trend, foreign investment funds with multi-billion dollar war chests have flocked to Japan in the last three years in the hopes of making fortunes by buying financially distressed properties at a huge discount. This is how many companies initially built their wealth during the late 1980s and early 1990s in the US, buying from the Resolution Trust Corp., which was set up by the US government to help clean up the banking sector. But will this same strategy work in Japan? While everyone agrees that Japanese real estate is cheap by historical standards, is it really cheap vis-a-vis the fundamentals? Or are prices going to continue to drop? First, ask yourself why Japanese real estate prices went up in the first place: because of loose bank lending and widespread speculative buying. Why did real estate prices go down? Business slowed and people could no longer service the debt. This led to liquidity problems because there were no buyers for these properties at prices high enough to pay back the loans. This set of circumstances created a vicious cycle with enormous shock effects on the Japanese system, since most lending was collateralized by real estate, not by the underlying cash flows of the business. So why do the optimists think Japanese real estate prices are going to appreciate? Some domestic institutional investors think the economy is going to turn around, and they are happy to buy land at current prices because the yields exceed what they could earn by buying Japanese government bonds or by putting their funds in the bank. Foreign funds tend to believe that prices are low by historical standards and Japan is near the bottom of the cycle, or that Japan is going to be forced to inflate its economy by printing massive amounts of yen, which will help real estate appreciate. The people working at these funds will also tell you they like the "positive carry" (the fact that the cost of borrowing here is less than the yield on the investment, which means that by borrowing you can increase your returns while still keeping your cash flow positive). But most foreign investment funds have short investment horizons and need to sell in three to five years. They also need high rates of return to appease their largely foreign sources of capital, which means that "carry" alone is not enough -- they have to sell at a higher price. Foreigners are hoping that Japanese mortgage-backed securities markets develop quickly enough to create the liquidity that will facilitate their exit. It is worth pointing out that while these derivative credit markets do create liquidity, which in turn stimulates investment demand for real-estate-backed investments, they do not affect the real, underlying user-driven demand for real estate. In the bears' camp The pessimists say real estate could fall further. Their core reasons include excess supply, a weak economy with no clear signs of structural recovery and historic levels of unemployment. Consider for a moment what drives user demand, and compare that with the reality in Japan today: jobs (fewer in Japan with each passing day); demographics (Japan's population is expected to decrease from 127 million people in 2000 to 90 million people by 2050 -- that's a decline of nearly 30 percent due to plummeting birthrates and a society which discourages permanent immigration); quality of life (poor air, mediocre water, concrete jungles, long commutes, long work hours fraught with face time, promotion based on age more than merit); supply; and pricing. Even after the massive decline in land prices, the average price for a used 70-square-meter apartment in Tokyo during the first 10 months of 2002 was JPY 35.607 million or approximately $297,000, according to the Real Estate Economic Institute and the Haseko Research Institute. By comparison, American Property Consultants, a company I work for, buys entire apartment complexes in large US cities for investment purposes at an average purchase price per apartment of JPY 4.8 million -- and these apartments are also about 70 square meters. Obviously some US cities are more expensive than others, but in general Tokyo prices are still far from cheap, especially taking into consideration the fact that the US has a stronger economy and significantly better demographics due to immigration and strong birthrates. The government's role The sixth major variable that affects real estate and property valuation is government regulations. These can have a serious impact on the way a city develops. For example, consider two regulations that affect the valuation of land in Tokyo as well as the city's very character: Japan's zoning laws, which closely monitor the amount of sunlight a building gets and how it affects the sunlight of nearby buildings; and Japan's floor-area ratios (FAR), which are calculated by dividing the gross floor area of a building by the area of the lot. By controlling these ratios, the government in effect controls how tall buildings can be. Both of these regulations serve to artificially prop up the price of real estate by limiting land usage. These two regulations, as Alex Kerr points out in his book Dogs and Demons, result in a very cramped and horizontally dense city where people live and work in woefully small quarters. Tokyo has a FAR of less than 2 to 1, which, according to Kerr, is the lowest of any world capital. If you think real estate prices are going to go up, you believe that people are going to be willing to buy the same properties for higher and higher prices. In simple terms, there are two types of buyers -- those who use the real estate and those who buy it as an investment. Now let's look at the variables that drive investment demand. These are: economic fundamentals, inflation expectations (good; Japan is likely to inflate the economy by printing yen, and traditionally real estate does well during inflationary periods), interest rates (good; super low interest rates), ability to borrow (mixed; some progressive Japanese institutions will lend, but most are playing defense on account of their existing problems), positive carry (good; the cost of borrowing in Japan is typically less than the yield), and lastly, relative value (negative).  Who is going to buy land in Japan given this climate? Individual investors are largely irrelevant except in the individual home market in Japan, which suffers from horrible resale values and a declining population base. Domestic institutions are unlikely to pour enough into real estate to make a difference. They might like to because of the positive yield, but most are constrained by perverse notions of risk and a paucity of financial know-how. For example, many institutions in Japan are slow to reduce their equity holdings because that requires officially recognizing huge losses. In addition, most institutions hold huge amounts of Japanese government bonds (JGBs) because they are considered "risk free," despite the petite 1 percent current yield on the 10-year note. Japanese regulators also place strict limits on the type of "risky" (non-JGB) investments that insurance companies, banks, pension funds, et cetera are permitted to hold. Foreigners will continue to buy Japanese real estate but will likely find it difficult to buy in bulk and still meet their return hurdles, since domestic institutions can pay higher prices and still meet their (lower) required rates of return. Barring a spike in inflation, some foreign funds that have recently entered Japan may struggle to meet their business targets. There are, however, a few foreign groups that will continue to thrive because their focus is on creating value through asset repositioning, or re-tenanting, for example, instead of merely hoping to pick the bottom of the market.

Who is going to buy land in Japan given this climate? Individual investors are largely irrelevant except in the individual home market in Japan, which suffers from horrible resale values and a declining population base. Domestic institutions are unlikely to pour enough into real estate to make a difference. They might like to because of the positive yield, but most are constrained by perverse notions of risk and a paucity of financial know-how. For example, many institutions in Japan are slow to reduce their equity holdings because that requires officially recognizing huge losses. In addition, most institutions hold huge amounts of Japanese government bonds (JGBs) because they are considered "risk free," despite the petite 1 percent current yield on the 10-year note. Japanese regulators also place strict limits on the type of "risky" (non-JGB) investments that insurance companies, banks, pension funds, et cetera are permitted to hold. Foreigners will continue to buy Japanese real estate but will likely find it difficult to buy in bulk and still meet their return hurdles, since domestic institutions can pay higher prices and still meet their (lower) required rates of return. Barring a spike in inflation, some foreign funds that have recently entered Japan may struggle to meet their business targets. There are, however, a few foreign groups that will continue to thrive because their focus is on creating value through asset repositioning, or re-tenanting, for example, instead of merely hoping to pick the bottom of the market.Catching falling knives So where does this leave us? The old investment proverb, "beware of catching a falling knife," may well apply. Prices are falling and will likely fall further. Given weak demographics and a poor economic outlook, it is difficult to predict where and when prices will bottom out. The speed of change in Japan, despite some exciting baby steps in the past couple of years, continues at a snail's pace, constrained by obdurate politicians and a populace that remains one of the least financially educated in the world. I could not help but smile when I noticed a picture of Norika Fujiwara's bust on a government poster in the Post Office, encouraging the ignorant to buy more government bonds. When you add in the problems of under-funded pension funds, the size of Japan's central and local government debt, rising health care costs and the gentrification of the population, one scenario cited by some financial analysts is that Japan is, in fact, slowly going bust. Real estate remains an important wealth-building asset. Until the market bottoms out, the smartest land investments will be the ones that seek to profit through specific changes to either the property or the way it is managed. The Japanese should also actively consider assets outside of Japan and begin to think of wealth in global terms. @ |

|

Note: The function "email this page" is currently not supported for this page.