By Cassandra*

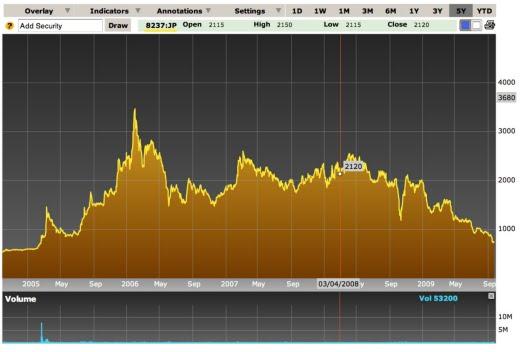

While many stocks have doubled or tripled over the past five or six months, venerable Ginza retailer, Matsuya, has been more than cut in half during the last three. The charts herein minimize the need for words about the pain inflicted upon large and concentrated (not to mention potentially leveraged) shareholders.

"Why has this happened", one might ask, at a time when re-risking, carry-trades, fast-narrowing risks-premia are more than de rigeur? Some might point to a recent poor earnings announcement. But this has been a prevailing fact of Matsuya life for more than two decades for this time-honoured family and passive shareholders. In fact, one might argue that for the controlling family, it is more a way of life than an economic pursuit. No. the more probable answer is classical entropy as described in December 2007 post entitled Matsuya (8237) - Good Luck ! ( You'll Need It....). Therein, I described the folly of SFP Value Realization's accumulation of Matsuya shares (at least from SFP investors point of view) at higher and higher prices, and, suggested that eventually, the supremacy of the Second Law of Murphy will rule, in which not only will anything that might go wrong, will, but these things will inevitably be caused by unforeseen Sh*t Happening. And so it has come to pass.

We will eventually know the precise reasons as returns are revealed, and filings are made public. In the meantime we might, on the basis of historical experience, intelligently speculate as to the cause. Occam would suggest that Mr Baran's SFP Value Realization has been liquidating. Volume averages are somewhat symmetrical to the original accumulations, and the price impacts similarly devastating, even before the earnings disappointment. For outside of index investors, there are no players excepting SFP. Redemption requests, performance-related issues, release of funds from gates, all might have caused vicious unwind into a veritable vacuum.

There is however, a second possibility. This might be termed the "low hanging fruit" thesis. Armed with the knowledge of the paucity of inflows, a venturesome plunger might posit SFP was in little position to buy more to maintain absolute (or even relative) prices from index flows. Although there is no non-callable stock to borrow, one might be able to source sizable chunks of callable stock, to push the proverbial boulder down the hill. Commencing such an operation would likely trigger a red-alert at SFP's Prime Broker, and cause grave damage to prevailing daily P&Ls and thus NAVs,, thus raising the alarm with investors in sufficient time to submit that September 30th redemption notice, an outcome which would force liquidation into the hands of the plunger who (having big balls and a strong constitution) would undoubtedly continue to hit the bids in front of their increasingly desperate sales, a script (from the Concentrated Long's point of view) that would resemble anything Hitchcock might have conjured at the peak of his abilities.

Yes, maybe it was earnings related. But the comparison with other retailers remains stark. Fortunately perhaps, for SFP, few care about about such market games. Matsuya, it appear, will not be be committing Seppuku anytime soon in order to placate the whims of foreign carpetbaggers. For the purposes of this post, I am agnostic. But for investors, who've paid "2 & 20", on the upside, and who will not nor cannot claw it back, the outcome is sobering, for even if they had the good fortune to have money with the plunger, they will be haircut there, too, and still need then to exit their now-oversized short position...

*not her real name. Cassandra is an investment banker who authors the blog Cassandra does Tokyo.

Blog:

Other posts by Japan Inc: