The Pulse

Back to Contents of Issue: July 2003

|

|

|

|

|

|

Robots that can follow the bouncing ball

ROBOTS ARE INEXPENSIVE AND efficient when working in a very controlled environment. They can work on a factory assembly line and grasp an object within a three-dimensional box-like workspace. Tell a robot to pick up the silicon chip located at x=52, y=200, z=29 and it will do so. However, as soon as one small variable is changed -- the location of the object or the starting position of the robot arm -- the whole system gets out of whack and requires a human to reset it.

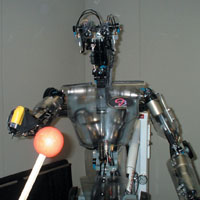

Dr. Chris Gaskett works at the ATR research center in the hills of southern Kyoto. Gaskett is working on creating robots that adapt to our environment. He works with a multi-million dollar robot that has two movable eyes mounted on a movable head. The 2-meter-tall robot also has human-like arm movements and is able to turn its body from side to side.

Unlike a more traditional robot that uses the x,y,z axes to locate objects, Gaskett instructs the ATR robot to use a closed-loop system in which the robot can see and identify both its hand and a target object -- in this case a pink ball. The robot gracefully moves its "hand," a yellow piece of plastic, toward the ball, eventually touching it. The constant feedback loop allows the robot to follow the ball anywhere within its workspace. The robot learns more about the structure of its body as it moves.

The difference in orientation between the traditional robot and the one at ATR is significant because with the closed-loop learning system the robots can adapt to their environment.

Gaskett's next objective is to help a robot locate an object outside of its field of vision, essentially telling a robot, "Look behind you." This task is made difficult by the fact that the robot is physically supported by a 2-meter pole and a hydraulic lift sticking out of its butt.

A robot will need to be able to stand by itself and walk around in order to increase the size of its workspace. Once it does, though, eventually the robot could be instructed to search your house and pick up your dirty socks. If robots have a humanoid shape, they'll be able to reach for and use objects and live in a human-like environment.

The most interesting thing in the robot's demonstration was how human-like its movements were. Move the pink ball close to the robot's chest and his head and torso tilt down, his eyes cross and remain fixated on the ball. The movements are nearly identical to those of an infant practicing depth perception while reaching for and grasping its first cookie. While other robots, like Sony's AIBO dog, are programmed to be cute by mimicking natural movements, the ATR robot's gracefulness is almost a side product of its main objective.

A video of the robot following and reaching for a moving object is available on Gaskett's homepage: www.his.atr.co.jp/~cgaskett/

-- Mark McCracken

THE TOKYO AMERICAN CLUB kicked off its four-month-long 75th Anniversary celebration at the end of May with a massive party at its Minato-ku facility -- just a stone's throw from Minoru Mori's massive Roppongi Hills complex. Clearly, much has changed since the club's inception in the late 20s.

In the late 40s, the private and prestigious club was granted Shadan Hojin (non-profit) status, and today General Manager Michael Bumgardner intends to strengthen the club's presence as a bridge between its cosmopolitan membership and the local community.

"Our unwavering commitment to the community will be a top priority for the Club," Bumgardner says. "And in the months to come, we will be announcing new activities in our effort to strengthen that relationship." These include anniversary-related happenings during the Bon Odori festival on August 2, in addition to special public events and activities to be posted on the Club's Web site (www.tac-club.org). Private and prestigious -- yet open to the public. A very American concept, indeed.

Will Resona spark a buyout spree?

FALLOUT FROM THE JPY2 trillion bailout of Resona in late May produced many days of turmoil on Tokyo markets as investors ran scared of a financial meltdown.

Bank stocks across the board suffered one of their worst one-day falls in nearly four years, and the troubled banking sector led the Nikkei 225 index down below the 8,000 point mark and into the realms of a 20-year low.

Even before the opening bell rang, fears of a crash in public confidence and a run on the cash machines prompted the Bank of Japan to flood the money market with an extra JPY1 trillion. Governor Toshihiko Fukui last took that action exactly two months earlier on the day the US launched its assault on Iraq.

Japanese banks may have some serious Despite its de facto nationalization of Resona, the Japanese government was determined to allow shares in the battered financial group to continue trading. Sell-orders were piled high as the market opened, and Resona shares quickly took a near 15 percent dive.

But investors have since turned their attention to the significant question of what will happen next, and there are several important clues. They all point, say the analysts, to the prospect of a buyout spree. Japanese banks may have some serious problems, but there are still some extremely profitable operations lurking in the mire. Resona's weak results came in spite of hidden business strengths dotted about the group.

Japan's wider economic problems have already exposed a number of areas where Western buyout groups -- such as Ripplewood -- are eagerly sifting through the deadwood in search of gems. Investment houses like Goldman Sachs have found prime opportunities in golf courses; others have gone for parts of big retail empires or entertainment conglomerates.

The Japan buyout game may be in its early stages, but if the foreign -- or even adventurous domestic -- firms descended on the Japanese banks, the whole process could be vastly accelerated. There are also hints that the more visionary elements of the Koizumi administration would be all too happy to let that scenario play itself out.

And all the banks could be buyout targets. After the so-called "Resona Shock," government ministries and financial regulators dripped information about Resona's future into the market. Traders, meanwhile, decided not to risk giving the other big banks the benefit of the doubt. "Look at the economy, look at deflation, look at the bankruptcies," said one SocGen broker. "Resona is not facing these problems alone."

Despite repeated assurances from the Koizumi administration that the financial group's appeal for capital had not triggered a crisis, many took it as a clear sign of worse troubles to come. Others, however, applauded the nationalization as a bold piece of reformist action on the part of the government.

"This is a tacit admission by the government that the financial system is on the verge of crisis," said Lehman Brothers economist Paul Sheard. "We have long argued that the Financial Crisis Response framework could be used to pre-empt rather than just react to a crisis."

Mizuho and UFJ, which, like Resona, are the result of recent defensive mergers, are the houses that most believe are in the firing line. Those fears were partially confirmed when Mizuho finally turned in results for fiscal 2002 and hit the market with the biggest loss in Japanese corporate history.

Plenty of experts are now reaching the conclusion that the ultimate solution to the problems of Japan's banks may lie in outside forces: buyout firms coming in, forcing the necessary restructuring and turning a profit. As JP Morgan banks analyst Seiji Otsuka explained: "The Resona group's crisis has steadily worsened, coming as it does right in the midst of a financial system crisis, and indicates that the major banks are having difficulties improving their financial situation on their own."

As investors have quickly realized, if the same accounting rigor is applied to Resona's rivals and companies in other sectors, they too might fall below the capital adequacy line and into prime buyout territory. The deadwood is plain to see. The question is: Who is bold enough to swoop down and seek out the prizes?

-- Leo Lewis

|

|

Note: The function "email this page" is currently not supported for this page.

75 Years of Americana in Tokyo

75 Years of Americana in Tokyo