The Deal -- The Big, Green Giant

By Shaun Davies

By Shaun Davies

Sanyo’s eco-friendly technology proved too good for Panasonic to look past.

The biggest deal in town in November was without doubt Panasonic’s proposed tie-up with smaller rival Sanyo.

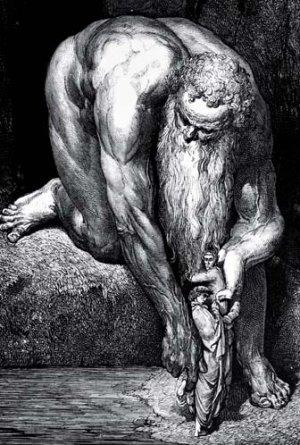

The two companies, which have combined sales of 11 trillion yen, agreed to start alliance talks at the beginning of November. Their combined size would be monstrous—Panasonic would overtake Hitachi to become Japan’s biggest electronics manufacturer, and the second-biggest in the world, after General Electric.

But why is Panasonic so keen to merge with a smaller rival that has struggled in recent times, despite some innovative ideas? Sanyo’s stake in green technology is a big motivating factor. Sanyo, which, if the deal goes through, will become a subsidiary of Panasonic, is the world leader in lithium-ion batteries such as those used in cell phones, portable computers and environmentally friendly hybrid cars. Sanyo and Panasonic, between them, control over 50 percent of the lithium-ion battery market, and the tie-up would give Panasonic dominance in a sector where rapid growth is likely if production of hybrid cars ramps up and the market for cell phones and laptops stays strong. Environmentally friendly solar batteries and panels are another reason for Panasonic’s interest—Sanyo has a small but significant stake in this sector (around 4 percent), while Panasonic has zilch.

Panasonic’s planned merger with Sanyo would see it become the biggest electronics manufacturer in Japan.

Panasonic’s planned merger with Sanyo would see it become the biggest electronics manufacturer in Japan.

Rumors flew thick and fast before the announcement that rival firms, including Chinese and Korean electronics manufacturers, were preparing bids for Sanyo. Once again, it was Sanyo’s lithium-ion and solar battery arms that piqued their interest. A Panasonic source, who was quoted in the UK Times newspaper, said: “We want it [Sanyo’s battery technology] so badly we can taste it...It would be a tremendous blow to us if another firm took it.” Analysts have generally been positive about the deal, which sees Panasonic using its substantial war chest to aggressively grow its business, the professed strategy of the company’s president, Fumio Ohtsubo.

In a report issued on November 10, Nikko Citi analysts said synergies between the two companies in areas such as flat-screen TVs, audio equipment and air conditioners would create significant savings for the companies. “We expect rationalization to contribute to profits more than the simple combination of both firms’ totals,” the report said. The Nikkei, meanwhile, said in an editorial that the deal was likely to spark further consolidation in the industry. “The implications for the industry are far larger than a simple reshuffle of the rankings,” the editorial said.

“The first merger between two major Japanese consumer electronics makers is bound to create huge additional momentum for the consolidation of the overcrowded Japanese electronics industry, especially in areas like semiconductors.”

The economic downturn has soured the environment for Japanese electronics manufacturers. The yen’s rapid appreciation, coupled with declining demand across the world, will make life for these companies particularly tough over the coming months. Indeed, Panasonic announced on November 13 that it would scale back LCD panel production by about 10 percent from previous plans during mid-December and late-January. Six out of eight of Japan’s leading electronics manufacturers, including Sony, Toshiba and Sharp, have faced deteriorating profits since the credit crunch began to bite.

And speaking of the credit crunch, investment banks have a role to play in this saga too. It’s almost three years since Goldman Sachs, along with Japanese giants Sumitomo Mitsui and Daiwa Securities, ploughed 300 billion yen into Sanyo in an attempt to turn it around. These banks forced the company to move away from a mishandled strategy of diversification and focus on its strongest areas—in particular, lithium-ion and solar batteries.

The Nikkei noted that the financial crisis that’s laid waste to the world’s markets has forced these banks to sell their shares, in order to raise much-needed capital. Sanyo issues two types of shares—ordinary shares and preferred shares. These three banks hold all of the preferred shares, and between them they have 70 percent of voting rights in Sanyo. It’s not clear yet whether Panasonic wants to buy Sanyo outright, or will be content with purchasing a majority shareholding and turning Sanyo into a listed subsidiary. But whatever its decision, there’s bound to be tension with Panasonic, which will want to secure the lowest possible price for Sanyo, and the banks, which will naturally aim to get the best price possible.