High Returns

How CBRE has thrived on the "white hot" real estate market in Tokyo

By Peter Harris

CBRE’s Man in Japan

It’s no wonder that Ben Duncan is smiling. CB Richard Ellis’ 35 year old Representative Director has the look of a man in the right place at the right time, but this wasn’t always the case. When Ben first came to Asia he was stationed in Hong Kong in 1996, at which his friends quipped that he wouldn’t have much trouble finding a seat on the plane given that most foreign real estate executives were sprinting home before the impending ‘Handover.’ As a relatively new graduate however, Duncan was finding the London rat-race less than stimulating and had his eyes set on more exotic climes. Frankly armed with his certification as a Member of the Royal Institution of Chartered Surveyors, he headed to Asia and quickly rose up the ranks. Hong Kong provided him with the opportunity to cut his teeth on some substantial deals and get experienced with the major players in the Asia’s real estate markets.

Only 17% of Tokyo's real estate falls into the Grade A category (photo by Leonid Safonov)

Only 17% of Tokyo's real estate falls into the Grade A category (photo by Leonid Safonov)

After 8 years Ben was married and looking for a change of scene, and he chose Japan. Not longer after arriving in Tokyo, his first child was born in the Aiku Hospital near Hiro-o. When he does get a break he has some property in Niseko where he likes to ski or is happy visiting the zoo with his daughter. A keen rugby player, Duncan, together with some of his colleagues from the Tokyo office, form a strong contingent of the Yokohama Country & Athletic Club (YCAC) rugby team. As fly-half he has a tough job negotiating the ball between the forwards and backs and one wonders if it was out on the pitch that he gained his first lesson in business.

The “white hot” real estate market in Japan

Essentially, it was Japan’s real estate market that drew him further east. In his own words, the attraction lay in Japan being “the most opportune market in Asia, if not the world.” Crucially, the opportunity lies in grade A property. If you scan the Tokyo skyline from Roppongi Hills it may look like a city to rival Manhattan but in reality only an estimated 17% is in the grade A category compared with at least 60% in Singapore and Hong Kong. Businesses are hungry for high-end office locations and so far demand is way in excess of supply. Combine this with the wide gap between rates on borrowing and rates of return and it easy to see why the market is moving so fast. The Financial Times reported in March that property prices in Tokyo have enjoyed an annual rise of 30-40% and this, together with the necessary know-how and experience has enabled CBRE to boast an annual global revenue of $4.3 billion.

Over the last few years, the real estate market in Japan has taken an interesting course and, as with other industries, doing business in real estate in Japan has its particular quirks and challenges. For a start there is the continuing influence of the five major landlords: Mitsubishi, Mori, Mori Trust, Sumitomo and Mitsui. Between them they account for 60% of the market but Duncan sees that in the future, given the level of growth, they will need to outsource their services arm in order to focus more on their core businesses. The foreign players already here such as AIG, GE and Morgan Stanley may be the first to do so but where they lead, domestic corporations might follow. A caveat would be that there are, unsurprisingly, some structural barriers to overcome first.

The problems for foreign corporations attempting to offer real estate broking, leasing and other services may strike a chord with those in other industries. For one, there is the issue of transparency. During the period of high activity of the Japanese Real Estate Investment Trusts (JREITs) there was not only a growth in investment but also an improvement in practices with a higher demand for reliable data and accountability. In short, it created a “window of clarity.” However, in the last 18 months JREIT activity has dropped off (although technically the number of JREITs has grown, their pricing/capital is not as competitive as it was two years ago). This decline of activity has resulted in a return to more opacity and less scrutiny. Ben Duncan also mentioned that the industry needs more regulation; there is a grey area regarding the role of the trust banks, “should they actually be out there in a brokerage capacity trying to sell assets on behalf of their trustees?” This has often prompted the opinion that the Japan market is a tough environment to work in.

|

Ben Duncan

|

PROFESSIONAL PROFILE SIGNIFICANT ASSIGNMENTS

CREDENTIALS

EDUCATION

|

Indeed, for outside investors, such as large global funds, actually finding assets in Japan can be tough because nothing ever actually seems to be on the market. For primarily cultural reasons, the Japanese don’t like to be seen selling their assets. Being seen selling off an office building in Japan leaves the action open to being interpreted as confirmation that the seller is undergoing financial difficulties- a nightmare in a country where reputation often takes precedence over reality. In business terms, Ben Duncan finds this puzzling, “you’ve got the hottest market since the bubble era and Japanese owners only try and sell to one selected party, it’s crazy.” This is where CBRE come in. By virtue of their on the ground presence and connections, they are able to source off market assets, and when it comes to selling, they are comfortable managing a wide range of competitive tenders - unusual in Japan.

Although “white hot”, it is important not to get overdramatic. Markets can always turn and it is hard to make optimistic predictions beyond 2009. With interest rates creeping up all the time the investment yield in real estate may start to look less attractive when compared with other options such as the bond market. Moreover, some analysts see the current situation as following the contours of a bubble – and what bubbles always bursts. With rents in Marunouchi soaring to JPY100,000 per tsubo (3.3 square meters) a month and the price of Tokyo land reaching approximately JPY7million per tsubo it is easy to see where this view comes from. However, when general economic improvement is factored in and the return is compared with that in other markets, such cautioning remarks look less worrying. Duncan counsels being prudent but is comfortable with making the prediction that for the next 2 years at least, continuous growth can be expected.

Ben Duncan - Photo by Franck Robichon

Ben Duncan - Photo by Franck Robichon

Masters of all that they survey

CBRE has a history stretching back to 1773 when Richard Ellis founded his company in London, but its story over the last 10 years is one of remarkable growth backed up by a number of vertiginous Mergers & Acquisitions. In 1998 the North American company, CB, acquired Richard Ellis and thus CBRE was born. Having set up in Japan in 1986, in 1999 they merged with Ikoma Corporation to become Japan’s largest real estate service provider and most recently acquired Trammell Crow giving it a unique inside arm into the Japanese market. For those familiar with Alex Kerr’s now classic book Lost Japan the name will certainly ring a bell being the organization that gave the author his first business break. Outside of the business, Trammell Crow himself is a prestigious collector of Asian art boasting one of the finest personal collections in the world. For those more familiar with the market however the name will be recognized as that of a global property services heavyweight based out of Dallas. In Japan, Trammell Crow boomed in the late ‘80s bubble and rode out the crash in the late ‘90s emerging in more recent years as a respected veteran of the turbulent market here. Acquiring Trammell Crow has been a super-boost for CBRE taking their global staff to the figure of 21,000 and reconfirming their status as the largest real estate services group in the world. Duncan explains that not only did Trammell Crow possess exceptional revenue generating power and highly envied expertise but also a common culture with CBRE and this has made integration both swift and painless.

Acquiring Trammell Crow has been a super-boost for CBRE taking their global staff to the figure of 21,000

CBRE’s recruitment philosophy is to get a sophisticated blend of bilingual communication skills and real estate know-how. Duncan told me that they have a number of experienced and competent Japanese professionals but have also brought in people from overseas who while lacking in language skills, bring different kinds of management and strategic expertise that it can be hard to find in Japan. Crucially Duncan believes that there are structural and cultural reasons why Japanese brokerages find it difficult to offer satisfactory services to their clients. Consider broking. Japanese brokerages are close to the landlords and thus less likely to do anything that might endanger that relationship. Many Japanese clients end up signing away their rights to negotiation and then have to put on a brave face for unseen cleaning and maintenance costs that they have no control over. Foreigners are less compliant and so CBRE has had to learn how to tailor its strategy to each landlord. And having placed more than US$1.5 billion into Japan on behalf of overseas investors since 2004, it seems fair to say that have learned their lessons well.

With some more regulation and without any major shocks to the market it is such fresh thinking and expertise that Duncan sees as being the way forward. Advice to investors would be to keep an eye on the width of the yield, and strike while the iron is hot.

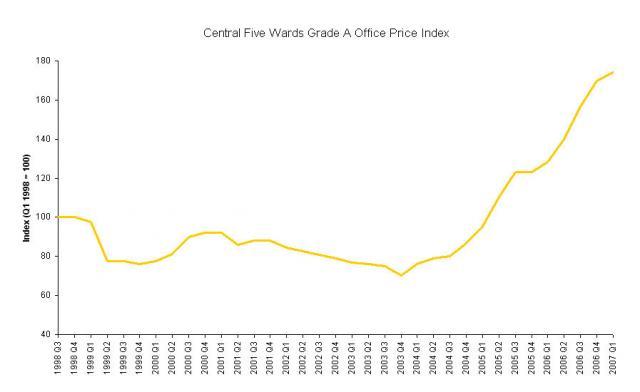

Graph printed courtesy of CBRE

Graph printed courtesy of CBRE

Click on image for enlargement

Comments

Daniel Noonan (not verified)

August 19, 2007 - 15:19

Permalink

I want to work for CBRE

I am an American law school graduate with 3 years of experience working and living in Japan. I am trying to break into the commercial real estate sector and would love to return to Japan to work. Please email me for my resume.

Sincerely,

Daniel Noonan

Burgundy1 (not verified)

September 14, 2007 - 11:34

Permalink

Why don't you just give them

Why don't you just give them a call?