Internet Initiative Japan (IIJI) (3774) is a Japanese internet service provider offering a full suite of connectivity and outsourcing services. It is a pioneer among Japanese internet-related companies, having originally listed its shares on the Nasdaq in 1999, before eventually listing in Tokyo (Mothers) in 2005 and later transitioning to Topix 1st Section.

At the end of February, I submitted a letter to the company’s chairman (Mr. Suzuki) and its other directors. While applauding them for their prior decision to repurchase shares, the timing of which coincided with the bottoming of IIJ’s stock, and also for maintaining the dividend, I voiced some concerns and submitted proposals that are either to be actioned or designated for resolution at the Annual Shareholders’ Meeting this June. IIJ’s Investor Relations Officer has been helpful and cordial, and has already forwarded my letter and proposals. Below, I will briefly outline my position.

Unfortunately, despite having listed in the U.S., making it to Topix-1, and having a reasonable level of awareness within commerce and government in Japan, IIJ remains a largely unknown company in the investment community. Since I’ve been a shareholder for a while now I am not pleased about this, but it in fact represents an opportunity.

A cursory review of IIJ’s financials will show that the company met some hard times in 2008 (fiscal year-end March ‘09), as did most companies, but it remained profitable. However, given the weak economy in Japan and lingering deflation, 2009 (FYE 3/2010) is not looking as if it will be significantly better than 2008; that is, as revenues are forecast to be lower, although earnings are expected to rise about 20%, but still be only about a third of what they were between fiscal years 2006-2008. Meantime, IIJ is moving right along with capex, granted some of it is regarded as critical given the upgrade cycle of networking equipment. I have asked IIJ to review its capex/depreciation, while considering the models of Google and Amazon for cloud computing, an area, along with mobile connectivity, that represents great opportunity for the company.

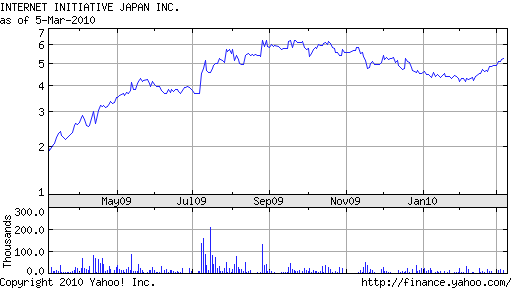

One of my chief concerns relates to the level of capex and correspondingly, the heavy depreciation. Furthermore, the growth in assets, while it had led to top-line growth, it hasn’t brought an increase this year, and has not generated growth on the bottom-line for the past two years. To make matters worse, IIJ is sitting on a sizable pile of cash, nearly ¥8.5 billion ($94M) as of the most recent quarter’s end, compared to total assets of around ¥47 billion, and a market capitalization of around ¥40 billion (keep in mind that its shares are up about 25% in the past month). The company doesn’t have long-term debt, but it does utilize capital leases, which represent a “long-term” liability of ¥3.9 billion. IIJ has no working capital concerns whatsoever, and has access to very cheap bank lending facilities at a cost of capital under 2%.

My specific proposals involve:

I. A stock-split of the ordinary shares of at least 10:1, but preferably 100:1. Correspondingly, in light of the 400:1 ADR-to-Ordinary ratio and IIJ’s subsequent five-dollar per share ADSs, again I suggest a 100:1 ordinary split and a 1:4 ADR split. While stock splits don’t impact the fundamentals, they would most certainly help improve IIJ’s trading liquidity and improve its potential investor base.

II. Switch to a quarterly dividend payout schedule instead of biannually. I suggest this given it is common practice in the U.S. and the appreciation most shareholders will have for a more frequent payout.

III. Announce another stock buyback. I have already summarized IIJ’s cash position above. I regard IIJ as undervalued both based on a valuation of its assets and a return to at least the levels of profitability it achieved in the recent past. Use of cash for share repurchases is ideal considering IIJ’s recent low ROA (and ROE) and its foray into a non-core business (see below).

IV. Allow shareholders to vote on any investment or acquisition in excess of ¥1 billion that does not involve IIJ’s core business related to internet connectivity and services. This proposal is prompted by its new ATM business. It has a majority stake in a business that places ATM’s in pachinko parlors (similar to how ATMs are placed in casinos). While this business may someday become profitable (I have asked for revenues/earnings guidance), it has accumulated losses to-date of over ¥1 billion, and it will need even more capital before all the thousands of ATMs are deployed.

One-year stock chart of IIJI:

Disclosure: The author owns shares of IIJ. Note this article does not constitute investment advice.

More on this topic (What's this?)

Japanese Stocks: Why Small-Caps Will Lead Japan’s Economy Out of the Wilderness (Investment U, 2/11/10)

Japan: Past the Point of No Return By Vitaliy Katsenelson (market folly, 2/25/10)

Read more on Investing in Japan at Wikinvest

Other posts by Steven Towns: