Safe from Subprime?

By Brad Frischkorn

With the break of the subprime mortgage crisis in the summer of 2007 and the global scale of its spread, the parade of negative real estate related news has been relentless as financial institutions fall, central banks launch massive credit-easing campaigns, and home foreclosures put many on the street—all with shocking swiftness. After experiencing its own real estate market collapse through the 1990s, Japan is certainly no stranger to this kind of pain. Should the country brace itself for another round of carnage?

“The way real estate is now packaged and repackaged, it is not really real estate like we used to know it,” cautions Kentaro Sato, a securitization analyst with a foreign investment bank. “In many places, it’s just another financial product.” As such, he says, real estate has become just as subject to speculative buying and selling, fear and hubris routinely seen in the stock, commodities, options and futures markets.

The Spread of Securitization

The meteoric growth of so-called asset backed securities (ABS) in recent years has illustrated this trend. ABSs are debt securities based on pools of diversified assets made from a receivable—from credit card payments and auto loans to more exotic cash fl ows. Globally, MBSs (mortgage backed ABSs) have gotten an increasing share of bank and lender attention, particularly as US and European markets have rapidly expanded with rising asset prices.

Gordon Hatton, Executive Officer, Bovis Lend Lease Japan

Gordon Hatton, Executive Officer, Bovis Lend Lease Japan

While Merrill Lynch, Morgan Stanley, Citigroup and others have announced large losses on mortgage and securitized mortgage- based investments in recent months, the subprime meltdown spelled the veritable end for 86-year-old Bear Stearns, one of the largest underwriters and traders of mortgage bonds in the US, and for Countrywide Financial, that nation’s largest home lender and subprime debt collector. On April 1, Swiss-based UBS AG announced forecast losses and write-downs of US$19 billion in the first quarter; its $37.4 billion loss total for the past nine months tops all banks to date.

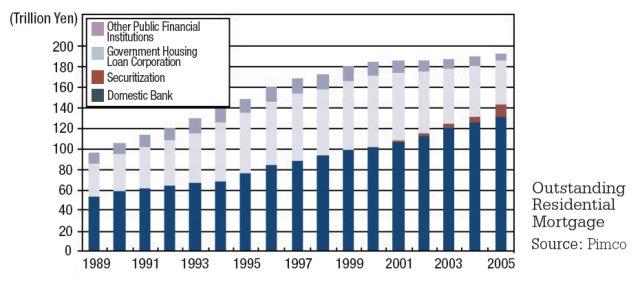

Japan has embraced the MBS trend, especially in residential mortgage backed securities (RMBS), where the Government Housing Loan Corporation (GHLC) is the largest player. From 2000 to 2006, the market grew from virtually nil to some 160 trillion in issuance, with GHLC alone behind around 40% of that total. Many experts point to continued aggressive growth as Japan shifts to a rising interest rate environment.

But even so, the scale of the residential mortgage market against GDP is only about 30% in Japan, less than half that of the US and comparatively low among developed countries. And while the value of real estate in overseas markets has soared over the last decade, Japan’s residential mortgage market has been substantially hit by prolonged economic slowdown and asset deflation, writes Koyo Ozeki, executive VP at PIMCO in his March 2007 report Japan Credit Perspectives.

As in the US, residential mortgage remains a burden for Japan’s household budgets, where the mortgage-to-disposable income ratio is currently around 132%. But with the virtual disappearance of the high-risk market in the 1990s, Japan really has no equivalent to the US high-risk subprime market, Ozeki says. Outside the US, Canada, Australia, and the Netherlands, MBS instruments are actually not very widespread.

Takeo Maezawa, Executive Managing Director and Head Consultant, Ikoma Data Service System

Takeo Maezawa, Executive Managing Director and Head Consultant, Ikoma Data Service System

Different financial animals

Japan’s real estate market is a study of contrasts in many respects, especially when viewed from the perspectives of large urban versus regional areas, and for residential versus industrial and commercial space. Industry location, demographics, logistics, foreign investment and other factors all come to bear in the comparison. But the most intense interest in Japanese real estate has traditionally been centered on Tokyo, where some bellwether transactions have recently been reported.

Last summer, Goldman Sachs Group acquired the property and the building of US jewelry retailer Tiffany & Co’s main Japanese outlet in glitzy Ginza. The 37 billion price tag made it the nation’s most expensive piece of real estate; Goldman’s bid was also substantially higher than the 16.5 billion Tiffany’s paid for the facilities in 2003. Separately last February, Morgan Stanley agreed to sell The Westin Tokyo, an upscale foreign hotel in Meguro, for 77 billion to the Government of Singapore Investment Corp (GIC).

The two deals, done during the heat of the ongoing subprime meltdown, may illustrate several impressions about Tokyo land: 1) some areas, while expensive, may still be seen as value investments, and 2) the subprime problem is not seen as having major fallout. Goldman’s purchase was actually its second in Ginza last year, while GIC, with more than $200 billion in assets under management, is one of the biggest sovereign wealth funds in the world, and known for identifying stable investments.

“The attractiveness of the Tokyo market is the thinking that prices have to bottom out some time,” says Gordon Hatton, Executive Offi cer at Bovis Lend Lease Japan.

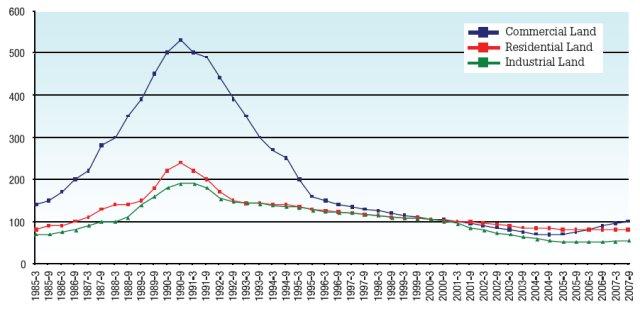

Japan Real Estate Institute (JREI) statistics indeed show that while average prices for commercial, residential, and industrial use land nationwide have fallen consistently by mid-single digit rates annually from 1991 through 2007, the same fi gures for Japan’s six largest cities (Tokyo, Yokohama, Nagoya, Kyoto, Osaka and Kobe) show a defi nitive turnaround from 2006. The most dramatic reversal has been seen in commercial land prices, which have been appreciating sharply for the last two full years.

REITs pushing prices up

The rise of prime urban real estate prices— especially, but not exclusively in Tokyo—has been linked by some analysts specifically to the recent and rapid proliferation of REITs, which have transformed the commercial land market (especially in central wards such as Chuo and Chiyoda) in some ways akin to how RMBSs have transformed home mortgages. They have also been credited with helping push disclosure in an otherwise traditionally opaque market. Residential land prices in Tokyo’s 23 wards have also generally benefited.

After originally targeting higher-end office buildings and other select Tokyo-based properties, REITs have since diversified both by asset type and by geography as available supply has run thin, and spread far beyond the Kanto area in search of investment-worthy assets. A two-tiered market has nevertheless been created in which prices are rising in a few select areas but still falling in others, although the rate of the widening may be decreasing.

Outstanding Residential Mortgage -- Source: Pimco

Outstanding Residential Mortgage -- Source: Pimco

Subprime symptoms

More signs of the subprime contagion include the obvious: subprime loan-related losses incurred by Japanese financial institutions already totaled 600 billion as of end- 2007, a figure that may rise as the value of securitized assets held remains depressed. Abroad, outstanding loans by Japanese banks topped 32 trillion overall through end-February, the most in eight years. Writedowns by foreign banks are also forcing a scramble to shore up their capital bases and brake on lending, resulting in a global credit shortfall. Here in Japan, spreads are widening even for high credit corporate names.

“Borrowing rates are higher. The number of people looking at properties has dropped off—temporarily perhaps. The number of building permits has slowed,” reports Bovis’ Mr Hatton. “Sub-prime is a global economic issue, not just a real estate issue.”

Takeo Maezawa, Executive Managing Director and Head Consultant at Ikoma Data Service System, also notes that the FSA has taken a more watchful eye on bank lending from 2007 into this year. “Overseas investors have a harder time obtaining capital now and can’t issue debt for leveraged real estate investments, which makes leveraged property investments diffi cult since prices usually come at a multiple of both cash and debt.”

For the widely watched REIT sector, where assets now span a range of premium to lower grade assets, tighter credit, together with higher prices and lack of supply, made 2007 the worst in fi ve years for new REIT acquisitions. IPOs are well off their peak pace, with only two new units listing last year after a stellar run that saw 25 of the 41 publicly tradable REITs come to market in 2005-6. From late May 2007 to mid-March 2008 the TSE’s REIT Index also fell over 50%.

Real Estate Values: Japan Six Large City Areas, Mar 1985 - Sep 2007 (End of Mar. 200 = 100) -- Source: Japan Real Estate Institute

Real Estate Values: Japan Six Large City Areas, Mar 1985 - Sep 2007 (End of Mar. 200 = 100) -- Source: Japan Real Estate Institute

Some lenders are going even further—by simply refusing to provide loans to lower-tier REITs and would-be borrowers. “Without the extension of credit, foreign firms in particular may be forced into selling assets in order to cover shortfalls or losses elsewhere,” said one real estate analyst.

With vacancy rates edging up in some key areas, rents may erode, and if that happens there is a risk that properties will not generate anticipated returns, causing them to miss expected yields, and therefore fall in price, says Mr Maezawa.

Few expect to see such a large impact from such a scenario, however. Many experts think that with its growing population demographics, a restructured economy, and plenty of investors (including foreigners) waiting to buy property on the dip, any meaningful downturn in premium Tokyo real estate may be short-lived, even if the subprime problem doesn’t immediately go away. However the same is less likely to be true elsewhere in Japan.

“Japan’s regulatory authorities have actually been very wary of risks to the real estate sector since 2006-2007, and engineered a tightening of credit well before the current subprime problem cropped up,” says Jesper Koll, President and CEO of Tantallon Research Japan. “Higher interest rates were accompanied by stricter oversight to lenders. In doing so, they provided a tremendous amount of guidance on the clampdown… this is a cyclical phenomenon that will eventually play itself out.”