In 1996, in The Future of Capitalism, Lester Thurow observed the following:

"When a run against the dollar starts, there are enormous amounts of money that can, and will, move into appreciating currencies. Sixty percent of official reserves and 50 percent of private reserves are currently held in dollars. Those funds will certainly move, but they will be a small fraction of the total funds avalanching down the slope. Financial speculators will pile on the downward trends in the dollar and the amounts moving will be many times the world’s dollar holdings. Those whose debts are denominated in the appreciating currencies (most likely yen and marks) will find the real value of their debts explode — evaluated in their own currency or dollars. Many will be unable to repay their yen- or mark-denominated loans. Financial institutions in Japan and Germany will take big losses as foreigners default on their loans."

Mr. Thurow’s observation suggests that the yen would appreciate — something it has done and sustained since September ‘08. However, the implications of an even more significant surge in the yen (with a corresponding plunge in the dollar), suggests that it would be detrimental to Japanese financial institutions — and we have witnessed the kind of mayhem that problems at banks can bring to the broader economy, let alone the effects of currency appreciation on exporters.

It seems then, that a lot of the presumed yen appreciation would be short-lived, since damages to the financial sector would likely result in downward pressure on the yen. What is not readily clear today, is how much exposure the financial system, excluding the BoJ/MoF, has to the dollar. In fact, given the significant foreign reserve holdings of the BoJ, it could be the case that a run on the dollar, while certainly resulting in chaos initially, would compel the government to finally look beyond the current account and do much more to encourage domestic-demand.

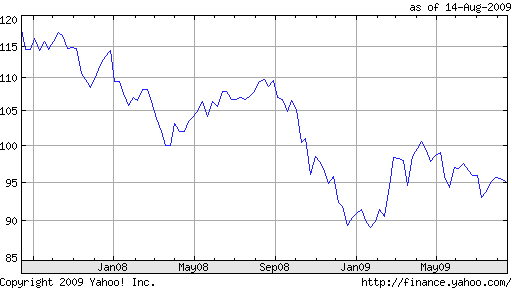

United States Dollar (USD) in Japanese Yen (JPY) over 2 years

United States Dollar (USD) in Japanese Yen (JPY) over 2 years

Other posts by Steven Towns: