Back and Forward

Back and Forward is a regular column that takes a slightly irreverent look at some of Japan’s biggest business stories.

Higher costs, falling profit...

Higher costs, falling profit...

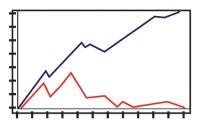

In the January-March quarter, pretax profit at Japanese firms fell 17.5% year-on-year, as sales slid 1.5% during the same time. It was the third straight quarter that profit fell at firms in Japan, and the January-March drop was the biggest seen since the fourth quarter of 2001. Increased raw material costs also contributed to a 4.9% decline in capital spending. Looking back, it seems more and more difficult to speak of an economic recovery having fully fueled Japan out of its doldrums. Looking forward, expectations are high that Japanese firms will seek improved efficiency-possibly through consolidation, cheaper access to raw materials, and greater direct access to overseas markets.

...and hotels look at consolidation, overseas operations...

...and hotels look at consolidation, overseas operations...

Faced with increased competition from foreign luxury hotel operators, Hotel Okura and Royal Hotel have announced plans to set up a joint venture. Such an alliance would allow the firms to merge their booking, customer management and sales systems. Combined food purchases and employee sharing have also been discussed as part of the plan, though no mention of improved buffet facilities has yet been seen in print. Will more consolidation in the hospitality industry follow? It seems likely, especially given the overseas ambitions of many operators-Okura alone plans to open about 25 hotels overseas in the next decade.

...while Seven-Eleven rolls the dice in China...

...while Seven-Eleven rolls the dice in China...

Another firm with its eyes set on the Chinese market is Seven-Eleven Japan. Seven & I Holdings has set up a subsidiary in Beijing called, you guessed it, Seven-Eleven China. In China, the number seven is sometimes considered lucky, as it stands for 'togetherness' and sounds like 'family.' However, it is an unlucky number in northern China, and the seventh month of the Chinese calendar is known as the 'Ghost Month.' Although possibility of a tie-up with Hotel Okura and Seven-Eleven has not been mentioned, it could lead to some interesting number combinations, with the 096 of Okura and the 7-11 of Seven-Eleven in play?

...and Steel Partners swings its hair

...and Steel Partners swings its hair

Steel Partners, which has made high-profile unsuccessful bids to acquire Sapporo and Bull-Dog, managed to convince shareholders to oust the top management team at Aderans. As the largest single shareholder of the wig-maker, Steel had previously demanded the resignation of Aderans’ president. The firm refused, and management’s heads rolled at the annual shareholder meeting. With just over half of Aderans’ shares owned by foreign investors, and local shareholders growing fed up with management’s performance, the vote’s result was not surprising, and could strike fear into boardrooms well beyond the wig-making industry.

Overtime pay? Is nothing sacred anymore?

Overtime pay? Is nothing sacred anymore?

Further pressure on Japanese firms could come in the form of increased wages. Although wages have been increasing slightly over the past few months, as more workers switch to full-time positions, the decision by McDonald’s to pay overtime to store managers might motivate others such shops to follow suit. Seven-Eleven, Yofuku Aoyama and Aoki have already announced that they will begin paying overtime to shop managers. In the case of Yofuku Aoyama, the increased payroll bill is expected to total just over ¥500 million per year.

Whale meat imports; where’s the butter?

Whale meat imports; where’s the butter?

For the first time since 1990, Japan has imported whale meat. 80 tons of fin whale caught in 2006 by Iceland arrived in Japan in May, and five tons of minke whale caught by Norway have been shipped to Japan so far this year. With the US State Department urging Iceland and Norway to stop the export, the importation of the meat raises several questions: Have western protests over Japanese whaling led to increased domestic demand? Is the government importing meat to pass off to hospitals and schools? Have the decreased sizes of Japan’s ‘research’ catches in recent years led to shortages of whale meat on supermarket shelves? Do Norway and Iceland have any butter to send over?

Ken Worsley runs JapanEconomyNews.com. He can be contacted at ken@japaneconomynews.com