OVERVIEW

The consumer finance sector typifies nonbanks, which have significantly outperformed other financial peers over the past decade. FY3/01 RP from the five listed major players accounts for 2.99% of overall TOPIX RP, and RP growth over the past five years of 16.95% substantially eclipsed TOPIX RP growth of 9.78%. Recently, renewed concerns over market saturation, rising bad debt levels, and the competitive threat from banks has led to share price declines as investors moved to take profits. We feel that the operating environment is almost certain to deteriorate as funding rates cannot fall further, bad debt levels continue to rise, and market saturation must eventually occur. However, we also believe that market demand is unlikely to decline, and that those better managed players that embrace diversification can continue to grow and compete with banks and other new

entrants.

MARKET SIZE AND THE THREAT OF SATURATION

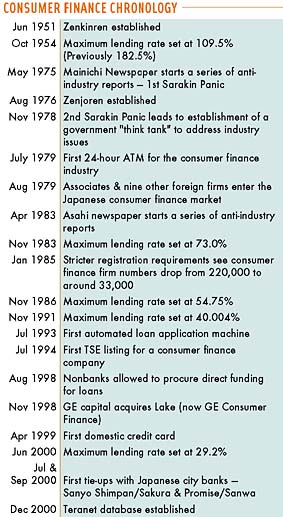

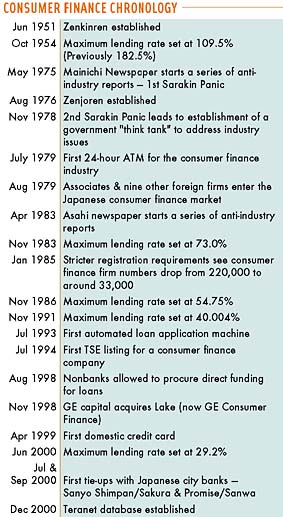

Japan's consumer finance market is currently around JPY11 trillion, out of a personal credit market of around JPY74 trillion, with around 14.5 million users. While similar to peers in the US, such as Household International, the Japanese consumer finance market developed rapidly after a period of public and media bashing known as the "Sarakin Panic" around 20 years ago for a number of reasons1. Firstly, the industry commoditized unsecured card lending by creating a sophisticated, jointly owned credit database known as the Zenjoren2 and developing automated card and cash dispensers with a turnaround credit appraisal time of around 30 minutes. Secondly, the competitive environment has favored these mavericks, with domestic banks unwilling to lend without collateral or in the credit "Grey Zone"3 between 20-29.2%. Also, credit card companies have actively discouraged revolving credit, and until Acom introduced its own Mastercard, none had minimum monthly payment systems. On the question of market saturation -- although most players are growing well now, we believe that industry growth is likely to slow in the 20%-plus lending bracket, leading to an adjustment period. However, the middle market, i.e. the 10-20% lending rate range, offers a new frontier. Further, although much speculation on market saturation revolves around picking specific loan balance numbers, we feel it is more dynamic. Therefore, while Japan's lackluster economy may hasten saturation in a particular segment, improvement in the economy is likely to allow certain players to be able to resume solid growth.

COMPETITIVE ENVIRONMENT & FUTURE EARNINGS GROWTH

Consumer finance players have been more efficient in producing a commodity that appeals to borrowers, and have arguably acted by default as the providers of revolving credit. However, will the banks now enter their turf? And do rising bad debt levels suggest erosion of the traditional business model? We believe that under-capitalized Japanese banks are unlikely to compete in the 20%-plus lending market. Further, the proliferation of alliances between banks and consumer finance companies to offer mid-tier lending4 is a sign that banks lack necessary credit evaluation and collection skills. The natural result of this will be a sharing of bank customers with consumer credit card companies rather than vice versa. Furthermore, once these alliances are in place, we feel it is unlikely that banks will be able to dissolve them or set up competing vehicles easily. The rise of bad debt levels, we feel, is largely a result of three factors. Firstly, legislative changes have made it easier for individuals to seek personal bankruptcy. Secondly, the lowering of the maximum lending rate to 29.2% in June 2000 forced out smaller players who lent at higher rates, resulting in a build-up of heavy credit users in larger players. Thirdly, the domestic economy is poor. People eventually cannot afford for employment and future credit usage to be constantly bankrupt. Continuous credit assessment is likely to cap the impact of lower credit quality. Finally, new niches bringing new customers will also tend to help correct this trend. The model for Japanese consumer finance firms will undoubtedly have to embrace diversification (as it has in the US); however, we feel that the subprime model as such remains largely intact.

2002 SHARE PRICE TRENDS

From the above, we conclude that the industry is becoming mature, and that correction periods, with earnings volatility, are likely to occur as they do in any industry. However, fundamental demand is unlikely to decline significantly, and new growth niches will arise. Consolidation and a shift to a credit card platform (as noted above) are all likely to follow US trends. However, with international players such as GMAC RFC still eyeing the market, we believe that finding growth players (especially those that can maintain high growth in new customers) will bring long-term rewards for investors. We still believe that strong players will be able to match earnings growth in their banking, broking, and non-life insurance peers. In terms of short-term price trends, we feel that market concerns are likely to weigh on share prices in the sector for the next 12 months as investors adjust to the fact that traditional consumer finance is maturing, but that stronger players will evolve and adapt. Given the strong share price performance during most of this year, the re-appearance of concerns surrounding the sector has provided a good opportunity for investors to take profits. This will tend to cap significant gains in the short term. However, as a counterpoint to the above, we would be wary of a further, significant worsening in the US economy in 1Q CY02, which is likely to cause a flight back to domestic issues sometime after 2Q CY02. ii

Edward Gordon is an analyst at WestLB Panmure, Tokyo.

1 "Sarakin" is short for salaryman kinyu (literally, finance for employed workers). The Sarakin Panic was a period of media bashing as a result of high lending rates and aggressive collection practices, after which larger players that embraced codes of practice thrived.

2 The "Zenjoren" is a highly sophisticated shared credit database, run primarily by the consumer finance companies. It is updated daily and carries "white data" on non-defaulting customers and "black data" on defaulting customers.

3 Japan has two laws governing maximum lending rates. The Risokuseigenho sets maximum rates at 20% under JPY100,000, 18% under JPY1 million and 15% thereafter. The Shusshiho sets it at 29.2% under certain conditions. The gap between these is known as the "Grey Zone." MOF guidance keeps banks out of the Grey Zone.

4 There are already 48, and we expect that most banks will have at least one within 2 years.

|