Pricey, and Japanese stocks, are typically not heard together in the same sentence. However, since last September's market rout, earnings have deteriorated to the point that the Nikkei 225 is trading at over 175x forward earnings; 10.1x on a trailing basis. No doubt the ratio will swell some more, potentially going negative for a quarter, before it begins to ease. For some time now, I have believed that Japanese stocks are being priced fairly by the market. Still, it remains true that money managers the world over see deep value in Japan.

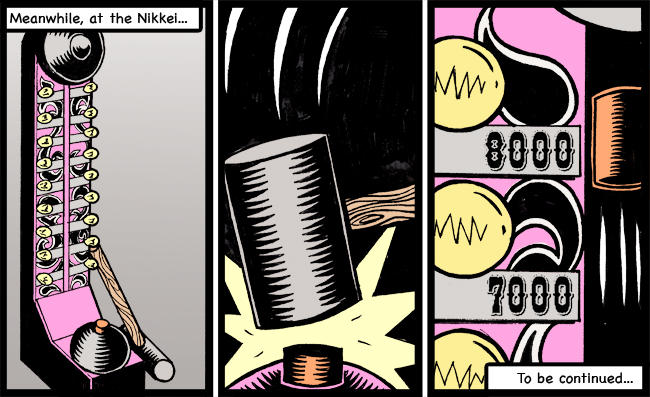

In order to prevent this article from getting long-winded I will summarize my position as follows: (1) Recent trading has been ostensibly positive given the strong rally in percentage terms off the bottom, but the action has been quite thin; which leads me to point (2) in that the 9,000 level has proven pretty elusive due it being right about the middle point of last year's finish and this year's high (remember the N225 flirted with 6,000 a month ago); and (3) buying up headline exporters and bank stocks is the easy and obvious way to play, but lack of participation and depth in this rally will surely create a situation of more range bound trading between 7,000 and 9,000. Therefore, with all eyes on the U.S., and with the country's financial magicians seemingly running out of rabbits, I would exercise caution at current levels. Ignoring media cheerleading, last check the economic negatives far outweighed the positives.

Blog:

Other posts by Steven Towns: