Economic Outlook: Rounding the Corner

By Michael Condon

So the banks have been saved, what’s next?

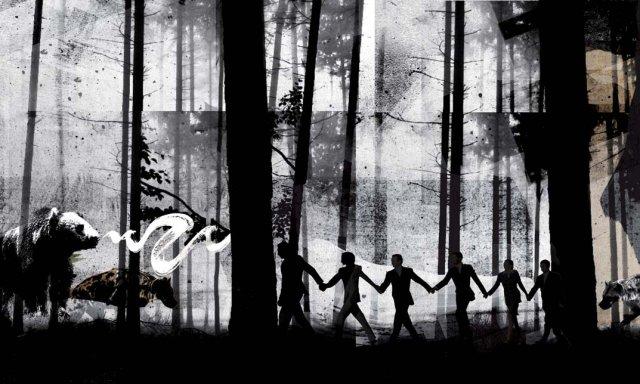

A wave of government bailouts may have saved the world’s banks, but we aren’t out of the woods yet...

A wave of government bailouts may have saved the world’s banks, but we aren’t out of the woods yet...

Illustration by Phillip Couzens.

After weeks of headlines about the “Nightmare on Wall Street,” one thing has become clear—it’s good for headline writers. But for all the news and analysis, the true nature of the financial meltdown and what will follow has remained decidedly murky.

At the time of writing, the collapse of the world’s financial institutions seemed to have been averted. On October 14 the US government announced plans to plow $250 billion of taxpayers’ money into its banks. Two days earlier, leaders in Europe moved swiftly to commit to a similar brand of debt guarantees and recapitalization, following the UK’s announcement a week prior. Germany said it would use 500 billion euros ($680 billion) to set up a stabilization fund while France committed 360 billion euros and the Netherlands, 200 billion euros. On October 13, Britain also announced it would use 37 billion pounds to recapitalize its banks.

But despite an initially favorable reaction, stock markets across the globe still took a nosedive on October 15 and 16 due to concerns the banks had been rescued too late to stop a slump in the global economy. Meanwhile the central banks were still throwing money around. On October 15 the US Federal Reserve, the European Central Bank, and the Swiss National Bank all made available unlimited dollar loans. Here in Japan, the Bank of Japan announced it would offer unlimited dollar funds from October 21.

In Asia, governments were discarding policy put in place after the Asian financial crisis. Australia and New Zealand discarded their anti-deposit insurance stance while Indonesia expanded its deposit insurance program.

Hong Kong now has full deposit insurance. The reactions in the money markets were not fantastic, but were somewhat encouraging. The London Interbank Offered Rate (LIBOR) for three-month dollar loans fell on October 15. The Credit-default swap (CDS) spreads on banks, which indicate their risk of bankruptcy, also dropped.

Despite the gyrations in the world market, the general sentiment was that catastrophe had been averted. So if the banks have been saved, when will credit start flowing again? The world’s authorities are doing their best to encourage the banks to get back out and get lending—but the government money did not come interest free. Germany, for example, is charging a flat rate of two percentage points. Some analysts believe that the government officials may have been worried about too much debt being issued.

“It won’t happen tomorrow or next week, but as things start to stabilize and the usual lending starts going on, we’ll see the US dollar tumble.”

Chris Edwards, from foreign currency services firm Elldridge Lynch

The freeflow of credit will not mean all positive outcomes, either. Chris Edwards, from foreign currency services firm Elldridge Lynch, said a big drop in the US dollar can be expected once credit starts moving: “It won’t happen tomorrow or next week, but as things start to stabilize and the usual lending starts going on, we’ll see the US dollar tumble.”

Edwards says that as credit dried up, those requiring funds within the US bought the dollar overseas and sold their foreign currency, causing big drops in currencies such as the euro, the pound and the Australian and New Zealand dollars. The US dollar in contrast remained high. But he warns this will not last. He says “it could be one month, three months, six months—the timing we won’t know.”

Edwards believes the strength of the yen was a different story. As Japanese investors repatriated, its currency remained strong. “The yen is interesting—I think it will remain strong. It’s a tough one to call though.” And of course, a strong yen means less profit for manufacturers.

Bank of Japan Governor Masaaki Shirakawa warned that the economy would remain stagnant for some time as corporate earnings continued to shrink and companies cut their capital investment. The high cost of raw commodities and energy combined with the global economic slowdown mean that exporters will continue to be hit.

In the second quarter of 2008, Japan’s economy suffered its worst contraction in seven years. If it wasn’t in recession already, it certainly will be shortly. Shirakawa said that business sentiment has become even more cautious, leading to less investment. Private consumption was also dropping, he said.

But Japan still remains in relatively good shape despite the negative sentiment.

The country’s financial system is in a comparatively healthy condition compared to the United States and Europe—Japanese banks such as Nomura and Mitsubishi UFJ Group being prime examples of the relative strength here. Analysts feel that the true nature of the complexity of the world’s financial situation will take sometime to be fully understood. More fluctuations in markets and foreign currencies will be seen before things start to stabilize and when they do, what then? Once credit frees up, will companies be able to use it?

As economies worsen, default rates will continue to rise—corporations unable to pay back debt will fail, adding to the malaise of these economies, and a rush of failures will further damage the badly ailing CDS market. While the world has closely been monitoring the banks, less focus has been placed on the non-bank sources of financing, which are increasingly fragile. The world’s banks may be still standing, but many predict that November will likely have more in store for businesses, as the economy continues to spew out some big surprises.