Exit Strategy

The Value of Responsible Withdrawal from the Market

By Peter Harris

Leaving the market as an issue of Corporate Social Responsibility

In a speech at the American Chamber of Commerce in Japan in August, Brackett Denniston III, General Counsel for GE spoke about how he has tried to bring “society into strategy.” Denniston, a firm believer that companies can provide social values and benefits, as well as employment and income, sees Corporate Social Responsibility (CSR) as a moral obligation as well as having a positive financial outcome for the company. In particular the “reputational capital” gained by behaving in a way that treats human beings and the environment with respect is highly valuable for the company’s brand image.

In part, Denniston’s inspiration comes from a strategy generated by the management consultants, McKinsey & Company. Writing in the Stanford Social Innovation Review this summer, a trio of McKinsey consultants suggest that, “The challenge that business leaders face is to find ways to incorporate an awareness of sociopolitical issues more explicitly into the their strategic decision-making processes.” According to their research, the most worried about social issue for consumers is the environment—thus we see a lot of companies attempting to win consumer approval by emphasizing their green credentials. However, the most worried about issue among executives is off shoring/layoffs. And it’s understandable why. For a company such as GE, which has multiple divisions across the world, leaving the market is a common if regrettable occurrence. Denniston argues that although it is always hard to leave a market, in the long run, it is always fairer to cease operations than it is to keep on going without making a profit, which would ultimately result in much bigger problems. However, he and many other multinationals in similar situations agree that companies have a responsibility to their workers, and also see long-term financial benefits in making sure that laid off employees are well treated. It is GE’s policy to assist employees in finding new placements, offer relocation counseling services, as well as to provide financial assistance for retraining and education.

Although Westerners often claim that Japan is doing well, or is “not far behind” in terms of CSR, when it comes to closing down operations, Japan is in many ways ahead of the game in this regard, even if Japanese companies’ marketing teams haven’t got the message out in ways that Western media would readily understand as CSR. For example, in the US and Europe, insolvent companies (defined as companies whose liabilities exceed assets and income), are encouraged to declare bankruptcy as soon as possible and in fact, it is often illegal not to do so. However, in Japan, companies are allowed to limp along for a while to see if the situation improves, and in certain respects they are structurally encouraged to keep trading. For instance, when it comes to tax, most Japanese corporations will at some point deal with the local office, and then once they get larger, they encounter the national tax office. For those companies dealing with local offices, the charge on unpaid taxes is only 14.6% interest, which is cheaper than a consumer loan. This makes it much easier for insolvent companies to go on trading through hard times and this is considered socially responsible as it buys time for the company and employees to plan for the worst.

Kazuaki Mori, President - Japan Third Party

Kazuaki Mori, President - Japan Third Party

President of the strategy consultancy and outsourcing company Japan Third Party (JTP), Kazuaki Mori, relates the origins of Japanese consumer preference for CSR practices to Japan’s agrarian social origins. “At harvest time the value of every individual harvester became easily visible and the loss of any one team member translated directly to substantial physical losses for everyone. Social values are created from the collective memory and in modern Japan this translates into a high respect for human resources. Seeing trained workers and their skill sets going to waste is something Japanese individuals and corporations are averse to.” Part of the reason for people caring about each other is that one less body means one less person to bring in the harvest.

Beyond the responsibility towards employees, Japanese corporations also have an obligation to their customers. Particularly for companies who sell products that require a high level of maintenance (including the ordering of parts) and technical support, they should ensure that the customer is able to go on using their product after they have left the market. Nobody wants to ring up the helpline number on the back of their computer or toaster only to find that the number has been taken out of service and the company from whom they bought it has disappeared from the face of the earth.

The following two case studies illustrate companies that were forced to close down their operations in Japan. The different ways in which they dealt with leaving the market had significant impact on their brand image, in the minds of the Japanese consumer.

Gateway 2000 Japan

Imagine the bustling scene at the Gateway 2000 Japan computer company’s headquarters in Yokohama in early March 2001. Salesmen on the phone, 24/7 customer support staff taking calls, technicians testing circuitry, accountants doing the books. Just two months later and the scene at the same location is remarkably different—phones ring unanswered, lights are off, and the photocopier is silent. Gateway’s senior management had taken an axe to the Japanese subsidiary and made over 90% of its 700 staff in Yokohama redundant in that short interval.

Gateway started their business in Japan in 1994, selling personal computers. Their timing was impeccable. As the IT boom exploded into the consumer market, Gateway’s sales figures climbed and climbed: in 1996 they released their P5-200 (200mhz) Multimedia computer with a Pentium processor, 2GB hard disk and recordable CD drive at a retail price of JPY643,800 (almost US$6000)—and it sold well. However, when the IT bubble burst in the late 1990s things began to look less rosy. Claiming poor growth in a number of markets worldwide, Gateway pulled the plug on their Japan operations and exited the market in haste. In hindsight it is possible to say that the way Gateway left irrevocably damaged their brand and reputation.

A former senior executive at Gateway, who wished to remain anonymous, told us that when things started going bad, despite a number of offers from potential buyers, the head office were greedy and held out for a high price. Consequently, instead of being able to continue their operations to go on trading under a different name, they were forced to shut down and lose everything. Although, to their credit, they did give very generous severance packages, they didn’t really attempt to find new placements for existing employees and the speed at which they collapsed their enterprise left many bewildered and angry. A trawl through Japanese online media, on sites such as www.itmedia.co.jp, reveals that there were a lot of disgruntled staff. Critically, Gateway told their staff that they would be made redundant on the same day as they announced publicly that they were leaving Japan.

The lack of continued customer care meant that many users were left without any assistance for their technical difficulties and unable to get necessary spare parts

However, one former Gateway employee told us that Gateway’s greatest sin was actually against the consumer; they closed down much of their support services that had been very good up until they left. The lack of continued customer care meant that many users were left without any assistance for their technical difficulties and unable to get necessary spare parts. Gateway did outsource some of their service operations, but the company did a relatively poor job of keeping up standards—their promise of 24-hour telephone support was one of the first to be broken. This alienated consumers who lost trust in the brand, making Gateway’s slogan of “we’re your friend in business” sound hollow.

The same anonymous senior executive told us that in not making good enough provision for existing users, Gateway did untold damage to their brand name which he believes has affected their more recent attempts to re-enter the market.

In illustration of his point, Gateway’s recent return to Japan with eMachines has stumbled to some extent, as a result of their previous betrayal. Not using the Gateway name has helped a great deal but online noticeboards and chat sites reveal a number of negative posts about eMachines’ Japan launch. One user writes, “You don’t treat your customers like that and expect to get away with it.”

Agfa Japan

Agfa-Gavaert have had their fair share of trouble in the global marketplace but their range of activities is diverse enough to have enabled them to keep doing business. A large multinational, they have divisions in photographic film, cameras, printing, imaging, and healthcare. After many years of struggling with competitors in the camera and photographic equipment industry — largely Japanese rivals — in 2001 they launched a major restructuring program across the board in order to focus on the imaging and healthcare businesses. It was at this time that Agfa decided to close down several major film and photo divisions in Japan.

Wanting to limit the fall-out from the closures damaging other divisions that they intended to continue, Agfa executives thought long-term and looked after there brand image and customer continuity by passing the discontinued business on to a trusted third party — in this case, Tokyo based outsourcing company JTP.

In 2004, before AgfaPhoto declared itself insolvent in 2005, top management in Germany started further discussions with JTP on how to go about leaving the market in such a way as to maintain their branding and position in Japan. AgfaPhoto’s demise was due in part to the trend towards disposable cameras, and competition from Japanese competitors, such as Sony. For AgfaPhoto, JTP provided two main services:

1. Employment Transfer

Given the brand specific nature of the work carried out by technical support staff, and the fact that AgfaPhoto closed down globally, it was tough to find new positions for staff within both the company and indeed in the industry. JTP took 16 Agfa staff and retrained them for other operations and advised on employment transfers. A former employee of AgfaPhoto told us they were happy their staff could continue in their jobs and, it also kept continuity for the end users, allowing them to deal with the same people.

While exiting the market is always hard on customers and employees, and it can’t be said that the operation was without its rougher edges, JTP helped limit the damage for the Agfa brand in Japan

2. Outsourcing of support for AgfaPhoto product users:

JTP took over the task of technical support for existing users in Japan and, unlike Gateway, Agfa was able to maintain a quality of service that consumers deserved and had become accustomed to.

While exiting the market is always hard on customers and employees, and it can’t be said that the operation was without its rougher edges, JTP helped limit the damage to the Agfa brand in Japan.

The Sunset Strategy

The difference between Gateway and Agfa is striking. While the former concentrated on their own problems and displayed little care for the consumer, the latter ensured that their customers were able to continue using their products and that their staff were, where possible, retrained or transferred. The critical difference is timing. Gateway vanished almost over night whereas Agfa, with their consumers, employees and brand reputation in mind, started talking with JTP almost a year before they announced closure and then allowed at least six months to wind down operations with the help of JTP’s Sunset Strategy. While Gateway upset employees and customers, and gained a lot of negative media attention along the way, the Agfa brand name remains intact and thus has a positive impact on their healthcare and imaging divisions as well as increasing the potential for market re-entry.

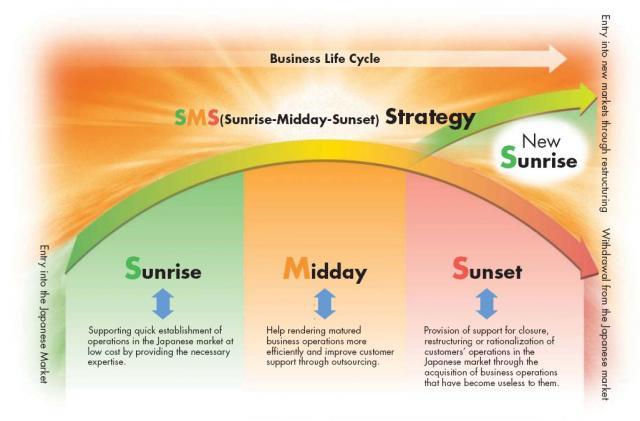

Business Life Cycle

Business Life Cycle

Moreover, Agfa didn’t have to pay JTP one yen. JTP, although they do not in any way pursue an active sales strategy for ‘sunset’ projects, make their profit from customer orders and through the existing customer base. Indeed, JTP’s Sunset Strategy has as one of its objectives, the goal of moving a company from in the red, to the black. By outsourcing to JTP, Agfa were able to slash their costs considerably.

Japan Third Party (see J@pan Inc Issue 70) made their name as experts in finding ways for foreign businesses in Japan to cut costs via outsourcing, and have a particularly strong record in the technology sector where they serve companies such as Sun Microsystems in finding bilingual, bicultural staff with highly specialized skill sets. As well as outsourcing, JTP help mold customer service systems to the Japan market through its strong regional network of help desks and enable clients to expand and consolidate their businesses across Asia.

Their Sunset Strategy is part of a widerthree part strategy for business that consist of a Sunrise, Midday and Sunset phase.

Following their success with Agfa Japan, they were also asked by other major manufacturers, Minolta and Kodak, to help with market exits. With a high degree of expertise in technology, JTP also has many clients from the IT and healthcare industry. With Philips in Japan for example, they have helped them in 4 ways:

1. Takeover of support service from the Philips trading company

2. Medical IT support for MRI scans and X-ray machines

3. Guidance for users of the Automated External Defibrillators (AEDS)

4. Setting up of a multilingual call center for technical support

97% of JTP’s clients are foreign firms and the company realizes the importance of being able to integrate with those customers as seamlessly as possible, especially when they are trying to emulate the same performance standards in supporting a shut-down. As a result, JTP trains over 12,000 staff for other firms seeking to globalize.

The emphasis on language, culture and technology competence makes the company quite unique, and last year’s successful IPO demonstrates the value of this skillset today. JTP is moving from being a niche player to becoming a strategic partner with market leaders from around the world.

On the horizon

Ten years ago, high school IT education consisted of how to use a mouse and perform basic MS Office functions, taught for one hour a week. These days it is not uncommon for 10- year-olds to make PowerPoint presentations about their summer holiday, or for high school kids to write their own websites from scratch.

By developing easy-to-use sites, and building up virtual communities to increase communication and share knowledge, JTP hope to remain at the cutting edge of support services

Being strategy consultants, as you would expect, JTP has a keen eye on the future and sees the consequence of young generations with a well developed set of IT skills as a huge opportunity. They therefore plan to appeal to the most talented by offering tailored training and education and develop what they term a “knowledge–intensive support company that provides up-to-date technical expertise, information and multi-faceted skills.” In essence, they are looking to model themselves to the jobseekers of tomorrow as well as provide recruits with training that allows them to meet the demands of clients.

They are also aware of the trend toward web-based support services—by developing easy-to-use sites, and building up virtual communities to increase communication and share knowledge, JTP hope to remain at the cutting edge of support services. Many of these online systems require little in terms of overheads. This will also help them to maintain their advantage as a cost cutter for clients who ask for their help in leaving the market.

More and more, there is no such thing as a closed door in international commerce. This means that when leaving a market, it is critical to maintain one’s reputation so that should the opportunity arise to return, the target market already has a favorable impression of your brand. In industries where ongoing technical assistance is key to the proper use of the product, JTP offers a solution to keep customers happy and prevent tarnishing of the brand.

Contact details

Shinagawa-Intercity A Building

2-15-1 Kounan, Minato-ku,

Tokyo 108-6012

Tel: 03-5782-7600

Fax: 03-5479-4797

Email: market@jtp.co.jp

Web: www.jtp.co.jp/english