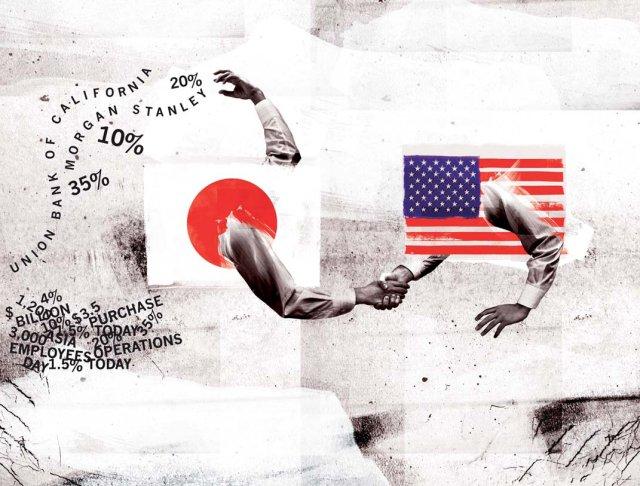

Bank Buyouts: The Circle of Strife

By Hugh Ashton

In the bubble years, Japanese companies roamed the globe, seeking status symbols to adorn their corporate portfolios. Now, is history repeating itself?

Nomura’s purchase of Lehman Brothers assets and MUFG’s preferred asset deal with Morgan Stanley have seen many heralding the return of Japan to Wall Street.

Nomura’s purchase of Lehman Brothers assets and MUFG’s preferred asset deal with Morgan Stanley have seen many heralding the return of Japan to Wall Street.

When Nomura, Japan’s largest brokerage, announced that it would buy out much of the bankrupt Lehman Brothers operations, many heralded the return to Wall Street of Japan Inc. Mitsubishi UFJ Group shortly followed suit, signing a preferred stock deal with Morgan Stanley. The two Japanese giants moved with a swiftness that matched the whiplash speed of the global financial meltdown that had put them in the position to be able to buy into some of the biggest names on Wall Street. Many might argue that events have moved too fast for safety, especially in the case of Nomura and Lehman Brothers.

Large fish, small pond

Buying out parts of Lehman, one of the largest investment banks in the Japanese market, at bargain prices may seem to be a good move for Nomura, but questions are already arising about whether this may cause indigestion.

Though it is the undisputed leader of the market in Japan, Nomura’s prowess off its home turf has been lackluster. This is partly due to its seeming inability to move beyond the tried and tested Japanese sales model of turning up at customers’ doors every morning and requesting the customer buy the special of the week. Nomura has also discovered that being the largest fish in the relatively small pond of Japanese brokerages does not automatically confer status in the deeper waters of the London and New York financial worlds. To customers there, Nomura is just another name, and even with offices in over 30 countries, 90 percent of Nomura’s global revenues are still derived from its Japanese base.

Poor handling of employee relations in the overseas branches and a rash of subsequent defections caused some commentators two years ago to predict the imminent demise of Nomura’s London operations. It seems that the purchasing of Lehman Brothers’ Asia-Pacific and European operations at fire-sale prices has been an attempt to re-establish the Nomura name outside Japan, and to acquire instant technology expertise in various fields, notably electronic trading.

It would seem, though, that not everything will follow Nomura’s expected plans. It has already been reported publicly that 100 of 170 workers from the equities front office, including 20 comprising the former Lehman electronic trading unit alone, one of the key assets for which Nomura apparently purchased the Lehman operations, will jump ship. In private, the story seems even worse. Although senior vice presidents and above have been promised salaries and bonuses for at least two years (remember that the performance-related bonus is a very powerful incentive within the financial services world, and is completely unlike the salary retention system termed “bonus” by Japanese employers), the troops in the trenches have had no such guarantees.

The real value of Nomura’s purchase remains to be seen.

The real value of Nomura’s purchase remains to be seen.

Illustration by Phillip Couzens.

Indeed, the first direct contact of some ex- Lehman employees with their new masters occurred two weeks after the deal was struck, and according to one observer, the results were not impressive. “We had no idea who the guy they sent along actually was, or what powers he had,” complains one such employee. Even among the Japanese Lehman employees, the announcement that Nomura was the purchaser was treated with groans, although the original prospective purchaser, Barclays, was not greeted with much more enthusiasm.

There is a definite clash of cultures between the freewheeling style of Lehmans, where relatively junior managers are expected to make independent decisions on hiring and firing, and the tight micromanagement style associated with Nomura, and what is seen as a parochial attitude (Nomura Securities’ headquarters building in Tokyo has the name in Japanese only on the front, in marked contrast to most other Japanese financial houses). An atmosphere seen as claustrophobic and heavy-handed, together with a different bonus structure, is unlikely to retain Japanese staff who joined a foreign firm at least partly to escape such an environment.

It is also doubtful whether the majority of staff in the three Indian arms of Lehman purchased by Nomura (service operations focusing on IT development) will stay at their posts. Their leaving would mean that Nomura’s IT development resources, other than the limited numbers of Lehman staff remaining, will be little better off than before, and by global standards, Nomura will continue to lag behind its competitors in this area.

When this is added to Nomura’s lack of sales skills outside Japan, and the perceived lack of ability to nurture and retain talent and skills abroad, it is easy to understand the response of one analyst interviewed for this article when asked “What do you expect Nomura to end up with at the end of all this?” His answer: “A lot less money”.

Keeping at arm’s length

In another recent move involving Japanese and American financial companies, Mitsubishi UFJ Financial Group (MUFG) has recently finalized the conditions under which it is to invest $9 billion in Morgan Stanley, in a deal involving convertible preferred stock (stock that has priority when dividends are paid, which may be fixed dividends, and which may be converted at a later date to common stock). This equates to a sizable, but by no means majority, 21 percent stakeholding in the distressed US investment bank.

Originally, the deal was to have been done through a purchase of common stock by MUFG, a move which aroused some considerable surprise, given the recent volatility of Morgan Stanley share prices. The re-negotiated deal provides MUFG with greater security and much less exposure to market risk.

As a long-term plan, there is talk of merging the MUFG securities business (Mitsubishi UFJ Securities, Ltd.) with the Japanese unit of Morgan Stanley. This would probably be a “hands-off” operation, with MUFG allowing Morgan Stanley to run the operation almost unaided by the other entity. Given the high standing of the latter in the market and the undoubted quality of the operational side of the business, it would seem foolish to do anything else, especially given the relatively minor investment by MUFG.

The risk, of course, is that Morgan Stanley is still not perceived by some as being fully out of the woods, despite the injection from MUFG, and despite the very real efforts being made throughout the group for reform together with revitalization in other areas of the world. It has also been said that MUFG acted precipitately in evaluating the worth of Morgan Stanley and may have overpaid for its share of a famous name.

In the long term...

One thing appears certain—the world is far from free of the credit crisis. Nationalization of banking entities may curb future lending excesses, but with nearly $1 trillion of credit card debt in the USA alone in April (which rose by a staggering 8 percent year on year), the financial services sector is sitting on another unexploded bomb which could lead to some more bargain basement sales.

In Japan, which is relatively free of consumer debt on this scale, bank deposit guarantees issued by the Japanese government could charm out of hiding the trillions of yen currently residing in closets in households throughout the nation, thereby giving Japanese banks a globally unique high liquidity. Once the dust has settled on the current market turmoil, which may take a few years, Japanese banks may be in a position to start casting their nets overseas for further acquisitions.

Will we see a return of the glory days of the bubble economy, when Japanese companies went around buying global status symbols such as the Rockefeller Center which later became white elephants? Probably not. “In the future, regulations governing financial institutions in the US and Europe will become stricter and there will be greater governmental oversight, at the same time that Japanese regulations start to ease a little. Though it’s early days to talk about a global banking culture, it’s possible that in two or three years’ time, Japanese and foreign banks will have more in common than they do now, and mergers and acquisitions will be less of the shot in the dark than they are at present,” says the industry watcher quoted earlier.

But for now, it seems that both Nomura and MUFG are in for a rough ride, and it is difficult to see how this can play out easily and happily, for Nomura at least.