In a week where the deck of cards that make up the Eurozone got its largest jolt so far and where there is now not only an imminent danger of a total economic collapse in Greece but also, much more worryingly, signs that Germany herself are beginning to tire of a common monetary union,I thought it would be nice to take a longer term and structural perspective on the global economy. And what better way to do this than to dig into the world of academia.

As some of you may know I recently earned my degree from the Copenhagen Business School and on that occasion I also produced a thesis which I'd like to share here.

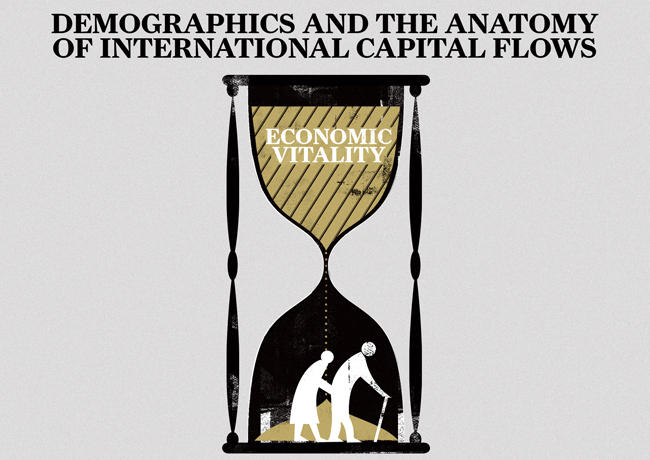

This thesis is built upon two core arguments. The first is the notion that the demographic transition should be narrated through the perspective of aging rather than population growth. The second is that aging on a macroeconomic level represents a strong driver of international capital flows.

These two arguments are used to discuss the standard prediction in a life cycle framework that aging leads to dissaving in the aggregate and thus how old economies should tend towards running current account deficits.

Using Japan and Germany as the subjects of analysis, this thesis develops the idea that rapidly aging societies are not, in the main, characterized by dissaving but rather by the fight against it. Finally, a small empirical exercise throws light on the results to suggest why aging might lead to a reliance on exports and foreign asset income to achieve growth and what this means in a global context.

In many ways, the ideas, thoughts and arguments that have gone into this work are shaped by the discussions and the activity here at this space and my interaction with the people I have come to know through my online presence. In this way, it is only apt that I present it here I think.

I believe that works such as this (and any other academic/economic piece of research) should be judged on two separate accounts.

One is its contribution to the methodology, discourse and lingo of its specific academic field which in my case is international macroeconomics and the second is on its contribution to the market and policy-oriented aspect of its topical sphere which in this case is the international economy and, in particular, global current account imbalances. I believe my thesis has something to offer on both accounts.

On the first, I will immediately disappoint the purists in announcing that my thesis does not develop a new model although I believe there are clear pathways from the arguments for anyone who likes to tinker with neo-classical modelling. Instead, I think there are two important points that I would like to emphasize as future reference and working points for my academic colleagues.

The first is that economists need a much more broad and dynamic theory of demographic changes than is the original idea of a demographic transition.

In my thesis I present this through an attempted coup de grace of the notion that demographic changes should be seen through the perspective of population growth. As an alternative I propose a focus on population aging. In itself this is not controversial and is already an inbuilt narrative in many (if not most) macroeconomic studies that deal with demographic change [1].

However, my aim here is more fundamental. What I consequently want to establish is the simple fact that the demographic transition is not over and not only that, it is non-linear and path dependent. Once we realize this, it opens up a whole new area of research in which macroeconomics is fused with anthropology and life course theory (sociology) in a way which I believe is crucial in order to truly understand what the macroeconomy, as we tend to call it, actually is.

Second, I raise and discuss the issue of dissaving as a function of old age. Specifically, I imply (although I do not show formally) that what may appear obvious on the microeconomic level may not be so obvious on the macroeconomic level.

In other words, there is a an aggregation problem [2] here and it is exactly tied to the fact that while dissaving may seem imminently rational and inevitable in a microeconomic perspective it is not all obvious to me why societies as a whole should want to dissave in the context of persistently low fertility rates and rapid population aging.

Realizing that dissaving will at some point be a binding constraint for e.g. an economy such as a Japan in which aging simply continues relentlessly, I develop the idea that rapidly aging societies are not, in the main, characterized by dissaving but rather by the fight against it which has come to represent the key proposition of my thesis.

I show this in relation to Germany and Japan as the two oldest economies in the world and try to build a frame of reference on which to examine and judge other economies who will inevitably move in the same direction as these two economies.

Finally, and on the second overall account it is with no hesitation whatsoever that I claim how my thesis goes a long way to frame the Gordian knot currently facing the global economy as it exits its worst recession since the great depression.

In short, if aging economies find it difficult to create growth based on domestic demand and momentum and if they are reluctant to rapidly dissave into a very uncertain future where they would rely on foreign credit, the logical consequence is that they must be dependent on exports to grow.

Now, the onset and path of this export dependency may vary from country to country, but in a world where all economies are aging and where, worryingly, a large host of economies are converging to very low levels of fertility, it creates an obvious and practical problem. Who is going to run the deficits to match the desired level of savings of all these aging economies?

Naturally, not everybody can export at the same time but just take a look at the discussions currently characterising the global economy. Everyone who is claiming a recovery is claiming one on the basis of growth in external demand, but this obviously cannot be true.

So, you get the trade wars between China and the U.S., you get internal squabbles in the Eurozone over whether Germany should sacrifice its competitiveness and just how Greece, Spain etc are suppose to pay down their debt while seeing some form of growth at the same time.

All this is about a lot of economies feeling the real and future pressure of deleveraging while only a few brave souls dare to proclaim that they seek growth through domestic sources. Something has to give and one obvious result will be lower trend growth quite simply because there will be lower accumulation of debt either because the capacity to pay off debt has shrunk or because the current level of liabilities disallows any further rapid debt accumulation.

However, another consequence will also be an externality represented by this higher level of desired external savings present in so many economies at the same time and behind it all, as the underlying current, I believe is demographic change and how it affects the working of modern capitalist systems.

So, am I going for an early catch of the nobel here?

Hardly, and thus the thoughts above represent my attempt to take the conclusions of my work as far as possible (and possibly way too far) on an overall conceptual level. Consequently, if you care to leaf through the thing, you will see lots of concrete empirically rooted points and arguments which are more down to earth than the barrage you have just worked your way through above.

In the end and because of my desire to continue my studies on a PhD level, I have (unconsciously I think) written my thesis with an open end and with many strings that can and should be picked up later. This is naturally what I hope to do in the future. For now, I invite you to have a look and by all means do not read it all, but you may just find some it interesting. Comments of all kinds are naturally welcome.

---

[1] - After all, it goes back to the idea of a life cycle and more formally the notion of overlapping generations which are two classic methodological concepts in macroeconomics.

[2] - Aggregation problems are not new of course and have haunted macroeconomic representative agent modelling for a long, long time. However, I think that the specific issue in the context of the life cycle in many ways represent the original sin in the context of aggregation problems (but I may be wrong here).

Other posts by Claus Vistesen: