Inside Out: Africa

By Gordon Jones

As China moves into the continent, how is Japan positioned?

“In the future, Africa will become a powerful engine driving the growth of the world.”

Former Prime Minister Yasuo Fukuda

When former Prime Minister Yasuo Fukuda addressed the crowd of dignitaries at this year’s Tokyo International Conference on African Development (TI-CAD-IV), he did so with bold predictions and promises. “In the future, Africa will become a powerful engine driving the growth of the world,” Fukuda said as he stood before the dignitaries of 52 African countries and a multitude of international organizations.

But for all the pomp and publicity of Japan’s commitment to the cause, it remains difficult to grasp the enormity of Africa and its challenges: a vast continent of 54 nations, covering approximately one-fifth of the world’s landmass, with a total population fast approaching one billion people, yet a combined GDP that amounts to just 20 percent of Japan’s.

In preparation for the Yokohama meeting, Japan’s Deputy Minister for Foreign Affairs, Masaharu Kohno, commented on the way Africa is reported in Japan and abroad. He said it is often characterized by three broad perspectives; “pitiful Africa”, “bright and cheerful Africa” and “profitable Africa.” Stereotypes abound, and generalizations cloud perception of what is a remarkably diverse region, but it is clear that Africa is a troubled continent.

Traveling across its land, seeing the extreme poverty, the all too frequent news reports of coups, conflict, famine and disease, it is difficult not to feel a certain despair regarding Africa’s plight and prospects. In the latest UN ‘Human Development Report,’ the bottom 24 ranked nations were all in Africa. Indeed, Africa’s poor growth performance since decolonization has been termed “the worst economic tragedy of the 20th century;” a squandered Eden. Whether the burden of blame is colonial, neo-colonial or local, Africa entered the 21st century with far too little to show for the hundreds of billions of aid dollars poured into the continent during recent decades.

In 2007, China’s trade with Africa stood at $73 billion, second only to the US.

In 2007, China’s trade with Africa stood at $73 billion, second only to the US.

In September 2000, 189 member nations of the United Nations and 23 international organizations embraced the Millennium Development Goals (MDGs), aimed at promoting development and reducing extreme poverty (50 percent in the case of Africa) by 2015. Now at the halfway point, Sub-Saharan Africa is clearly behind target and will need substantial improvements in aid and further investment in order to meet any of the major goals.

Whilst increased Western support remains crucial for Africa’s MDGs, a significant dynamic of the new century is the rapidly growing levels of aid, trade and investment from Asia—most dramatically, through China’s rising presence in there. Between 2000 and 2007, China-Africa total trade rocketed from $11 billion to $73 billion, propelling China into second position, ahead of the EU and likely to overtake the US as it targets $100 billion by 2010. Significant increases in trade and investment are also apparent from India, Malaysia, Singapore and South Korea.

This dramatic rise in the relationship between Africa and Asia signals a new chapter in development cooperation and a greater role for Asian leadership in the global economy. It is also bringing Japan into more direct competition with China outside their traditional Asian orbit.

Both countries have promoted high-profile African initiatives, aimed at building relationships through aid, trade and their respective ‘Asian development models.’ Perhaps most importantly, both are coming to realize the importance of Africa as a region of increasing national interests. For it is Africa’s abundance of oil, minerals, metals and other natural resources, which has been driving its positive annual growth rates and stimulating what has been termed “the new scramble for Africa.”

Ranked first or second globally in terms of its reserves of gold, manganese, platinum, chromium, cobalt and industrial diamonds, Africa accounts for 13 percent of the world’s output of oil (and at least 10 percent of known reserves) and with vast supplies of timber, fish and other primary commodities, Africa’s economic potential is now prominently on the international radar, with China leading the charge to secure long-term supply contracts.

With Africa already providing 30 percent of China’s oil imports (primarily from Angola, Congo, Equatorial Guinea and the controversial relationship with Sudan) the continent is becoming ever more critical to China’s energy strategy for fueling its booming economy.

In contrast, Japan has been more cautious in capitalizing on Africa’s commercial opportunities. Its involvement in Africa is relatively recent, stemming from the late 1980s post-Cold War period, when Japan’s growing sense of global responsibility coincided with the plight of Africa and the apparent ‘aid fatigue’ among international donors. The first Tokyo Conference was held in 1993 and the TICAD process has continued as a “catalyst for development,” together with Japan’s accumulated official development assistance of more than $13 billion to sub-Saharan Africa since 1993.

This year’s TICAD-IV gathering stimulated Japan’s commitment to double its annual aid to Africa to $1.8 billion by 2012. The conference also resulted in Japan promising to “proactively and flexibly” provide up to $4 billion in soft loans, as well as specific additional assistance in the areas of health, education and agriculture. Emphasizing the crucial importance of the private sector, Japan announced the creation of a new ‘Facility for African Investment,’ to provide financial coverage and support for Japanese companies to expand and invest in Africa.

Certainly, more government stimulation is required in order to address the ‘disconnect’ between Japanese aid, trade and investment in Africa. Japan-Africa total trade grew 16 percent in 2007 to $26.3 billion, though still less than 2 percent of Japan’s global trade, with negligible foreign direct investment.

Given the fragmented nature of the continent, its volatility and risk, Japanese companies have either shied away from the region or relied on channeling manufactured imports through local agents, regional hubs in France and Dubai, and primarily concentrating on South Africa. With 5 percent of Africa’s total population but more than 25 percent of its GDP, South Africa has a strong regional influence through its own intra-African trade and investment flows. It accounted for 47 percent of Japan-Africa total trade in 2007, with significant investments including the expansion of Toyota’s hi-tech manufacturing plant near Durban and its growing regional distribution network. Approaches into other African markets have been slow and primarily led by the likes of Mitsubishi, Mitsui and other trading and oil conglomerates, in search of resources.

Despite significant improvements in market accessibility, Africa remains a challenging region in which to start and sustain transparent business. According to the World Bank’s 2008 ‘Doing Business’ survey, 34 of Africa’s 54 countries were in the bottom 50 globally. That said, where there is development, there is business opportunity, with many foreign businesses in Africa thriving.

Japan is a long way from Africa and, despite former Prime Minister Fukuda’s assertion that “Japan wants to walk alongside the African people, shoulder to shoulder,” knowledge remains limited. There also seems to be little public interest in Japan becoming more seriously involved with Africa. Cynics also say that Japan’s support for Africa is motivated by its ongoing efforts to buy African support for a permanent seat on the UN Security Council.

“Japanese still retain the image of a dark continent, backward and unstable, where Japan has few stakes politically or economically,” wrote Professor Dennis Yasumoto back in 1986, and that perception still largely endures. One example of this is the rather scant presence of Japanese residents across Africa—just 6,351 at the end of 2007 (with a large proportion based in South Africa and Egypt). At the other extreme, it is estimated that more than 750,000 Chinese nationals are currently working across Africa: reflecting a much more active, concerted and labor-intensive approach to “resource diplomacy” through high level visits, myriad infrastructure projects and more embassies and companies ‘on the ground’ than any other nation. Of course, the Chinese are also experiencing the challenges of doing business in Africa— learning the hard way through trial and error, but clearly making headway.

The Chinese advance has undoubtedly stimulated Japanese attention toward Africa, and coincides with METI’s 2006 New National Energy Strategy, calling for more active measures to improve Japan’s energy efficiency and supply security. Given its 90 percent dependence on Middle East oil imports, Japan has more reason than most major economies to be concerned with supply risk, especially as China continues to expand into Africa while also seeking to increase its Middle East supplies.

Africa and Asia have a lot to offer each other, and can be a force for substantial progress towards realizing the TICAD goal of “a vibrant Africa—a continent of hope and opportunity”. It is yet to be seen in what direction the relationship will head. For Africa, its resources will either bring cure or curse during the coming decade. JI

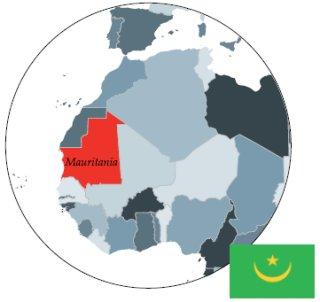

MAURITANIA

The country borders Senegal, Algeria, Mali and Western Sahara.

The country borders Senegal, Algeria, Mali and Western Sahara.

The Islamic Republic of Mauritania is a timely example of the hopes and difficulties of fledgling democracy and sustainable development in Africa.

An important historical center on the ancient caravan trading routes into Africa, this traditionally nomadic land of three million mixed Arab and African inhabitants occupies a largely desert expanse almost three times the size of Japan.

Having gained its independence from France in 1960, Mauritania experienced dictatorial rule for more than two decades, with little socio-economic progress. A bloodless military coup in 2005 led to the country’s first democratic election in March 2007, heralding a new era of stability and development, welcomed and supported by the international community.

Though among the world’s poorest countries, Mauritania offers diversified potential in terms of its natural resources and geographical location. Already an important producer and exporter of iron ore (50 percent of export earnings), Mauritania also has gold, copper and phosphate deposits. Offshore oil production began in 2006, with significant further reserves yet to be explored (estimated at more than 800 million barrels).

Mauritania’s Atlantic coastline is one of the richest fishing grounds in the world, with more than 15 species including tuna, squid and octopus. The European Union pays more than $100 million per annum for fishing rights and Japan is an important export destination. Mauritania is already the source of 40 percent of Japan’s import of tako (octopus).

With its unspoilt beaches, exotic desert landscape and historical attractions, including four ancient cities (designated UNESCO World Heritage Sites), Mauritania offers tourist potential but needs supporting infrastructure to attract more visitors to its hospitality.

The EU pays $100 million per annum to fish off Mauritania.

The EU pays $100 million per annum to fish off Mauritania.

Relations with Japan have been long and strong, with Japan as Mauritania’s top ODA donor in 2006/2007 and providing valuable technical assistance for health, education and industrial development. During TICAD-IV, a well-attended investment seminar focused on further opportunities in Mauritania’s mining, oil and fishing sectors, with interest to expand capacity and local added value, such as fish processing. The announcement of Mauritania’s capital, Nouakchott, as the location for Japan’s next new embassy in Africa, was also a solid indicator of Mauritania’s market potential for Japan.

All seemed well until August 6th, when news came of another coup, by the same figure who led the 2005 coup again protesting poor government and promising new elections in due course. Though apparently bloodless and with some share of popular support, nonetheless hardly the news to instill investor confidence and seemingly another sad example of the inability of democratic institutions to function and flourish in poorest Africa.

Most damaging is the disruption to economic momentum, with the overthrow and detention of the democratically elected President having been internationally condemned and vital aid frozen by the US, France and the World Bank, pending further political clarification.

Currently, a “wait and see” attitude prevails, with Mauritania hopefully able to regain positive momentum and the confidence of foreign donors and investors. Like so many other African countries, Mauritania has the ingredients to lift itself above a stunted past to a more promising future, but requires stability, support and patience.

ILLUSTRATION: Phillip Couzens