The DPJ’s rise (and the LDP’s fall) is no longer debate material, but a welcome reality. As expected, the yen exhibited strength, and looks poised to test 92 yen. The Nikkei meanwhile was quite volatile, gapping up, hitting a new ytd high at 10,767, tumbling into the start of the afternoon session to a low of 10,423, to close down 0.4 percent at 10,492. The star of the day, if you will, was the Jasdaq, up 1 percent to 50.49, right around its ytd high. Of course, now that the DPJ is in power, the real challenge is to keep campaign promises and stick to them, even if there is near-term pain — rather than postponing the pain as has often been the case.

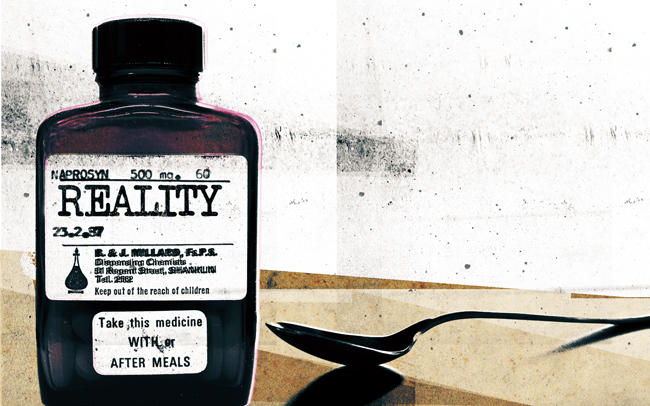

In terms of the markets and forex, the DPJ has almost certainly created a situation for further yen strength (and sustained relative yen strength after everyone piles into the trade and eventually moves on). Domestic-demand stocks, while not immune to certain negative externalities of a strong yen, are likely to be favored over exporters. The exporters, whether they like it or not, will have to get accustomed to a stronger yen. To summarize the first day of trading after Japan’s historic election, it is suffice to say that politics is front and center as it should be, but the market reaction was diluted by both a dose of reality and by the 6.7 percent selloff in Shanghai.

Blog:

Other posts by Steven Towns: