The Eyes of the Consumer

The Eyes of the Beholder

![]() Understanding the Japanese consumer in the digital age

Understanding the Japanese consumer in the digital age

By Andrew Till

Images Courtesy of Japan Market Intelligence

Images Courtesy of Japan Market Intelligence

Japan, and its population of demanding consumers, has always been a famously tough market to crack. Several of the world’s favorite brands, including Colgate Toothpaste and eBay, are simply not present here, and those that are often struggle in a war of attrition against strong, home-grown competitors.

In recent years, the Japanese marketing environment has evolved into yet new levels of complexity. The traditional model of the consumer watching a TV commercial at home and then strolling down to the local store to find the product, has become obsolete.

Direct marketing has become digital. Buses have become mobile billboards. Chatrooms, the juries on what’s cool and what’s not. These new “touch points” between consumers and brands have led to a situation where the Japanese consumer is now king (or emperor?), having more choice than ever before and more information in order to make these choices.

Yet this situation is also one of information overload. What proportion of the products and marketing messages bombarding consumers even get noticed? Of those that do, how many are able to make a sufficient connection with target consumers that they might re-emerge from the recesses of the subconscious at a later date …and actually trigger a purchase?

Luckily for marketers, the digital age is also providing new ways to study consumer behavior and these tools are finding a receptive audience in Japan.

Unseen is unsold!

It’s commonly said that over 70% of products on supermarket shelves are never even seen by the average shopper. In the chaotic splendor of Japan’s drugstores, this figure is likely to be even higher. So having spent small fortunes developing and bringing their products to market, how can marketers be sure that consumers are noticing their brands?

The solution is to conduct market research using a technique called “eye tracking”.

Shoppers are asked to wear a pair of eyeglasses that measures and records their eye movements as they go about their shopping. The data collected is aggregated and processed to provide visual representations of what the shopping population as a whole is actually seeing.

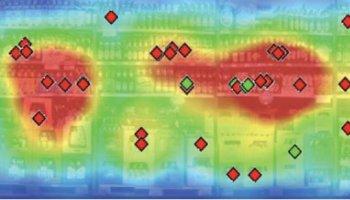

Highly visible brands, those that jump out of the shelf, appear as hot zones on heat maps, while those that are effectively frozen out of the market appear in blue zones. Statistics show the power of products to grab and then hold the attention of shoppers. The technique is now being used successfully to improve packaging design, in-store merchandising, and to optimize how products are displayed—often with dramatic results.

A heat map of brand recognition

A heat map of brand recognition

One global packaged goods manufacturer was shocked to discover that 40% of category purchasers in Japan didn’t even look at their market-leading brand at all when displayed in its favored location at point-of-purchase, while for a leading DVD retailer changes to layout and signage resulted in an immediate 16% increase in sales.

Many manufacturers prefer to research product visibility in real stores, however alternate technologies can provide similar outputs based on projected images and 3D virtual reality representations of stores. It’s even possible now to conduct such studies via the Internet while the target shoppers remain in the comfort of their home, using attention tracking software accessed via their PCs.

Unconscious urges

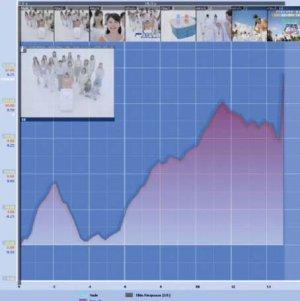

The world of experimental psychology and neuroscience that has provided marketers with this eye tracking technology is now also a source for other advanced tools that are used to gauge the effectiveness of advertising, especially costly TV commercials. For example, skin response measurements, which function in much the same way as lie-detectors, are being used to supplement the data traditionally obtained via consumer interviews.

Subconscious reactions to brands can be measured

Subconscious reactions to brands can be measured

At the recent the 2008 Conference on Neuroecomics held in Denmark, results were presented comparing the power of German and Japanese commercials to make subconscious connections to their target audiences.

The measurements show a very strong correlation to actual performance of the brands in markets. This shouldn’t be surprising since those commercials which can make strong connections at a subconscious level are more likely to activate buying behavior when consumers come into contact with the brand at a much later date. Often the factors creating the emotive arousal in the commercial are very basic such as the timing of music or narration—aspects that the consumers themselves are unlikely to be consciously aware of when interviewed the traditional way.

24/7 consumer research

Another high-tech, but much more familiar device that is being used increasingly to track and understand Japanese consumers is the mobile phone. While the amount of data that can be input via mobile phones is limited, it does provide the great advantage of being with the consumer at all times.

This makes the mobile phone the ideal tool for 360 degree tracking of all the touch points between brands and consumers covering traditional media, new media and even consumer-generated media. Consumers are recruited off an Internet panel and asked to become researchers themselves for 1-2 weeks. During this period, each time they come across a brand that they have been asked to track—on TV, in a store, on a train, on a T-shirt, in a conversation with a friend, even seeing a piece of garbage— they log the touch point, their feelings and any images/movies or comments using their mobile phone. This data is then sent to an online diary for that individual.

The aggregated results, typically taken from 500 participating consumers, represent a snapshot of consumers’ real experiences with brands, delivered in real-time. In categories where word-of-mouth is a key driver of consumer behavior e.g. Cosmetics, cell phone carriers and entertainment, companies are able to compare their marketing campaigns directly with the consumer generated discussion that increasingly determines whether a brand, product or movie is accepted or not.

Back to the future

So as markets in Japan become ever more complex and competition heats up, help is at hand for marketers. Powerful new tools that leverage technology are helping companies get to the heart of the Japanese consumer and in the process are helping them to craft the messages that will deliver success in market. And when it comes to the new digital world of consumer understanding, this is just the beginning! JI

Andrew Till

CEO: Japan Market Intelligence (JMI)